The rapid and strategic adoption of Artificial Intelligence (AI) is revolutionizing the fintech sector, empowering businesses with tools for threat identification, fraud prevention, task automation, and enhanced service quality. Fintech companies are witnessing improved operational efficiency and burgeoning profits by harnessing these AI-driven benefits.

AI is far from a fleeting trend—it's a technological revolution shaping the future of industries. But what is its impact specifically on the fintech sector? How is AI being utilized, and how can businesses effectively leverage this transformative technology to reap its immense benefits? Join us as we delve into these questions, and unravel the intriguing landscape of AI in fintech.

How is AI used in the fintech industry?

You may be considering investing in AI as a worthwhile endeavor. What's the actual value it could bring to your organization?

Firstly, it's essential to recognize that customer acquisition and retention form the pillars of a company's success, and AI provides a robust solution in this regard. AI-powered tools streamline the work of dedicated teams by easing the process of gaining new customers.

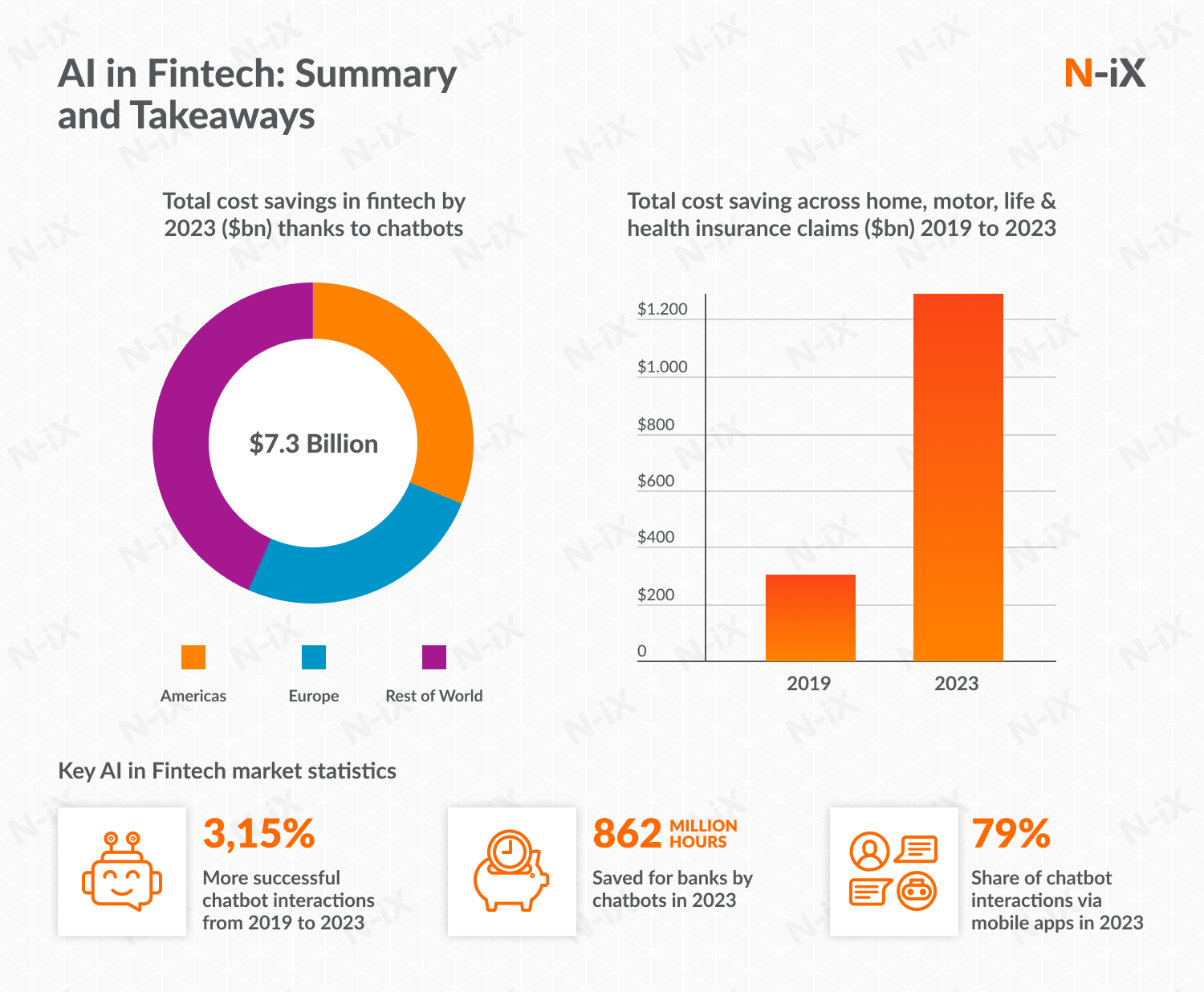

Secondly, AI fortifies customer retention strategies by heightening user engagement through chatbots and digital assistants. These AI enhancements lead to more personalized customer experiences, fostering loyalty and retention.

