Nearshore software development has become a strategic response to the shortage of niche engineering skills and rising development costs in the US. By partnering with teams in nearby countries, organizations can scale their engineering capacity faster while benefiting from geographic proximity, cultural alignment, and real-time collaboration. But which Latin American country offers the right balance of talent availability, operational reliability, and industry maturity?

According to the American Industries Group, Mexico has strong nearshoring potential and is one of the leading IT exporters in the region, generating more than $21B in IT service exports. The key reason? When hiring Mexican developers, businesses benefit from both technical proficiency and cultural compatibility with their US-based teams. In the following sections, we will explore these and other factors that make nearshore software development in Mexico an attractive option and examine the key characteristics of the local tech market.

Why should you opt for nearshore software development in Mexico?

Hiring software developers onshore often comes with limitations in cost or access to specialized skills. For US businesses looking to scale development capabilities with top talent and collaborate in real time, team extension in Latin America, and Mexico, in particular, offers a pragmatic nearshore alternative. Let’s view these and other benefits you can expect when choosing Mexico as your destination.

Mexico offers a wide and versatile tech talent pool

As one of the leading software engineering hubs in Latin America, Mexico is home to over 700,000 highly skilled tech professionals. This makes the country a prime destination for nearshore software development in Mexico, providing US businesses with access to qualified talent.

With a strong focus on digital literacy and interpersonal skills, Mexico’s workforce is well-equipped to tackle the growing demand for IT specialists. According to Accelerance, Mexico ranks highly with a Partner Skill Level score of 92, reflecting the quality of education and the proficiency of its tech experts.

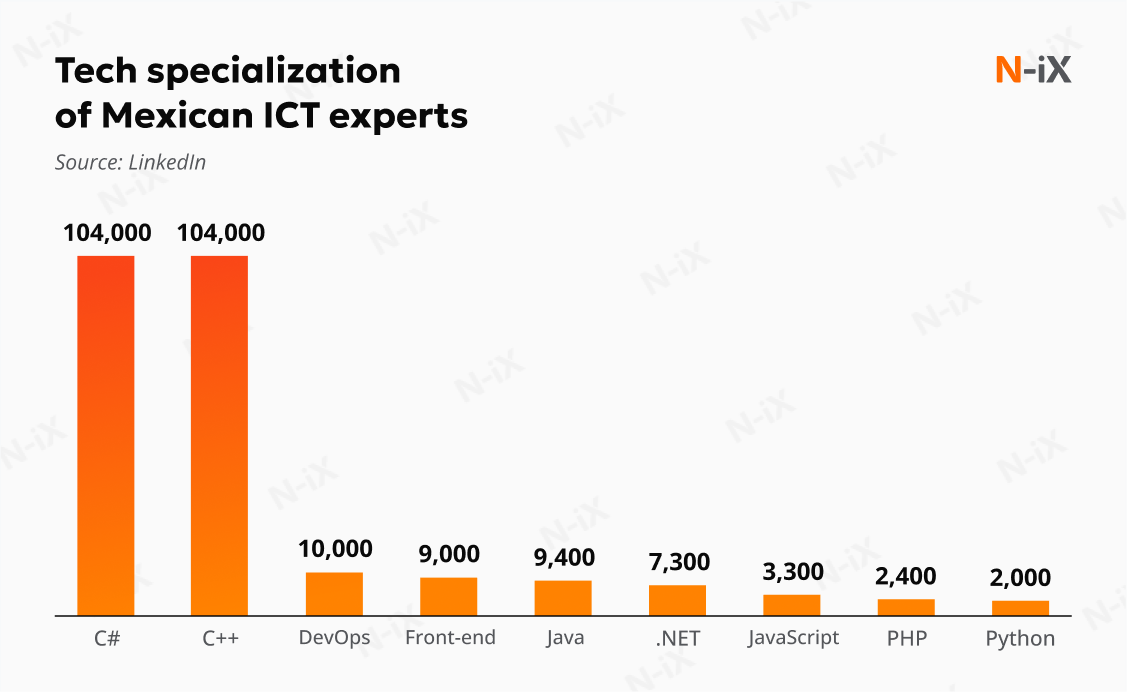

Mexican developers demonstrate strong specialization and versatility across various technologies, with the largest number of experts specializing in C++ and C# (around 104K each). Following closely are Java, .NET, and front-end development, with approximately 9.4K, 7.3K, and 9.9K specialists, respectively. The country also houses a significant pool of professionals skilled in Python, PHP, and JavaScript.

