What if your data could become more than an internal asset and drive new business outcomes instead? An increasing number of companies are incorporating data-driven strategies to support business growth. One notable area demonstrating adoption is data monetization.

Data monetization is the process of generating measurable economic benefits from data, whether by improving internal operations or creating new external revenue streams. It demands a structured, organization-wide strategy that connects data assets to business objectives through governance, infrastructure, and execution. This article outlines what a data monetization strategy entails, its value to enterprises, and how to approach it effectively.

What is the business value of a data monetization strategy?

A data monetization strategy is a deliberate, enterprise-wide framework that defines how an organization will generate measurable revenue, savings, or strategic advantage from its data assets. It is not a collection of disconnected data initiatives or a technical exercise in analytics deployment.

Such a strategy aligns data capabilities with commercial outcomes. It defines what value the organization aims to extract, how it will be delivered (internally or externally), and what infrastructure, governance, and competencies must be in place to support that delivery at scale. In practice, specifying a data monetization strategy means answering critical questions:

- What economic value can our data generate and through which channels?

- Which data assets are monetizable, and what is their commercial potential?

- What are the viable monetization models for our organization and industry?

- What business functions, platforms, and customer journeys will monetization enhance?

- What operating, legal, and governance frameworks are required to support monetization at scale?

- How will we measure success and prioritize ongoing investment?

- What risks must be mitigated to protect competitiveness and reputation?

Build a data strategy roadmap that delivers value—get the complete guide now!

Success!

Defining a clear strategy is only the beginning. The impact becomes evident when that strategy is put into practice. What does this look like in operational and commercial terms? Several core areas consistently show the most tangible and strategic value:

Revenue growth through flexible monetization models

One of the clearest outcomes of successful data monetization is the ability to open new revenue streams. For example, insights generated from user behavior or operational performance can be sold to partners, suppliers, or customers under governed conditions. As synthetic data and generative AI capabilities mature, new monetization formats emerge, including synthetic datasets for model training and APIs that deliver real-time decision-ready insights.

Organizations generally assess the business case for data monetization over a 3 to 5 year period to capture both short-term wins and long-term gains. For example, an enterprise with $2B in annual revenue may initially generate only $5M from data-related activities. In a conservative growth scenario, with limited investment, that revenue might grow by 10% annually, reaching only $6.7M over three years [1]. However, with a structured data monetization strategy, that same organization could grow its data revenue fourfold to $20M over the same period.

Cost optimization and operational gains

Beyond topline growth, data monetization delivers tangible operational savings. Organizations can reduce inefficiencies, eliminate waste, and reallocate resources more effectively by applying analytics to internal operations. Some examples may include automating routine decisions, optimizing inventory levels, or identifying fraud more accurately.

One documented case from Harvard Business Review highlights how a national bank deployed a single data product across 60+ use cases, leading to $60M in added revenue and $40M in annual savings through better credit scoring and automation [2]. These operational improvements are monetization in practice.

Competitive advantage and market differentiation

In increasingly data-saturated markets, monetization is becoming a critical differentiator. According to Gartner's CDAO Agenda Survey 2024, 50% of data leaders have already deployed data products, and an additional 29% are piloting or planning deployment within the next year [3]. Organizations that can extract, refine, and deploy insights faster gain a strategic edge, whether through more personalized offerings, better timing, or a deeper understanding of customer needs.

Data also plays a role in creating new service layers. For example, embedding data-driven recommendations or usage-based pricing into an existing product can dramatically enhance perceived value.

Read more: How to generate value with data monetization in banking

Pillars of an effective data monetization strategy

A successful data monetization strategy guide requires technical maturity, organizational alignment, commercial clarity, and strategic foresight. The following pillars form the core of a durable, scalable, and revenue-generating data monetization approach.

1. Strategic vision

Data monetization efforts must be tightly integrated with the broader business data analytics strategy. That means defining long-term, executive-backed objectives focused on business impact: improving margins, accelerating innovation, expanding into new markets, or enhancing the customer value proposition.

Data should be treated as a dynamic, evolving asset. As the business grows, use cases, customers, and monetization opportunities shift. An adaptive strategy ensures alignment between data initiatives and market conditions while reinforcing accountability at the leadership level.

Read also: What are the biggest opportunities of data monetization in healthcare in 2026?

2. Robust data foundation

Monetization cannot proceed without a solid data foundation, such as high-quality data and the architectural discipline to manage it across silos, formats, and functions. Organizations must ensure data is complete, consistent, up-to-date, and contextually relevant. A strong foundation includes:

- Master Data Management (MDM) to maintain a unified source of truth across key entities (customers, products, partners).

- Metadata management for better traceability, discoverability, and reusability of data assets.

- Semantic layering to align business definitions with technical assets.

- Data architecture designed for integration, performance, and scale.

3. Value identification

Not all data is equally valuable. The most effective monetization strategies begin by identifying high-impact data assets and mapping them to concrete business outcomes for internal optimization or external monetization. Value is not static. It must be continually reassessed based on regulatory shifts, changes in industry standards, or evolving partner needs.

