According to Statista, the overall transaction value in the fintech sector in the US is predicted to grow at the rate (CAGR 2017-2021) of 20.5% and total US$6,962,224m in 2021.

Contactless payments, digital currencies, and robo-advisors are now commonplace. People want their transactions easy, fast, and secure. Thus banks and financial companies which strive to retain their customers today and win more consumers tomorrow are urged to undergo digitization and join ‘the fintechs’.

Financial software development service is technologically complex and calls for varied expertise. So many companies address Ukraine, Belarus, Poland, Bulgaria and other countries of Eastern Europe for partnership since they have a big talent pool of experts in high-end technologies and tools.

Major fintech companies develop technological solutions in such areas as:

- Payment/billing software;

- Money transfer/remittance;

- Digital banks;

- P2P lending;

- Crowdfunding;

- Personal finance management;

- Insurtech;

- Investment;

- Blockchain-based solutions;

- Risk&Compliance management technology.

To streamline processes and enhance customer experience, banks and financial companies leverage:

- Automation of customer-facing and back office operations,

- Mobility solutions,

- Data Science and AI,

- Integrating back office with a ready application,

- Chatbots,

- Cloud-based solutions,

- Microservice architecture,

- Distributed ledger technology,

- blockchain, and more.

While building fintech solutions, you may confront the following challenges:

- High value of data and accuracy of operations;

- Preventing data loss;

- Load-balancing;

- Scalability;

- Implementing complex integrations;

- The security concerns and compliance with fintech regulations.

We’ve met and combatted those challenges while delivering solutions across a wide range of fintech directions to such clients as Lebara and Currencycloud.

Let’s consider 10 top directions in fintech software development:

1) Payment/billing software

“Digital Payments” is the largest fintech sector. Its transaction value amounts to US$2,672,420m in 2017.

Payment fintech companies leverage new tech solutions (webcams, fingerprint, blockchain etc), streamlined POS processing, enhanced risk management, and mobile payments to deliver a better and easier customer experience.

There are two major sectors of digital payments:

- Mobile payments

With the advent of mobile wallets and contactless payments with Apple Pay, Android Pay, Samsung Pay, and Google Wallet, more and more people are using mobile payments instead of using their credit cards. What’s more, using NFC technology and biometrics for authentication alleviates the security concerns.

Source: Statista

- B2B payments, cross-border B2B payments.

As of 2016, the value of B2B cross-border payment market amounted to more than $150 trillion, and it is continuously growing. The key challenges of B2B payments are accuracy, flexibility, and security.

To face the challenges of B2B payment, businesses leverage the following technologies and tech solutions:

- Private blockchain platforms are used for security, transparency and real-time money transfer.

- Payment management platforms offer flexibility in choosing among payment methods, payment networks, rate providers, electronic wallets etc.

- E-invoicing platforms are employed for fast and cost-efficient approvals of the payment processes.

- Mobile b2b payment platforms ensure faster payment, enhanced customer experience, improved reporting and data mining capabilities.

Currencycloud is a good example of a successful fintech company in the sector of cross-border B2B payments. The service it offers allows businesses to make payments, convert currencies, set beneficiaries, and track reports in real-time mode.

N-iX specialists have worked on the Payment engine for the project. The solution is cloud-based and delivers Cross Border Payments as a Service providing access to many exchange rate providers and payment networks, with full automation of the entire payments lifecycle.

2) Money transfer/remittance

Digital technologies transform the way people perform their banking transactions and send/receive money. The most successful remittance companies leverage blockchain, NFC, face and voice biometrics, and other innovative technologies.

The most renowned remittance companies include Transferwise, WorldRemit, TransferGo. For instance, users of Worldremit can send money to more than 110 countries, and recipients can get their money via bank deposits, mobile money, delivery or numerous cash pickup locations. The service is reported to be fast, simple, and secure.

Another notable remittance company, Transferwise, makes remittances cheaper and less time-consuming thanks to their smart strategy: for someone to receive money abroad you actually don’t have to send the funds abroad. It is a peer-to-peer transfer money platform.

The company uses real currency exchange rates to help expats, foreign students and businesses transfer money online securely, conveniently, and at a very low cost.

3) Digital banks

According to Statista, it is expected that the 60.2 percent of the adult population would bank digitally in 2018.

Online banks offer banking as a service enabling their users to perform most banking operations online. They leverage the most innovative technologies such as face, voice biometrics, and AI to enhance customer experiences. Also, thanks to their digital model, they are more cost-effective and can offer lower, more competitive rates.

