Located in Jalisco, Guadalajara has established itself as Mexico's technology capital, hosting over 1,000 tech companies and generating around 150,000 technology jobs as of 2025. The region accounts for 40% of Mexico's entire IT sector. Major technology corporations, including Meta, Google, Apple, Netflix, and LinkedIn nearshore to Guadalajara, validating the city's infrastructure and talent quality. Companies choose this tech hub to hire developers in Mexico, gaining access to a skilled and experienced workforce.

Why companies nearshore to Guadalajara

What's driving companies to choose Guadalajara for their nearshore software development operations? Geographic proximity, competitive costs, and expanding technical capabilities have positioned Guadalajara as an attractive nearshore destination for US companies. The city has established itself as a center for software development and innovation. Let's examine the specific advantages of nearshoring to Guadalajara.

Guadalajara's technology ecosystem and infrastructure

The city hosts specialized IT clusters that provide software development services, with particular strengths in artificial intelligence, biotechnology, and enterprise software development. Guadalajara's manufacturing heritage means many developers have domain expertise in industrial software, IoT platforms, and systems integration. The city is Latin America's most important semiconductor design center, as evidenced by investments such as Foxconn's superchip complex and ASE Technology's new semiconductor packaging hub. These facilities complement Guadalajara's capabilities in original design manufacturing, software development, and advanced technology services.

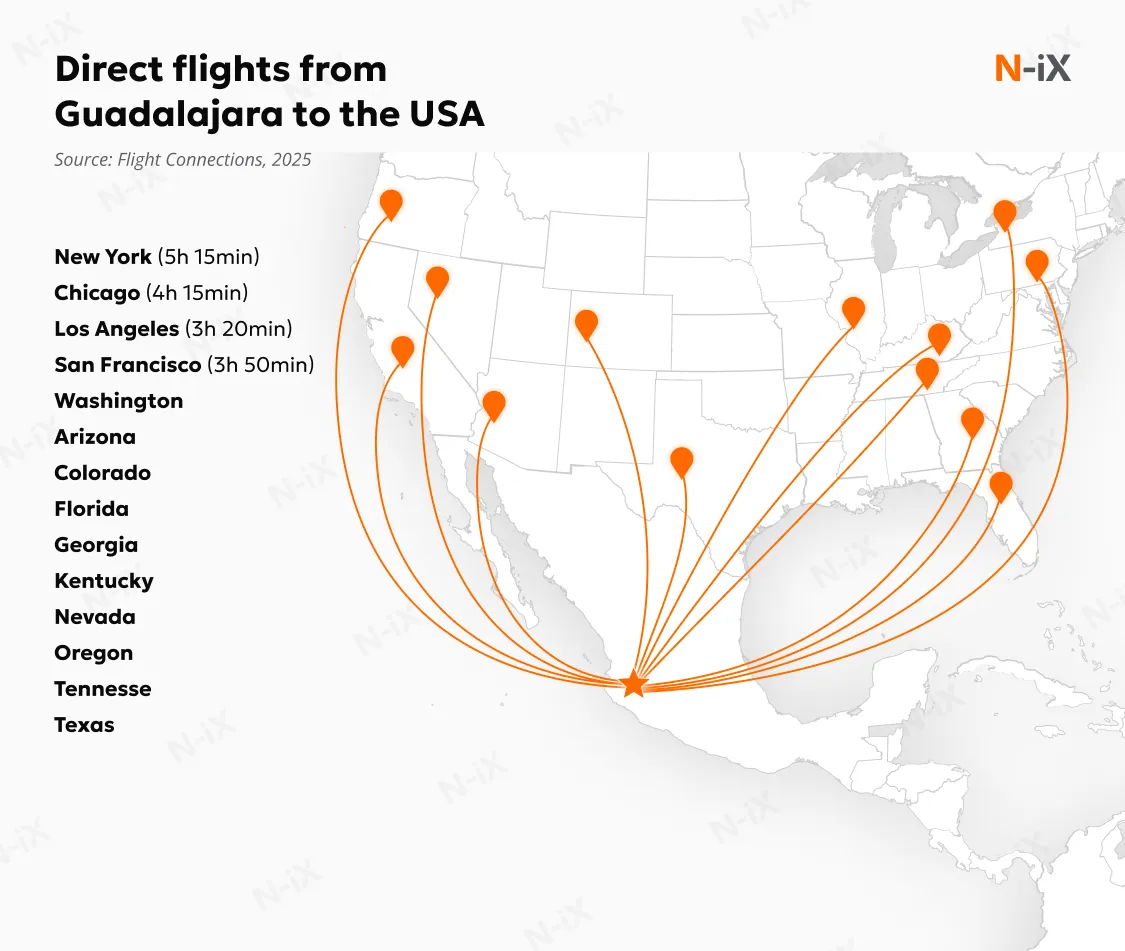

Internet connectivity infrastructure in Guadalajara meets international standards, with 83% penetration in Mexico in 2023, expected to exceed 90% by 2028. Thirteen submarine cables connect Mexico to the United States through the Pan-American Crossing network, providing robust international connectivity. The city's Guadalajara International Airport handles international traffic with frequent direct flights to major US cities.