Organizations must define:

- What kind of value does the data create: Is it enabling better decisions? Automating manual processes? Powering new products?

- Where is that value realized internally through operational improvements or externally through new revenue streams?

- How that value will be measured: Financial metrics, performance indicators, or customer impact.

4. Clear data monetization models

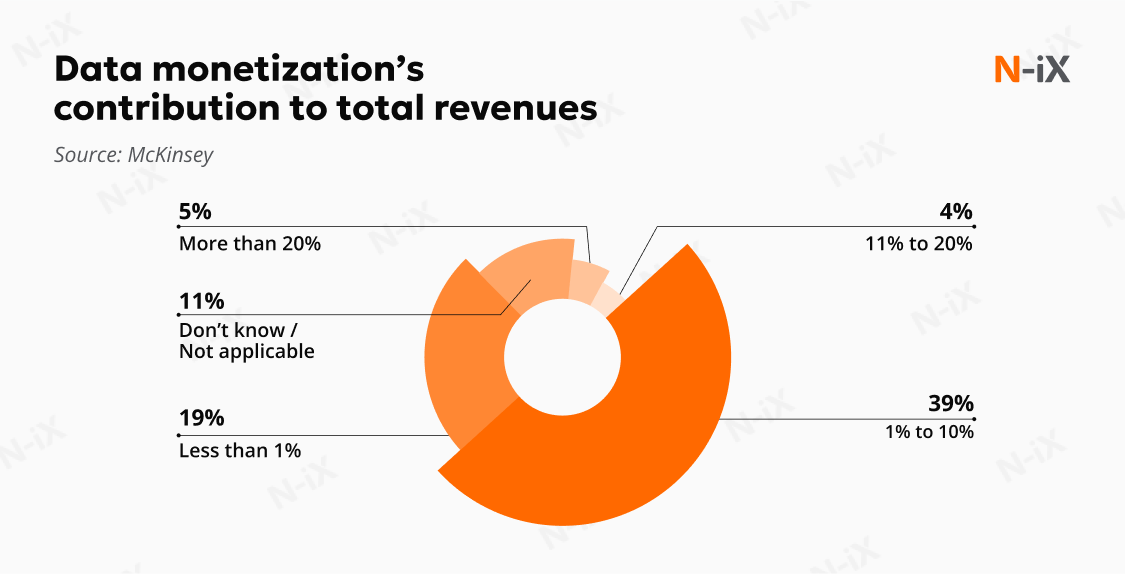

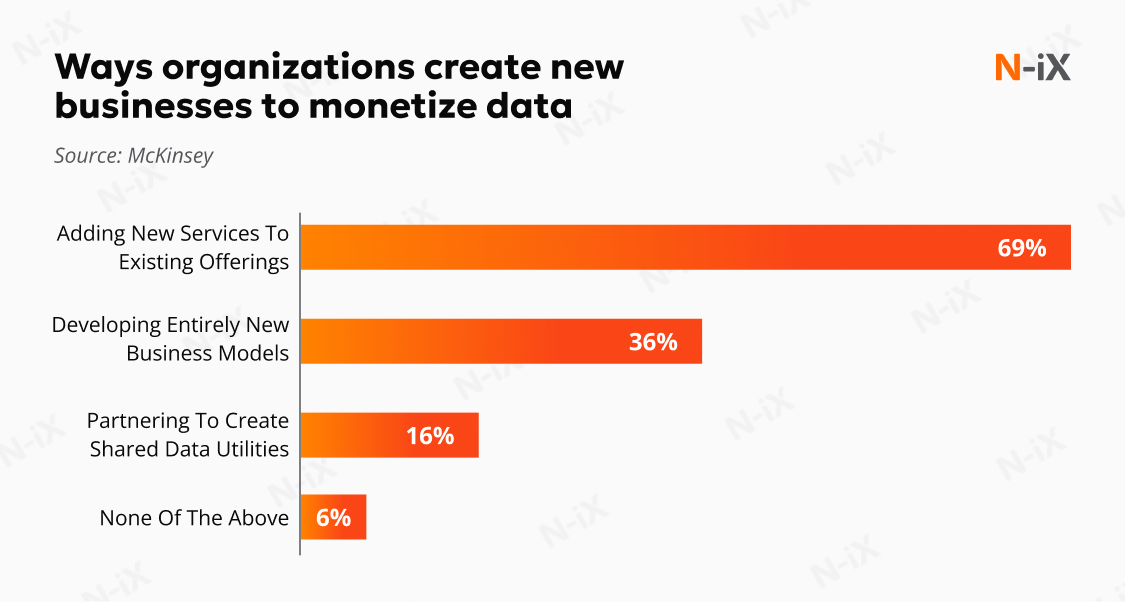

A one-size-fits-all monetization model rarely works across the complexity of enterprise ecosystems. Organizations must adopt a layered approach, leveraging direct and indirect monetization paths, tailored to their operational maturity, data assets, and industry context. According to McKinsey, companies that engage in direct and indirect data monetization models outperform their peers: high-performing organizations are three times more likely to derive over 20% of their revenues from monetized data initiatives [1].

