...COVID 19 has been a catalyst for a digital transformation of the healthcare industry.

~ Animesh Gandhi, Sr Director Analyst at Gartner

The worldwide pandemic has switched our focus back to the healthcare system. Many healthcare facilities are operating at maximum capacity, facing numerous challenges, including patient overflow, supply shortages, and changing clinical/staffing needs. Most clinical trials and research have been postponed or cancelled. Most institutions are doing everything they can to cut the costs. So how does healthcare software development fit into this equation and what can we expect from it in the time of COVID-19 and beyond?

Market overview

Healthcare software development has emerged as a promise to transform the paper-based system into a digitized structure to ensure effective care and patient safety. And for a while, things were going well in this segment.

However, when the Covid-19 pandemic has struck, it has initiated the three-phase reaction of the healthcare system: respond, recover, and renew. The first step caused the cut of all non-essential projects, including the research and development of prospective IT solutions.

Analysts say that once the initial shock is over, health IT will be the driving force behind the recovery phase of the healthcare system. Many healthcare providers will reconsider cost -cutting and will focus on the total cost of ownership, ROI, and value creation of software development. We will see new forms of technology and healthcare blending together, like on-demand research or digital labs, virtual care, digital force as the response to the work-from-home mode, etc.

Despite the slight decrease in investments in 2019, healthcare received over $17.B of VC-backed investments. The largest number of deals included clinical administration, digital devices, genomics, medical Big Data, and IoT.

Venture Scanner also notes development of new sectors like gamification of healthcare, health marketing, patient engagement, and growing interest in segments such as remote monitoring, healthcare robotics, and telehealth.

IT technology will be the driving force behind the recovery phase of the healthcare system. So, let’s take a look at healthcare industry trends that will be shaping the industry software development in 2020 and beyond.

Healthcare software development is a large and diverse sector. Main healthcare software types are:

- electronic health record (EHR) software;

- medical diagnosis software;

- imaging and visualization;

- medical database software;

- e-prescribing software;

- appointment scheduling;

- medical equipment management;

- hospital management software;

- medical billing;

- medical research.

However, certain technological trends are going to reshape traditional medical software development and respond to the new needs of the healthcare system.

Healthcare technology trends

Telemedicine

After examining 15 major metropolitan areas, the Merritt Hawkins survey[6] states that the average wait for a new patient to get an appointment with a family medicine doctor is 24.2 days. With a COVID-19 pandemic hanging over our heads, this time can even double for non-urgent cases. Therefore, many hospitals started introducing telehealth services into their routines. It allows them to:

- expand access to care and reach more patients, sometimes even beyond the primary care;

- reduce the number of patient no-shows;

- minimize the need for non-emergency visits to the clinics and ERs in time of pandemic;

- improve healthcare quality;

- advance clinical workflows and increase efficiency.

The global telemedicine market size reached $41.4B in 2019 and was expected to reach a CAGR of 15.1% during the forecast period (2020-2027).

However, the worldwide pandemic is going to give telemedicine an even bigger boost, as it can also help reduce variations in diagnosis, and make the overall access to healthcare more effective.

Telemetry and remote monitoring

Several US hospitals report that they initiated the discussions [7] with monitors production companies after FDA approved the use of remote monitoring devices during the outbreak (and possibly further on). The worldwide pandemic has forced the further development of this field in order to:

- improve the quality and speed of healthcare services, especially during the initial visits to the ER and family doctors, or to help paramedics make decisions faster.

- provide timely assistance to patients diagnosed with COVID-19 that were admitted to hospitals;

- offer patients with unrelated diagnosis an alternative of staying at home and being monitored to reduce the potential exposure.

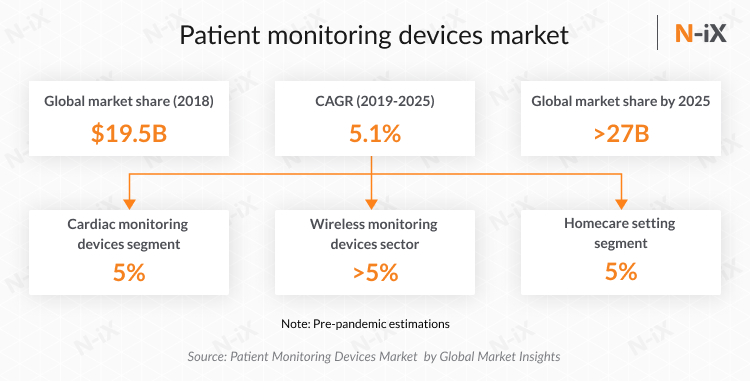

In 2018, the global healthcare telemetry market share reached $19.5B and is expected to reach more than $27B by 2025. The largest shares of the market belong to the wireless monitoring devices, cardiac monitoring sector, and homecare setting segments.

Telemetry will allow patients who previously required constant medical supervision to stay home while still receiving timely medical attention.

IoT and IoMT

The growing interest in telemedicine and telehealth, along with the IoT development has resulted in a new industry - Internet of Medical Things (IoMT). It combines the use of several wearables, including ECG and EKG monitors, covering some of the most common medical measurements, such as skin temperature, glucose level, and blood pressure readings.