Furthermore, AI allows for strategic optimization of your team's workload. By automating routine tasks, you free up your staff to focus on more valuable, complex assignments that drive growth and innovation. This shift enhances productivity and leads to substantial cost savings in user support, enabling the allocation of funds to other critical business areas.

All these advantages are attainable through AI-driven automation, making it a beneficial investment for businesses striving for efficiency and growth.

Automation can help across business domains thanks to its wide range of applications.

Wealth management with AI: Raising the bar for financial advisory

Beyond the basic functionality of chatbots, AI utilizes its advanced analytical abilities to create sophisticated wealth management assistants. These AI-powered assistants can guide clients toward informed purchasing decisions, contributing to more productive financial management.

For instance, clients can receive customized suggestions for investing or saving based on their spending patterns, financial goals, and risk tolerance. AI also allows you to promote tailored financial products and services that align with your clients' needs. These automated financial advisories ensure consistent, round-the-clock assistance without taxing your workforce.

Data analytics made convenient: Making sense of financial patterns

In the finance industry, AI's role is instrumental in identifying changes in data patterns, autonomously analyzing them, and adjusting them as necessary. Even with less-than-perfect data quality, AI can provide invaluable insights, enabling precise forecasting and more data-driven decision-making.

One remarkable capability of AI is its analysis of unstructured data, a critical need in financial services. For instance, a custom solution can predict product propensity by analyzing customer behaviors, allowing you to adapt your marketing strategies accordingly. This helps tailor your services to meet customer requirements and optimize customer satisfaction.

Digital assistants and chatbots: Personalizing financial advisory

AI-powered digital assistants and chatbots alleviate the pressure on your call center and client support team. These tools provide personalized financial advice to clients, assisting them in tracking expenses, achieving financial goals, and monitoring their purchasing patterns. For example, chatbots can proactively remind users of upcoming bill payments or suggest adjustments in spending habits based on their financial goals.

Natural Language Processing: Enhancing compliance and customer interaction

Natural Language Processing (NLP), an AI subfield, can significantly streamline compliance checks in contract management. For example, simply by analyzing an image of a contract page, an AI system can identify potential non-compliance issues.

In client interaction, NLP companies empower chatbots to comprehend customer inquiries accurately and provide precise responses. This technology is also helpful for facial recognition, aiding in Know-Your-Customer (KYC) processes and streamlining client onboarding efforts.

Fraud prevention: Bolstering AI-powered financial security

With exceptional analytical abilities, AI can monitor and analyze client behavior, determine purchasing habits, and track client locations to spot suspicious activity. AI's role in fraud prevention is significant, helping financial services identify and preempt potential frauds before they occur.

In an era where cyber threats are increasingly sophisticated, it's essential to counter them with advanced protective measures. By leveraging big data tools such as AWS Kinesis, Apache Pulsar, Amazon Redshift, and Machine Learning (ML) solutions like Amazon ML, Google Cloud AI Platform, Azure Machine Learning Studio, and others, our team at N-iX ensures robust and reliable fraud detection solutions for our clients.

As hackers come up with more advanced ways to gain access to your clients’ personal data, so should you come up with more advanced ways to protect it? We can guarantee reliable fraud detection solutions by leveraging the capabilities of such big data tools as AWS Kinesis, Apache Pulsar, Amazon Redshift, as well as Machine Learning solutions such as Amazon ML, Google Cloud AI Platform, Azure Machine Learning Studio, and more.

AI in fintech: Use cases

According to the Fintech 5x5 report, 67% of fintech companies identify AI as the key technology that will most profoundly shape the sector over the next decade. Disregarding such a transformative shift in the financial industry equates to missing the myriad growth and development opportunities AI can offer in fintech.

Take ZestFinance, for example. This trailblazing company is harnessing the power of AI to build an automation platform specifically designed to expedite the assessment process for potential borrowers. This platform gives employees a swift and comprehensive understanding of the borrower's creditworthiness by rapidly evaluating risks.

