The financial industry is undergoing a significant digital transformation driven by the need for increased efficiency, improved customer experiences, and enhanced operational resilience. And while the process itself is complex, digitalization is essential for financial institutions that want to succeed in the future.

From advanced technologies like RPA, AI, and Big Data Analytics to strategic approaches to cybersecurity, data privacy, and ecosystem management, financial institutions are leveraging various tools to drive innovation and efficiency.

Therefore, choosing the best strategy and the right tech tools are the crucial first steps toward digitalization in financial services. To transform their operations, deliver personalized services, and achieve sustainable growth in an ever-evolving digital environment, financial service organizations can adopt the range of different strategies.

7 strategies for effective digitalization in finance

1. Moving toward hyperautomation

Hyperautomation is an approach to digitalization in financial services, which combines Robotic Process Automation, AI and Natural Language Processing, Business Process Management, and others to automate business processes. Gartner predicts that by 2024 hyperautomation will reduce operating costs in organizations by 30%, and by 2025 its market will reach $860B.

In the banking sector, hyperautomation is proving to be a game-changer. Its applications vary from customer service and loan processing to fraud detection, compliance, and risk management. It streamlines operations, saves resources, and eliminates manual errors.

For instance, 60% of banks use artificial intelligence to glean insights from data, while 59% rely on AI to increase productivity. In over half of the banks, AI is used to reduce costs.

Implementing hyperautomation requires the following:

- Identifying repetitive and manual tasks: Analyzing the organization's processes to identify tasks that can be automated, such as data entry, invoice processing, treasury operations, and customer service.

- Implementing RPA solutions: Developing and deploying RPA bots that automate routine tasks, reducing manual labor and increasing efficiency.

- Integrating AI and ML: Enhancing the capability of RPA bots to handle complex tasks and automated decision-making by implementing AI and ML algorithms.

- Utilizing cost-effective computing and storage resources: Switching between different price tiers of computing and storage resources and services based on current and future capacity requirements.

- Ensuring data security and compliance: Adhering to industry standards and regulations, including GDPR and PSD2, to protect sensitive financial data.

- Monitoring and optimization: Continuously monitoring the performance of automated processes and making improvements as needed to ensure maximum efficiency and effectiveness.

- Leveraging third-party services: Using custom tools and cloud services to cover your needs optimally.

2. Optimizing processes with AI and RPA

AI and RPA hold immense potential for optimizing processes and reducing digital waste in the financial sector. AI-powered algorithms can analyze vast amounts of data to identify patterns, detect anomalies, and provide valuable insights for decision-making. RPA, on the other hand, can automate rule-based, repetitive tasks, eliminating errors and accelerating processes. Artificial Intelligence and Robotic Process Automation can unlock significant cost savings and productivity gains for financial institutions. 86% of executives in the financial sector plan to invest more in AI by 2025, according to the Economist Intelligence Unit (EIU).

AI and RPA can be used for process optimization in financial services organizations by simplifying workflows, automating repetitive tasks, reducing manual efforts and errors, and enhancing decision-making. You can apply these technologies in such areas as:

- Data management: AI and RPA automate data extraction, validation, and cleansing, ensuring accurate and up-to-date information for better decision-making and reduced digital waste.

- Fraud detection and prevention: AI algorithms can analyze massive data sets for patterns and anomalies, while RPA can automate the investigation and resolution of potential fraud cases, minimizing financial losses.

- Customer service: AI-powered chatbots and RPA handle routine customer inquiries, reducing response times and allowing employees to focus on more complex tasks.

- Regulatory compliance: RPA can automate compliance-related tasks, such as report generation and data validation, ensuring adherence to regulations and reducing the risk of fines and penalties. By implementing AI and RPA solutions as part of their digitalization, financial services organizations can reduce digital waste, improve efficiency, and enhance overall performance. Automating repetitive tasks allows employees to focus on value-added activities. RPA improves efficiency, accuracy, scalability, and compliance in finance functions.

3. Prioritizing investments in modernization and digital growth

For financial organizations, digital growth and modernization are crucial investments. Utilizing the latest financial technology solutions allows organizations to become more responsive to market changes, reduce costs, and drive innovation, ultimately leading to increased revenue and growth. A financial organization should invest in the following:

- Omnichannel banking: Developing seamless, integrated experiences across all channels (online, mobile, and in-branch) to enhance customer satisfaction and retention. You will need a tech partner to help you define your omnichannel strategy.