Local STEM education system ensures constant talent inflow

The country is on track to provide its tech industry with the talent to meet growing demand with a constant inflow of qualified graduates. Annually, more than 130,000 students with engineering degrees graduate from Mexican universities . In fact, the country boasts some of the best technical universities in the region. Some are listed at the top of the international rankings, such as QS and Times World University Ranking.

Currently, the three universities with the highest scores in international rankings in technology studies are Tecnologico de Monterrey (ITESM), the National Autonomous University of Mexico (UNAM), and the Autonomous University of Sinaloa (UAS). These and other institutions prepare qualified professionals who will enter the labor market in the years to come.

Time zones in Mexico overlap with major US business hubs

By choosing nearshore outsourcing to Mexico, US-based businesses gain the advantage of working with teams in similar or overlapping time zones. This, in turn, ensures seamless communication and collaboration with the added benefit of regular syncs and real-time project updates.

Mexico’s proximity to the US enables convenient business travel

Additionally, Mexico shares its borders with the US, making potential business trips much faster and more convenient.

This geographical advantage facilitates seamless in-person collaboration and strengthens business relationships. Below is a visual representation of key flight connections from major US business hubs to major Mexican cities.

Mexican professionals are a good fit for international teams

The fact that Mexico and the US share a border means that the two cultures have a long history of coexistence and exchange. However, it is not the only reason that representatives of these cultures work well together. According to the Culture Factor Group, Mexico has a score of 34 in terms of individualism and is considered a collectivistic society. It means that Mexican professionals showcase long-term commitment in groups, in this case, the work environment. So, they are good team players, which is vital for successful nearshore outsourcing to Mexico.

In terms of power distance, Mexico scores 81, indicating a preference for clear structures and guidance. While this reflects a respect for hierarchy, it also means that Mexican experts are accustomed to defined roles and expectations, facilitating smoother management and collaboration. This balance of team-oriented values and organizational clarity makes Mexican tech professionals a particularly attractive choice for nearshore projects.

Get a complete overview of the software development market in Latin America!

Success!

Local laws ensure intellectual property protection

Mexico and the US have established trade agreements that ensure robust intellectual property protection. These agreements, including the USMCA, set high standards for safeguarding intellectual property rights, such as trademarks, geographical indications, and copyrights. As a result, nearshore software development in Mexico provides a secure environment for innovation, allowing businesses to collaborate with confidence while protecting their intellectual assets.