Crest Financial Group is another company that is strategically utilizing AI. It employs the machine learning capabilities of the DataRobot platform to monitor and analyze client behavior. Deep learning developers enable the process to predict, detect, and prevent fraudulent transactions with exceptional accuracy and speed.

Platforms like Payoneer and Skrill have integrated AI to analyze unstructured data in online payment. This allows users to upload scans of their identification documents, and the system, through advanced text recognition algorithms, can extract and process the information contained within them. This ensures efficient and error-free data collection, bolstering security and streamlining operations.

A sizeable Ukrainian bank, Privatbank, has employed an AI-powered chatbot that utilizes Natural Language Processing to interact with clients. It can answer general inquiries, provide step-by-step instructions on using various banking services, and even handle more complex client needs, offering a more personalized and practical customer service experience.

These innovations all align towards one fundamental objective – enhancing productivity within fintech companies. By leveraging AI-driven data analysis automation tools and chatbots, you can substantially lighten the workload of your human resources. This, in turn, frees up your team to focus on strategic, high-value tasks, boosting operational efficiency and enabling business growth.

How you can apply AI in fintech

AI's potential to revolutionize financial services is immense, positioning it as the next frontier in fintech. However, many advanced companies must work on unlocking their full potential due to unrealistic expectations. It's crucial to remember the following:

- Human supervision is still vital. Even the most sophisticated automation systems necessitate human oversight for smooth and efficient operation. They complement human skills but only partially replace them.

- Expertise is essential. Implementing AI and ML solutions, and ensuring their seamless operation, requires a skilled team of experts. Building or acquiring this expertise is a crucial step toward successful AI adoption.

- Continuous evolution. AI is rapidly evolving, and its full potential is yet to be unveiled. Early engagement with AI could give your organization a competitive edge as these technologies mature.

Despite the potential of AI and automation, early adopters often need help with where to begin their journey. So how can you leverage these technologies effectively and gain a competitive advantage?

Big Data solutions offer a practical starting point, providing tangible tools to tackle present challenges while preparing you for future ones. Proper data engineering and analytics are usually your best bet, setting the stage for successfully implementing ML and AI.

Incorporating Data Science and ML solutions in your operations can pave the way toward a robust AI system. These technologies enable you to process vast amounts of information, derive insights, and create predictive models to enhance your decision-making.

While it's essential to consider the future impact of AI on financial services, it's also crucial to keep the adoption process simple. Aim for pragmatic, working solutions currently available. By doing so, you set yourself up as a forward-thinking early adopter, poised to exploit AI as it evolves fully.

Key insights

- AI is seen as the future's most influential technology in fintech, with Big Data and ML as stepping stones toward its adoption.

- Automation, an essential product of AI, enhances productivity and reduces employee workload.

- AI proves critical in fraud detection and prevention, utilizing behavioral analysis to identify suspicious activities.

- Natural Language Processing enables streamlined communication through AI-powered chatbots, enhancing customer interaction.

- Adopting new technologies requires expertise, a reliable team, and a focus on core business objectives.

- Incorporating Big Data, ML, and AI in fintech spurs the era of growth in financial services. Now is the prime time to leverage these technologies for your strategic growth.

The financial services domain is experiencing unprecedented growth and development thanks to Big Data, ML, and AI in fintech. These technologies have become instrumental in several processes, including but not limited to fraud prevention, customer service, financial analytics, and stock forecasting. Now is the optimal time to embrace ML and AI solutions with N-iX to boost your business's growth and development.

Why choose N-iX as your AI in fintech provider?

- N-iX stands as a global leader in AI, ML, and Data Science, boasting more than 21 years of expertise in Data services;

- The company is home to a team of over 200 data specialists, proficient in various domains such as Data visualization, Business Intelligence, AI/ML, Data Analytics, and Data Warehouse Consulting;

- With an extensive client portfolio in the Data services sector, N-iX has catered to numerous prominent names like cleverbridge, Discovery Limited, Questrade, along with several Fortune 500 companies;

- As a testament to its industry standing, N-iX has been consistently distinguished by CRN as a top-notch solutions provider in North America, evident from its Solution Provider 500 and CRN Fast Growth 150 rankings;

- The company's commitment to industry regulations and standards is reflected in its adherence to PCI DSS, ISO 9001, ISO 27001, and GDPR.

Have a question?

Speak to an expert