For example, Atom bank is a branchless, digital-only bank. The bank provides face and voice biometrics, chatbots, and AI tech. Also, it is known for its low-cost digital model and highly competitive rates.

To learn more about key, easy steps in digital transformation in banking, read the DX roadmap.

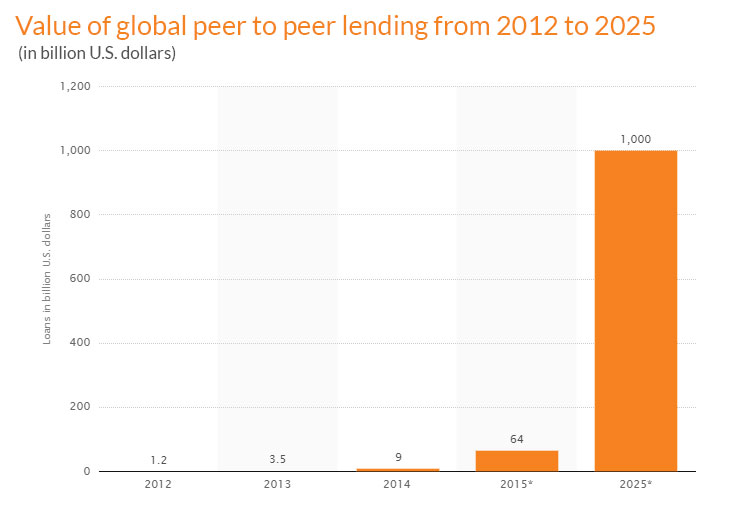

4) P2P lending platforms

Source: Statista

Digital lending is one of the key directions of fintech software development. The major enhancements it is targeted at:

- involving new audiences of borrowers,

- using omnichannel to target new points of touch,

- employing intelligent algorithms,

- using automation technology and AI for underwriting processes,

- ensuring uninterrupted customer journey and faster approvals.

What’s more, P2P lending platforms enable fintech businesses to use digital technologies to automate and accelerate the loan decisioning process while reducing costs and delivering exceptionally user-friendly solutions. Using machine learning in lending enables to streamline the processes, decrease the possibility of mistakes, accelerates the loan approval time and receiving money by the borrower, thus enhancing customer experiences and reducing costs.

Also, machine learning is used for spotting and targeting underserved borrowers and better credit scoring. Machine learning and intelligent algorithms enable businesses to accurately predict a user’s trustworthiness and creditworthiness.

Source: FintechXpert

The key challenges of implementing P2P lending:

- a large amount of transactions daily;

- need to withstand the load;

- scalability challenge when the business and the number of borrowers is dynamically growing.

A leading peer-to-peer lending service in the UK, has had more than 250,000 active users and has matched more than £1.6bn in P2P loans since 201.The company is constantly implementing innovations and modernizing its IT system. To enable greater scalability and faster service improvements, they engineers and the dedicated developers at N-iX have implemented the microservice architecture for the platform. That helped the customer to face the challenge of rapid growth and deliver continuous improvements of the system.

N-iX engineers have been involved in the development of the ‘Decision Engine’ which is a great tool for data insights and predictions. To enhance the functionality, it is planned to introduce AI and nonlinear data analysis to drive decisions based on new algorithms.

5) Crowdfunding

The number of crowdfunding platforms is rising, and they are mostly spread in the US and UK. According to Statista, total crowdfunding volume in the world amounts to 16,2 bn $. A crowdfunding platform is aimed at raising money for an existing or a new business using collective effort of many people. It usually happens via the Internet, and its major challenge are:

- load-balancing since it may be simultaneously used by a lot of people;

- UI, UX;

- payment integration.

The leading crowdfunding platforms are Kickstarter, Indiegogo, and Seedrs.

6) Personal finance management

Source: Statista

Typically, PFM fintech companies provide mobile and web services to help a user handle their finances, income, and expenditures. The software often entails categorization, data visualizations, spending trends etc. Some PFM Fintech companies may request access to an app user’s bank account, some other data, and open banking API.

However, now the largest sector of the PFM is “Robo-Advisors” with a total transaction value of US$224,802m in 2017. Robo-advisors are a new type of investment advisory service which is automated and based on algorithms. Betterment LLC is one of the robo-advisor leaders, with $7.356 billion in assets under management.

Other renowned PFM fintech companies include such names as CompareAsiaGroup, CreditKarma, Nutmeg, and Yodlee.