Read more about IT outsourcing to Mexico

Nearshore software development in Mexico: Market overview

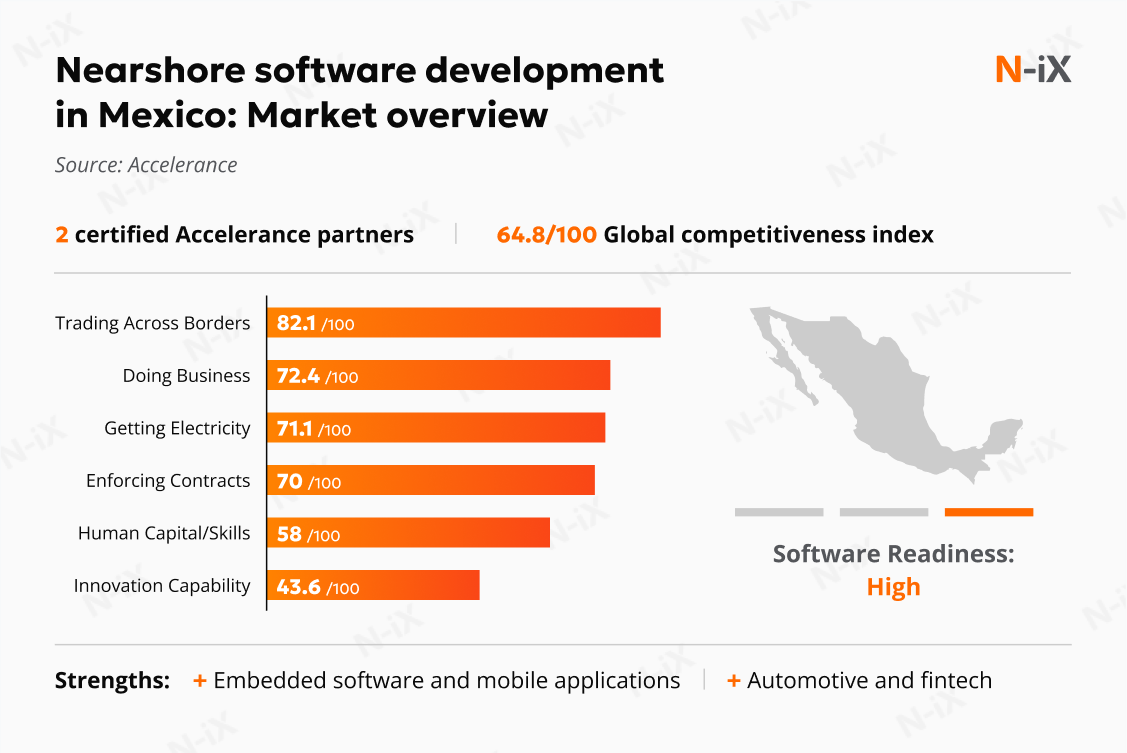

Mexico, Latin America’s second-largest economy, has developed a strong nearshore outsourcing industry. According to Accelerance, this sector is valued at around $12B a year and is expected to maintain steady growth.

This is reflected in several key areas that influence the nearshore market, from the presence of global R&D centers to stable economic conditions and a broad ecosystem of technology vendors and accelerators. The following factors highlight why Mexico continues to attract businesses looking to build or extend their engineering teams.

Many global businesses have already established R&D centers in Mexico

Many industry leaders have opted for nearshore software development in Mexico—Delphi, Toyota, Ford, Whirlpool, and Mattel are just a few. A significant portion of Mexican tech professionals work in the R&D sector, which can be viewed both as an advantage and a disadvantage. On one hand, the presence of these global giants may lead to intense competition for top talent. On the other hand, these companies set a high bar for the experts they hire, so the other professionals in the market must keep up to stay competitive in the labor market.

The business environment in the country is stable and favorable for nearshoring

In 2024, Mexico’s Gross Domestic Product (GDP) reached $1,852.7B, ranking 14th globally. As an export-driven economy, Mexico’s economic environment is heavily influenced by the demand from its largest trading partner, the US. The country accounts for approximately 80% of Mexican exports.

The strong economic relationship between the US and Mexico is reinforced by the US-Mexico-Canada Agreement (USMCA), which has been in effect since 2020. The agreement includes a dedicated chapter on digital trade, aiming to foster closer collaboration between the three nations in developing and integrating their digital markets. Key provisions, such as the facilitation of cross-border data transfers, are essential for enabling seamless digital trade in North America.

In addition to its trade agreements, Mexico’s membership in the G20, the Pacific Alliance, and the OECD strengthens its position in the global economy, contributing to overall economic stability. The country also pioneered fintech regulations in Latin America in 2018, becoming the first in the region to establish a legal framework that ensures user protection in the financial technology sector.