Guadalajara is in the GMT-6 time zone, which aligns with Central Time in the United States (same as Dallas and Houston). This provides full business-day overlap with US East Coast operations and 5-6 hours of overlap with West Coast teams. Direct flights from Guadalajara to San Francisco take approximately four hours, enabling quarterly in-person meetings and rapid response to situations requiring physical presence.

Mature ecosystem with specialized expertise

According to the StartupBlink Global Startup Ecosystem Index 2025, Guadalajara ranks 3rd nationally within Mexico, maintaining its position as one of the country's main technology hubs. The city recorded an annual ecosystem growth rate of 16.8%, outpacing Mexico City and Monterrey.

Guadalajara has emerged as a rising industry hub in financial services, ranking 122nd globally in this sector. This specialization aligns with the city's strong fintech presence, with 15% of startups in the local ecosystem operating in financial technology. For companies choosing to nearshore in Guadalajara, this ecosystem's density means faster recruitment, higher retention, and access to specialized expertise that is difficult to find in smaller markets. Startup Genome ranks Guadalajara 15th in Latin America by startup ecosystem performance and innovation capacity.

Mexico's economic context supporting Guadalajara operations

Companies that nearshore to Guadalajara benefit from Mexico's broader economic stability and trade frameworks. Mexico's $1.85T GDP positions it as the world's twelfth-largest economy and Latin America's second-largest. The service sector accounts for 60% of economic output, with ICT services representing 3.9% of total service exports. Mexico's ICT service exports grew from $1.29B in 2020 to $2.43B in 2024.

The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in 2020, strengthened trade frameworks between the three countries. The United States accounts for more than 80% of Mexico's exports, creating established logistics and business channels that technology services leverage. USMCA includes provisions for intellectual property protection and cross-border data flows that support technology operations.

Mexico ranks 60th out of 190 economies in the World Bank's Ease of Doing Business rankings, maintaining its position as the leading Latin American country in this metric. The World Bank's Business Ready 2024 report shows Mexico performing particularly well in financial services infrastructure and regulatory frameworks.

Guadalajara's cost of living is 41% of New York's, with rents at 19.6% of New York levels. This translates to competitive salary expectations while maintaining strong purchasing power for professionals. Companies can offer compensation packages that attract top talent while achieving significant cost advantages compared to US-based teams.

Talent pool and education infrastructure in Guadalajara

Guadalajara draws on Mexico's 3 million STEM professionals and 250,000 STEM graduates annually. The city's concentration of technology companies attracts talent nationally, creating a deep pool of experienced professionals.

Guadalajara hosts 13 technical education institutions and three technical universities focused on industry needs. The private education system comprises 12 universities, more than 60 graduate programs, business schools, and technical training facilities. These institutions collaborate directly with state government and technology companies to update curricula based on industry skill requirements, a coordination model established through IJALTI since 2002.

Guadalajara exceeds Mexico's national average, ranking "moderately proficient" in the EF English Proficiency Index 2025. Software engineers in the city demonstrate strong English proficiency aligned with industry requirements, with technical documentation, coding standards, and project communication typically conducted in English.

Get a complete overview of the software development market in Latin America!

Success!

Innovation ecosystem and government support

In 2013, Jalisco became Mexico's first state to create a dedicated science and innovation ministry, cementing an institutional framework that ensures consistent technology support across government administrations. This was built on earlier pioneering efforts: the state established IJALTI (Instituto Jalisciense de Tecnologías de la Información) in 2002 as a public-private institute coordinating technology strategy among government, the industry chamber CANIETI Occidente, and universities. Guadalajara accounts for a significant share of Mexico's innovation activity, placing Mexico 58th among 139 economies in the Global Innovation Index 2025, 10th among upper-middle-income economies, and 3rd in Latin America and the Caribbean.

The Mexican government provides specialized programs that support the development of the ICT sector and benefit Guadalajara operations. The Fondo de Innovación Tecnológica (FIT), through CONACYT, offers grants for technological innovation and R&D projects targeting high-impact initiatives. Startup México provides incubation and acceleration programs, including co-working spaces, mentorship, and access to investor networks. PROSOFT 3.0/4.0 specifically targets the IT sector's development, providing partial funding for innovation projects in software, IT services, and digital content.

Mexico hosts 1,083 startups, accounting for 87% of all Central American startup activity. The country ranks 29th globally and first in Central America for fintech development, with six unicorn companies. Guadalajara's ecosystem includes numerous startups specializing in software development, artificial intelligence, and biotechnology, creating a vibrant environment that attracts entrepreneurial talent.

Market growth and technology services demand

Mexico's ICT market is forecast to reach $118.12B by 2030, growing at 10.65% annually from its 2025 valuation of $71.23B. This expansion stems from three primary factors: Mexico's role as a nearshoring hub for North American companies, 5G technology deployment combined with cloud computing adoption, and data center expansion in the Querétaro-Mexico City region.