For instance, CompareAsiaGroup is a solution which operates the leading comparison platforms for finance, telco, and utility products across 7 countries in Asia and 600 M+ potential customers. The solution provides trusted information on saving money and managing personal finances.

CompareAsiaGroup leverages machine learning and AI to match users with companies which meet their needs and risk profiles.

7) Insurtech

Insurtech funding volume was close to $1 billion in the 2017 second quarter, which is about 150 percent larger than the same period a year ago, according to CB Insights quarterly report on the sector.

Source: Statista

Insurtech leverages mobility solutions, Data Science and IoT, and other digital solutions. All the data gathered from sensors, wearables, and connected devices help deliver initial personalized offers, recommendations, and dynamic pricing schemes. Furthermore, real-time data streaming allows insurers to manage risks more efficiently and boost sales.

There are such notable insurtech solutions as BIMA, BrightHealth, Metromile.

For instance, BIMA is a leading provider of mobile-delivered insurance and health services in emerging markets. BIMA is the leading insurance company in the emerging markets. It uses innovative mobile technologies to deliver insurance to people who can’t afford it and leverages data and user-centric design to create new products. The company operated in 14 markets(countries) across Africa, Asia, and Latin America and gets about 575, 000 new users each month.

Another renowned insurtech company is Metromile. Metromile is a San-Francisco based startup that offers a pay-per-mile insurance and a driving app. It uses IoT to track the number of miles a car rides and lets drivers get lower car driving insurance rates.

8) Investment platforms

Investment platforms allow users to hold and manage all their assets in one place. A user can use a smartphone or a laptop to sell and buy their stocks, shares, mutual funds, and check the value of their assets at a convenient place and time.

Addepar and Hedgeable are good examples of investment platforms. Addepar is a fast, secure, and scalable investment management platform that facilitates managing all of user’s’ assets and helps them make more informed and grounded investment decisions.

Addepar opened their API and has integrated its data mining and analyzing tools into Salesforce, Citco Fund Services, RedBlack Software, and others. It is one of the leading investment platforms which lets capture and aggregate data from different resources.

9) Blockchain-based solutions

As Global Blockchain Technology Market report predicts, blockchain technology will grow at a CAGR of 55.59 percent between 2017 and 2021

Blockchain is a decentralized ledger distributed among several members into which transactions are recorded. It is used mainly for the following cases:

- Capital markets (streamlines trade process);

- Cross-border payment (makes money remittances more affordable);

- Insurance;

- Regulatory compliance and audit;

- Anti-money laundering;

- Peer-to peer transactions;

- Loyalty and rewards programs.

It offers such advantages as:

- Decentralization;

- Immutability of records;

- Fault tolerance of the system.

For instance, Santander is a global retail and commercial bank which introduced blockchain technology for international payments.

Many companies choose to implement private blockchains to leverage the benefits of the technology without sacrificing security and eliminating risks of espionage.

10) Regtech ( Regulation/Risk and compliance management )

Regulation technology, or regtech is targeted at solving regulatory challenges and problems using innovative technologies such as Big data, cloud computing, and machine learning.

It is targeted at improvements in such areas as :

- Risk data collection;

- Modeling, and predictions;

- Monitoring payment transactions;

- Identification of clients;

- Identification of legal persons;

- Payment transactions monitoring;

- Trading in financial markets;

- Finding new regulations.

Such technological innovations and tools help to accomplish the improvements:

- AI, machine learning, robotics – fraud prevention;

- Cryptography – enhanced security;

- Biometrics – better security;

- Blockchain – better security;

- API’s – better interoperability;

- Cloud applications – better scalability and efficiency.

Renowned regtech companies include Trunomi (manages a customer’s consent to use their personal data), Suade (aids banks in achieving continuous compliance with regulations and conducting analysis), Passfort (automates the collection, storage and management of unique customer passwords across multiple devices).

Summary

Many innovative companies take effort to leverage fintech software development. They typically create technological solutions in such areas as online and mobile payments, money transfer, digital banking, p2p lending, investment, PFM, and more. Fintech companies use automation of customer-facing and back office operations, mobility solutions, Data Science and AI, chatbots, cloud-based solutions, and microservice architecture. Those solutions help businesses to enhance customer experiences, risk management, and scalability, as well as involve larger audiences, streamline and speed up operational processes. Contact N-iX DDT to implement the fintech solution that will best meet your company demands and users’ expectations.