Mexico is home to a large number of tech vendors

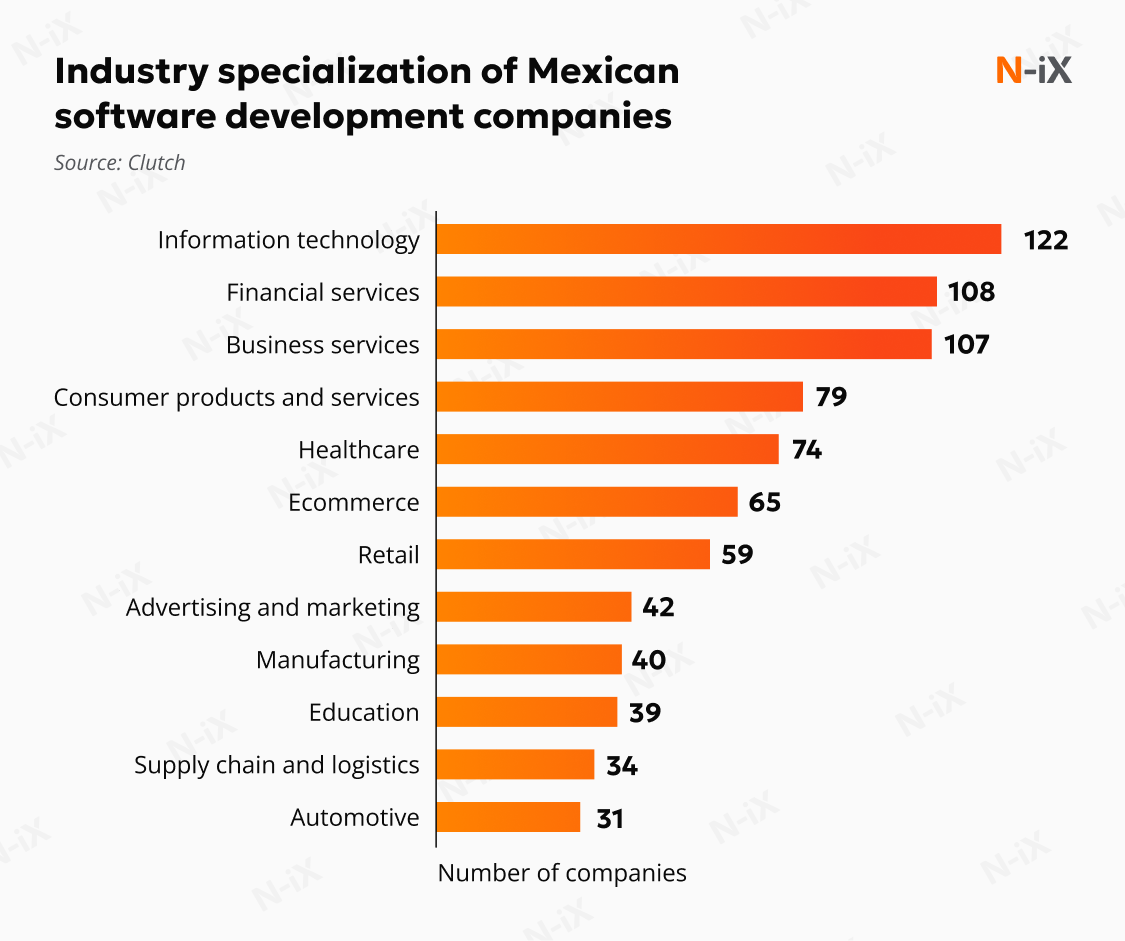

In the context of nearshore software development, Mexico offers a mature and diverse vendor landscape that can support a wide range of business and technology needs. The country is the second biggest IT market in the region, with 700,000 tech professionals and the largest number of IT vendors. As of November 2025, 515 Mexican software development firms are listed on Clutch. Regarding industry focus, many local providers specialize in financial, business, and consumer services, as well as healthcare, ecommerce, retail, and others. The main areas of expertise are mobile app development, web development, IT strategy consulting, and IT managed services.

Mexico provides attractive incentives for international tech companies

The country offers a supportive environment for foreign businesses, particularly those in technology and software development. Companies operating in Mexico can benefit from a range of financial and regulatory incentives, for instance:

- No obligation to pay local or state income taxes on corporate earnings;

- Special grants that are provided by the National Council of Science and Technology (CONACYT);

- Global commerce and free-trade agreements with several jurisdictions, including the EU, Norway, Israel, Switzerland, Costa Rica, Colombia, as well as Japan.

Moreover, Mexico also has some of the region's best and most sought-after accelerators, with a wide variety of high-quality programs and different sorts of investments. One example is 500 Startups LatAm, a leading early-stage accelerator and investor, supporting Latin American startups with funding and mentorship. It has invested in a wide variety of Mexican startups, including 99 Minutos, Aora Servicios, Apphive, Clivi, Kindor, and more.

In addition to private accelerator activity, the government also plays an active role in strengthening the tech sector. The government initiative Fondo Nacional Emprendedor supports entrepreneurship by providing financial assistance to emerging tech startups. Another national program, PROSOFT, focuses on growing the software industry through funding for innovation centers, workforce development, and the adoption of digital technologies. This combination of private and public support contributes to a dynamic tech environment in Mexico.