The IT services sector is projected to generate $16.16B in revenue by 2025, with IT outsourcing accounting for $6.05B of that total. From 2025 to 2030, the sector is expected to grow at 4.4% annually, reaching $20B by the end of the decade. Guadalajara, accounting for 40% of Mexico's IT industry, will capture a significant portion of this growth.

Companies that nearshore to Guadalajara position themselves in the fastest-growing segment of Mexico's technology market. Mexico has moved up to 10th place on the Kearney Global Services Location Index, benefiting from the largest increase in business environment scores, driven by substantial improvements in both the country environment and infrastructure components. This ranking places Mexico ahead of many traditional offshore destinations, with Guadalajara among the strongest locations in Mexico's offering.

Read more: Best Latin American country for staff augmentation

Why work with N-iX to nearshore to Guadalajara

Nearshore partnerships succeed when technical capabilities align with communication compatibility and shared project goals. Guadalajara attracts US companies through its talent concentration and favorable time zones, but establishing operations in an unfamiliar market presents challenges. N-iX provides guidance through this process.

Our 23-year track record centers on helping businesses expand engineering resources and grow technical capacity. Through our Latin American operations and Mexico-wide talent networks, we facilitate connections between US organizations and experienced software engineers in Guadalajara. Our support spans dedicated team formation and flexible capacity expansion, matching technical specialists to your industry context and development stack.

How N-iX approaches nearshore development in Guadalajara:

- Regional infrastructure throughout Latin America, with recruitment capabilities in Guadalajara

- Team composition that prioritizes communication alignment and organizational fit

- Established hiring methodology emphasizing engineering consistency over time

- Engagement structures that adapt as your business requirements change

- Support for incorporating teams into your current development workflows, regardless of project phase

Our client base includes organizations in financial services, manufacturing, retail, healthcare, and other industries. Companies such as Fluke Corporation, TuneIn, and OpenText from North America maintain ongoing work with N-iX on strategic product initiatives. These partnerships persist due to delivery quality, operational clarity, and reliable execution. Take the next step toward establishing your Guadalajara-based development team. Connect with N-iX today.

FAQ

1. How to find the right tech partner to nearshore to Guadalajara?

Assess potential partners by examining their North American client history, employee turnover metrics, and the quality of their communication infrastructure. Strong partners demonstrate operational transparency, provide client references for validation, and demonstrate sustained quality delivery across extended engagements.

2. How do you ensure the developers have the specific technical skills my project requires?

N-iX uses a multi-stage vetting process including technical assessments, coding tests, and system design exercises aligned with your technology stack. We present only candidates who pass our rigorous screening; you interview the shortlisted candidates directly and make the final selection decisions. This ensures both technical competence and cultural fit with your team.

3. How does N-iX handle intellectual property and code ownership?

All intellectual property developed by your N-iX team belongs exclusively to you through IP assignment clauses in employment contracts and our Master Services Agreement. Your code resides in your repositories with access controlled entirely by you. N-iX maintains ISO 27001 certification and follows strict information security protocols to protect your IP throughout the engagement.

4. How does N-iX ensure consistent quality across projects when working with distributed teams?

N-iX maintains quality through ISO 9001-certified processes, mandatory code reviews, and automated testing requirements across all projects. Dedicated Delivery Managers oversee execution with regular quality audits, performance metrics tracking, and client feedback loops. Our teams also hold ISO 27001 and CMMI Level 3 certifications, ensuring process maturity and information security.

Sources:

- Mordor Intelligence, 2025. Mexico Semiconductor Market Size, Share, 2025-2030 Outlook

- ReportLinker, 2025. Forecast: Total Internet Users in Mexico

- TeleGeography, 2026. Submarine cable map. Mexico

- Flight Connections, 2026. Flights to Guadalajara (GDL)

- StartupBlink, 2025. Startup Ecosystem Report 2025

- StartupBlink, 2025. Top Startups in Guadalajara | StartupBlink

- Startup Genome, 2025. Ecosystem Report 2025

- Georank, 2025. Mexico's economy ranked: GDP growth, debt + 78 stats

- World Bank Group, 2020. Doing Business in Mexico - World Bank Group

- World Bank Group, 2024. Business Ready 2024

- Numbeo, 2026. Cost Of Living Comparison Between United States And Mexico

- PRODENSA, 2021. STEM Workforce in Mexico

- World Bank Group, 2024. SECTOR ASSESSMENT: ICT IN YUCATÁN

- EF English Proficiency Index, 2025. Mexico | EF English Proficiency Index

- Financial Liberties, 2024. Entrepreneurship In Mexico

- Mordor Intelligence, 2025. Mexico ICT Market Size, Share, Trends, 2030 Report

- Statista, 2025. IT Services - Mexico | Statista Market Forecast

- Kearney, 2023. Regenerative talent pools

Have a question?

Speak to an expert