- System refactoring and migration to microservices: Upgrading legacy systems and transitioning to a microservices architecture for better scalability, flexibility, and faster time-to-market. Consider a partner who can assist you in developing an architecture that meets your specific needs.

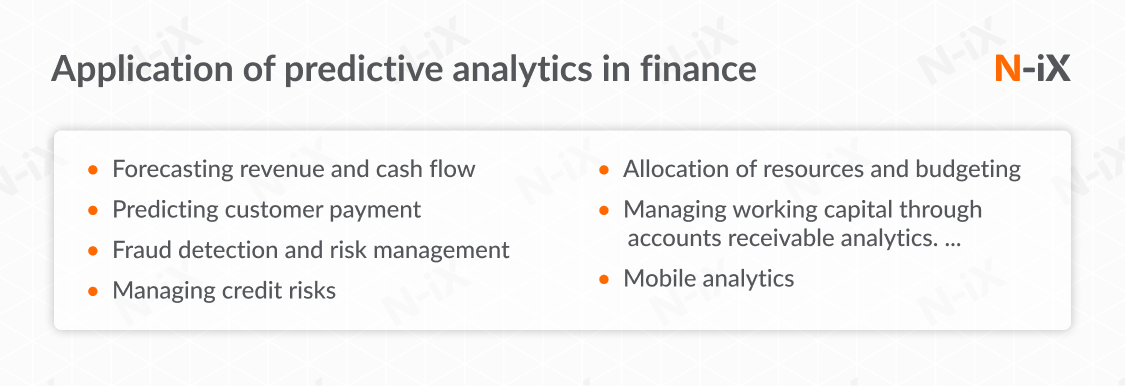

- Business Intelligence and Data Analytics: Leveraging data-driven insights to make informed decisions, optimize operations, and personalize customer experiences. A tech partner can help you to interpret your data and to use it to make informed decisions.

- Blockchain development: Exploring and implementing blockchain technology to enhance security, transparency, and efficiency in financial transactions and processes. You can implement the right blockchain framework, smart contract, and decentralized application for your business with the help of a tech partner.

- Security and regulatory compliance: Adhering to industry standards and regulatory requirements to protect sensitive data and maintain customer trust. An experienced tech partner can help you identify the right security solution and help your business with compliance , as well as develop a roadmap, and execute your plans for digitalization in financial services.

4. Scaling the usage of Data Analytics across your organization

Banking leaders have identified that the most important ways to use advanced analytics are to assess customer potential and enhance the productivity of relationship managers. Other use cases for Data Analytics include customer retention/churn, pricing, and risk management, to name a few. To scale Data Analytics across your financial organization should take the following steps:

- Designing a Data analytics roadmap involves analyzing your business case, formulating viable KPIs, and making realistic estimates. This process will help determine the most appropriate tech stack and architecture for your solution and create a roadmap.

- Building and integrating Big Data analytics ecosystems that integrate seamlessly with your IT infrastructure. Big Data engineers develop effective systems that collect, aggregate, preprocess, and clean large amounts of data.

- Building data lakes: Data lakes are repositories for unstructured or semi-structured data in their original form. A Big Data engineering team will find the optimal tools to tailor the data lake-building process according to your organization's needs and goals.

- Migrating your solutions to the Cloud entails a comprehensive range of services to support your migration, including everything from infrastructure setup and continuous integration & delivery to monitoring, logging, and alerting.

- Using the best methods to extract insights. Online analytical processing, ML, and AI are applied to automate data processing, enhance decision-making, and uncover hidden insights from your data. Implementing these strategies as part of your digitalization of finance helps your organization unlock the full potential of data analytics and drive better business outcomes.

Financial organizations leverage Big Data analytics to validate massive volumes of heterogeneous data in real time. Insights from data analytics are used to personalize customer experiences, drive marketing approaches, and gain a competitive edge in the digital era.

5. Leveraging the distributed cloud and gradually increasing your cloud adoption

Distributed cloud is constructed using multiple clouds to support compliance requirements, performance requirements, and edge computing, while being managed centrally from the public cloud provider. Benefits of distributed cloud for the financial sector include low latency and fast data processing for transaction time. Furthermore, it provides a higher level of security for personal information in comparison to other architectures. Financial services organizations can implement a distributed cloud architecture by following these steps:

- Assessment of the current infrastructure: Evaluate the existing IT infrastructure to identify areas for improvement and determine which services can benefit from a distributed cloud model.