With all the benefits and market peculiarities in mind, let’s now take a look at the most significant hubs you can сhoose for nearshore software development in Mexico.

Key hubs of nearshore outsourcing in Mexico

To attract foreign investment and foster innovation, Mexico has invested in more than 20 technological parks. As a result, some of the most prominent IT hubs in the country have emerged, with Mexico City, Guadalajara, and Monterrey leading the way. Let’s take a closer look at these cities and their role in the nearshore software development in Mexico.

Mexico City

As the country’s capital and the largest city, Mexico City houses a significant number of established tech vendors and startups. According to Statista, in 2024, Mexico City was home to around 450 startups and seven unicorns (Clip, Merama, Konfio, Kavak, Clara, Plata, and Bitso). As of November 2025, Clutch lists around 220 vendors that can help you with nearshore software development in Mexico. Moreover, the city boasts a robust network of incubators, accelerators, and venture capital firms, with a particular emphasis on fintech, ecommerce, and software development.

Guadalajara

Guadalajara, often referred to as the "Mexican Silicon Valley," has evolved from a manufacturing hub to a prominent center for technology and innovation in recent years. The city is home to 98 outsourcing companies, according to Clutch. Besides IT services, the city excels in the areas of electronics and custom software development, making it a key player in the country’s tech ecosystem.

Monterrey

This is another major IT outsourcing hub in Mexico, with an advanced tech hub with a high concentration of full-stack and back-end developers, QA specialists, and solution architects. The city is known for its expertise in software development, cybersecurity, and data analytics. The city is home to 64 software development firms, along with a growing number of startups specializing in fintech, edtech, and healthtech.

You might also be interested in a guide on nearshoring to Latin America

N-iX as a trusted partner for nearshore software development outsourcing in Mexico: Why we stand out

Choosing a partner in a new region is not just about filling roles. It is about trust, shared goals, and making sure your project moves forward without friction. Many organizations look to Mexico for nearshore software development because of the talent availability and cultural alignment, but navigating the market alone can be time-consuming. This is where N-iX supports you.

For more than two decades, we have been helping companies strengthen their engineering capabilities and scale efficiently. With a delivery center in Latin America and a wide talent network across the region, we help US businesses access experienced engineers across Mexico and neighboring countries. Whether you need to scale your engineering capacity or build a dedicated development team, we can connect you with specialists who understand your domain and development needs.

What sets our nearshore approach apart:

- A strong talent presence in Latin America, including a delivery center and established recruitment networks;

- The ability to build distributed teams across 25 countries while ensuring cultural and communication fit;

- A mature recruitment and vetting process that focuses on long-term engineering excellence;

- Flexible collaboration formats that let you scale up or down as business needs evolve;

- Smooth integration into your existing development at any stage of the lifecycle.

We work with organizations across BFSI, manufacturing, retail, healthcare, and other sectors. Global leaders from North America, such as Fluke Corporation, TuneIn, OpenText, and others, collaborate with our teams to build strategic products and platforms. They stay because of quality, transparency, and predictable delivery. Become the next company to successfully build a nearshore software development team in Mexico—contact us!

FAQ

How do I evaluate whether a vendor in Mexico is the right long-term nearshore partner for my business?

Look at their delivery track record with clients from North America, team retention rates, and the maturity of communication practices. A reliable partner will be transparent about processes, provide reference cases, and demonstrate that they can maintain performance standards over time.

Which engagement models are available when partnering with vendors in Mexico for nearshore software development?

Most mature providers, including N-iX, offer several collaboration models such as IT staff augmentation, dedicated development teams, and full-cycle custom software development. Each model allows you to tailor the level of ownership, control, and scalability to match your project needs and internal capabilities.

How can businesses protect intellectual property (IP) when nearshoring to Mexico?

IP protection begins with selecting a trusted vendor that follows established security and compliance standards. Clear contracts with defined IP ownership and NDAs, combined with controlled access to sensitive data, ensure your intellectual property remains secure throughout the engagement.

How quickly can a nearshore team in Mexico integrate into our development process?

Most experienced vendors can assemble and onboard a core team within a few weeks. At N-iX, filling a position typically takes 3-4 weeks, after which сomes a structured knowledge transfer phase. During this time, we ensure your Mexican team members are aligned with your workflows early in the engagement.

Have a question?

Speak to an expert