An overall application if IoT or IoMT can be divided into the following segments:

- telemedicine;

- medication management;

- clinical operations and workflow management;

- inpatient monitoring;

- remote patient monitoring;

- connected imaging;

- interactive medicine;

- others (fall detection, sportsmen care, and public safety).

The global IoT in healthcare market size is projected to reach $534.3B by 2025, expanding at a CAGR 19.9% over the forecast period. Rise in investments for the implementation of IoT solutions in the healthcare sector is one of the key factors that is driving the market. Let’s take a look at the US market breakdown as an example of the projected development of this subsector.

AR, VR, and MR

Virtual and Augmented Reality are now becoming real game-changers in healthcare. Modern VR and AR solutions help universities and training facilities improve the quality of medical education and practice. They also help clinics to provide profound patient treatment, medical rehabilitation, consultation, and diagnosis.

The healthcare-related AR/VR market is estimated to reach $7.05B by 2026, according to a new report [12]. Such growth can be mainly associated with the rising demand for innovative diagnostic techniques, surgeries preparations, patient care management, and educational purposes. Let’s take a North-American market as an example of projected growth.

Overall, Northern American countries are investing more in the adoption of AR and VR in healthcare facilities and learning centres.

Difference in the areas of application of AR and VR

AR is mainly used in such areas as surgeries, rehabilitation, training, and medical education. This technology uses sensors, simulators, and transparent displays to improve the quality of communication between a patient and surgeon, or student and professor to enhance the processes.

VR is used in many other areas, including simulation, diagnostics, exposure therapy, rehabilitation, and pain distraction. For instance, many medical schools and institutions are taking advantage of this opportunity around the globe by broadening their teaching methods and improving the learning processes.

You may also like:

Artificial Intelligence and Machine Learning

The growing need for lowering healthcare costs and reduction of human errors in healthcare, rising adoption of precision medicine, as well as overall technological advancement are driving the adoption of AI-based solutions in healthcare. The global AI in healthcare market size reached $2.5B in 2017 and is likely to hit the $36.15B mark by 2025.

Gartner predicts that we will see some heavy use of AI, ML, and NLP in both patient care delivery and administrative processes. Some areas of application include:

- robot-assisted surgery;

- virtual nursing assistant;

- administrative workflow assistance, especially in ecosystem orchestration;

- fraud detection;

- dosage error reduction;

- the clinical trial participant identifier;

- preliminary diagnosis, etc.

Accenture has analyzed the most common AI applications in healthcare considering their impact, the likelihood of adoption, and value to the health economy. The top three applications that can have the highest near-term value are robot-assisted surgery, virtual nursing assistants, and administrative workflow assistance.

More on the topic: Top 10 machine learning applications in healthcare

Chatbots

Many industries have already adopted and benefited from the use of chatbots. However, healthcare is only beginning to understand the potential benefits of chatbots in healthcare. Some of the use cases include:

- symptoms check;

- medical & drug information assistance;

- appointment scheduling & monitoring, etc.

For example, if a doctor is not available at the moment, a patient may ask chatbots a question and get a detailed response. Chatbots are often enriched with machine learning algorithms, which allows them to evolve and adapt continually.

The global chatbots market reached $116.9M in 2017 and is expected to reach $520M by 2026 at a CAGR of 20%, creating a lot of demand in North American, European, and Asia-Pacific regions.

All these markets require custom healthcare software development, so how can you find a reliable vendor?

How to choose a custom healthcare software development company: 5 things to look for

In 2020, a huge amount of health-related startups and product companies are appearing worldwide, and most of them can easily outsource their healthcare software development. But the question is where to outsource healthcare software development? Let’s take a look at the regions that offer the strongest industry expertise.

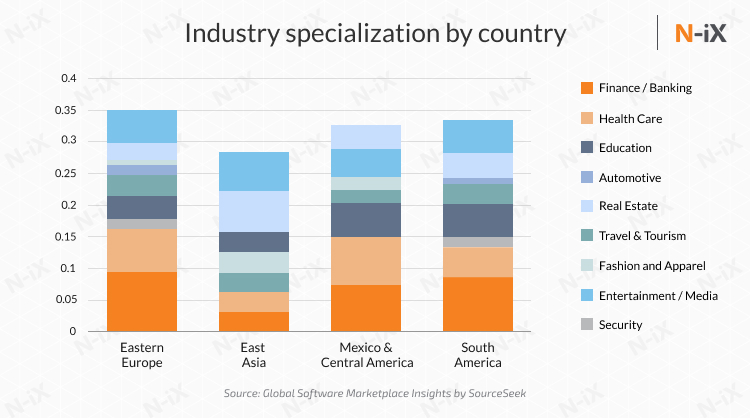

On the world-wide scale, several regions have experience in delivering healthcare solutions. When compared to others, it is clear that Eastern Europe has the most robust expertise and tech talent. Some regions may also have diversified portfolios, and have healthcare projects, but they may lack the resources. For example, the Middle East has a large amount of custom healthcare software development. However, the smaller size of those markets means that domestic demand will outweigh the popularity of outsourcing. So it’s better to choose the region that has developed the IT ecosystem and expertise on the worldwide market.