- Design of the new architecture: Work with cloud experts to design a distributed cloud architecture that meets specific needs and requirements, considering factors like compliance, performance, and data locality.

- Security and compliance: Implement strong security measures and adhere to industry regulations to protect sensitive financial data while distributing cloud resources across multiple systems.

- Data replication and distribution: Determine data replication and distribution strategies to ensure redundancy and high availability across different cloud regions.

- Integration and orchestration: Implement tools and processes to manage and orchestrate resources across various cloud locations, ensuring cohesive operation and data consistency.

- Monitoring and optimization: Continuously monitor the performance of the distributed cloud architecture and make necessary optimizations to maintain efficiency and cost-effectiveness.

Cloud-based solutions offer scalability, adaptability, security, and cost efficiency. Financial service providers should embrace cloud services to enhance operations and meet growing customer demands.

6. Building cybersecurity into all your systems and processes

Financial services were among the most breached sectors globally, with the average cost of a data breach being $5.97M in 2022. This is significantly higher than the average data breach cost in other industries.

Cybersecurity should be incorporated into all systems and processes of a financial organization by implementing various security measures and adhering to industry standards and regulations. Some of the key approaches to cybersecurity include:

- Open Banking: Complying with the EU PSD2 regulation by providing APIs that enable third-party developers to build secure applications and services around the financial institution.

- Fraud prevention: Implementing technical solutions like push notifications, Identity Guard, 3DS 2.0, and Snowdrop 2.0 integration to detect and prevent unauthorized financial activities, identity theft, cyber hacking, and insurance scams.

- KYC and KYB: Integrating standards and tools for verifying customers, their risk profiles, and financial profiles to ensure compliance with industry regulations.

- End-to-end encryption: Ensuring the secure transfer of payment information by implementing E2E encryption methods, preventing unauthorized access to data during transmission.

- Hardware security modules (HSM): Using HSMs to manage digital keys, encrypt and decrypt functions for digital signatures, and provide strong authentication as part of the E2E chain.

- Tokenization: Adding an additional layer of security by replacing sensitive data with tokens for secure financial transactions.

7. Choosing the tech partner that can support you through the entire digitalization journey

Digitalization in financial services is a multifaceted and intricate process that involves business, technological, organizational, regulatory, and cybersecurity complexities. Partnering with an experienced tech company can help navigate these complexities effectively and ensure successful digital transformation outcomes. There are several reasons why financial organizations need an IT partner that can provide comprehensive digital transformation support.

Keep reading: Digital Transformation in Finance

First, tech partners possess specialized expertise in developing and implementing digital solutions customized for the financial industry, guaranteeing optimal results.

Second, they prioritize security and compliance, ensuring their solutions are robust, secure, and aligned with industry regulations.

Third, dedicated tech partners stay up-to-date with the latest technological advancements and trends, enabling financial organizations to remain competitive and adapt to evolving market demands.

Next, tech partners offer resource optimization by providing dedicated development teams, allowing financial organizations to efficiently scale their resources and concentrate on their core business activities.

Lastly, partnering with a tech vendor with a similar cultural background and business values ensures seamless communication and collaboration throughout the process of digitalization in financial services. By selecting a reliable tech partner like N-iX, financial organizations can navigate their digital transformation successfully and achieve their desired business goals.

If you have any questions, feel free to contact us today!

More about N-iX and our experience with digitalization in financial services

- N-iX is a trusted partner for finance digitalization, modernization, and run-the-bank services with expertise in Banking, Capital markets, and Insurance domains and solutions.

- 25+ active financial services projects, including cooperation with industry leaders in the UK, EMEA, and North America;

- 10+ lending platforms partnered with N-iX for seamless digital customer interaction, fully digital/automated decision process, easy onboarding, automated anti-fraud monitoring, real-time reporting and notifications, risk analysis in scoring systems algorithms;

- 7 payment clients, including Retail banks, digital banks/Neobanks/Challenger banks. The solutions we’ve worked on include A cloud-based platform for B2B cross-border payments, payment gateways for the telecom industry, and an e-commerce billing platform, to name a few.

- N-iX has consistently been rated by CRN among the leading solution providers in North America, including CRN Fast Growth 150 and Solution Provider 500;

- The company complies with industry standards and regulations such as PCI DSS, ISO 9001, ISO 27001, and GDPR.