Whether you are looking for nearshore or an offshore healthcare software development, vendor selection might be a long and complicated process. Here’s is what to look for in a potential vendor:

-

Substantial industry expertise

Both custom healthcare software development and medical software development call for profound domain knowledge. One of the things you should look for are examples of similar projects within the industry.

-

Technological expertise

Once you know the tech stack of the project, make sure that the vendor has relevant competences. For example, a medical software development company needs to have experts in embedded software development.

-

Security certifications

Software development in healthcare deals with a vast amount of sensitive information. Make sure your potential outsourcing provider complies with international security standards such as ISO, PCI, HIPAA, and has sufficient security policies.

-

Capacity and scalability

Look for a midsize or large vendor, as they are more likely to have established processes, capacity, and scalability to handle long-term projects that require a lot of resources and ability to change the size of the team upon the client’s needs.

-

Experienced developers

Typically, healthcare software is an elaborate multi-level system with complex architecture and a variety of technologies. Thus, the healthcare software development company of your choice should have enough seasoned experts to work on your project.

Read more: 15 top healthcare software development companies

Why choose N-iX as your healthcare software development provider

N-iX has solid experience in custom HIPAA compliant healthcare application development and strong teams with expertise in complex system integration, embedded software development, Big Data solutions, VR solutions, and more. Since 2002, N-iX has developed many innovative software products helping healthcare companies to create transformation in the healthcare industry.

We have provided healthcare software development services to:

- Weinmann Emergency, a German company that specializes in medical software development and has been helping save people’s lives since 1874. It develops mobile medical devices for emergency vehicles, helicopters, and airplanes and has distribution centers in Europe, the USA, the United Arab Emirates, China, and Singapore. N-iX software engineers have been working on embedded Linux firmware for the defibrillators and monitoring devices. They have enhanced the client’s development capabilities and contributed to the successful development of the product.

- Think Research is a Canadian healthcare software company that develops evidence-based solutions and clinical documentation that enable doctors to deliver the best patient results. N-iX worked on a number of applications including EntryPoint, MedRec, ProgressNotes, Spotlight, eForms, PatientPortal, and Virtual Care. EntryPoint is a privacy-compliant cloud-based platform that supports a set of Think Research healthcare applications (e.g., Order Sets, Progress Notes, Medical Reconciliation, Patient Portal). One of its key apps, Order Sets, offers detailed, evidence-based clinical checklists, reducing medical errors and enhancing quality and safety. N-iX healthcare software developers used the most relevant and suitable tools and technologies, such as Ruby on Rails, Continuous Integration, MongoDB, Docker containers, etc.

- Brighter AB is a company based in Sweden, specializing in solutions for data-driven and mobile health services. The team of professionals developed a method that facilitates self-monitoring and self-treatment of diabetes. Over the years, they have expanded their scope of services, turning into a broader platform. N-iX helped Brighter improve and update the visualization and presentation of one of their projects. The redesign of the solution has increased its quality and notably improved the performance of augmented reality (AR) experience.

- Cure Forward, a US-based healthcare company which aimed at helping people find individual treatment for their cancer. N-iX dedicated team worked on the full-stack development for several of Cure Forward web-services, including client-side and back-end development.

References

- Leading Through COVID-19: Revenue and Cost Impacts in Healthcare and Life Science by Gartner

- The State Of Healthcare: Investment & Sector Trends To Watch (Q4 2019) by CBInsights

- Health Technology Innovation Quadrant by VentureScanner

- AR/VR, Teletherapy, & More: Trends Shaping The Future Of Mental Health by CBInsights

- Telemedicine Market Size, Share, Growth Report, 2020-2027 by Grand View Research

- Merritt Hawkins Survey: Physician appt wait times, Medicare acceptance by Arista MD

- Hospitals turn to remote monitoring tools to free up beds for the sickest coronavirus patients by Stat News

- Patient Monitoring Devices Market Projection Report 2019-2025 by Global Market Insights

- Internet of Things (IoT) in Healthcare Market Size | Industry Report, 2018-2025 by Grand View Research

- Augmented Reality (AR) & Virtual Reality (VR) in Healthcare Market Report, 2025 by Grand View Research

- AR/VR in Healthcare Market Analysis | Global Industry Research 2016-2026 by Reports and Reports

- AR/VR in Healthcare Market To Reach USD 7.05 Billion By 2026 by Reports And Data

- Artificial Intelligence in Healthcare by Accenture

- Chatbot Market Size, Share and Global Market Forecast to 2024 | COVID-19 Impact Analysis by Markets and Markets

- Chatbot Market Size & Share | Growth Forecast Report 2024 by Global Market Insights

- The global healthcare chatbots market by GlobeNewsWire

- Healthcare IT trends by Markets and Markets

- Global Market Report by SourceSeek