Indirect monetization often serves as a strategic starting point. Here, data is not sold outright but used to optimize internal processes, elevate existing services, and generate downstream economic benefits. Common models include:

- Operational optimization: Applying analytics to reduce inefficiencies, eliminate process bottlenecks, and inform real-time decision-making. For example, predictive maintenance or dynamic workforce planning can yield measurable cost reductions without exposing sensitive data externally.

- Embedded analytics: Integrating actionable insights into products, services, or customer portals, enabling real-time personalization, upselling, or dynamic pricing. This model enhances user experience while increasing customer lifetime value and product stickiness.

- Data-driven business models: Leveraging proprietary insights to introduce new service lines, digital offerings, or advisory tools. Examples include decision-support applications in insurance underwriting or real-time logistics optimization tools.

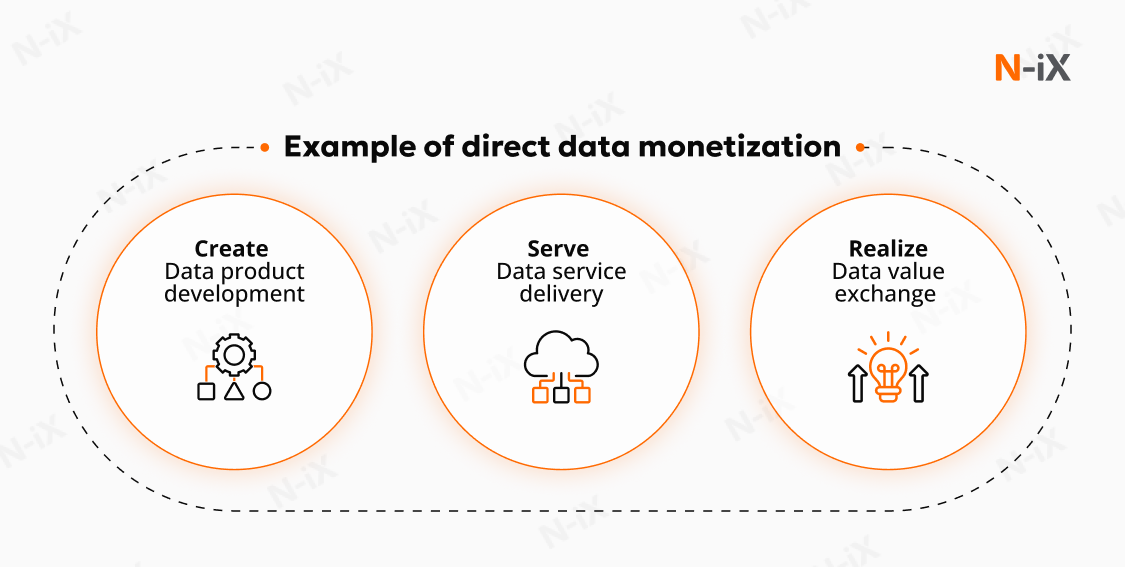

For organizations ready to commercialize data as a product, direct monetization models enable recurring revenue streams through external delivery mechanisms:

- Data-as-a-Service: Raw or structured datasets are delivered to partners, suppliers, or customers through secure APIs or data exchanges. Licensing agreements govern usage and access, allowing for controlled, scalable monetization with minimal incremental cost once infrastructure is in place.

- Insights-as-a-Service: Organizations deliver synthesized intelligence through dashboards, benchmarking reports, or predictive analytics. These offerings typically command higher margins and require more profound domain expertise.

- Analytics-enabled platforms: This model provides external stakeholders, such as channel partners, suppliers, or clients, with self-service access to analytics capabilities. Whether through embedded BI, configurable models, or on-demand visualizations, monetization opportunities are opened through subscriptions, usage-based pricing, or platform access tiers.

5. Proactive risk management and governance

Data monetization introduces risk, especially regarding regulatory compliance, data ownership, and ethical usage. When dealing with personal, financial, or sensitive data across jurisdictions, these risks are magnified.

A governance framework should address:

- Data lineage and provenance, ensuring clarity on where data originated, how it's transformed, and who has access.

- Privacy compliance, incorporating obligations under GDPR, PDPL, CCPA, HIPAA, and sector-specific regulations.

- Consent and licensing frameworks, particularly when monetizing third-party data or combining multiple data sources.

- Bias, fairness, and explainability, especially in use cases involving AI-generated insights or automated decision-making.

Discover also about retail data monetization and its use cases

Best practices for building a data monetization strategy

A strategy for data monetization demands far more than technological readiness or financial forecasting. Below, we outline the key principles that drive sustainable value from enterprise data.

1. Recognizing how data contributes to business performance

Monetization begins by clarifying the strategic role of data in current business operations. Which datasets drive margin improvement, enable better decisions, or reduce risk? Mapping these contributions allows stakeholders to distinguish between mission-critical data, operational exhaust, and high-potential byproducts.

2. Identifying valuable data that holds limited internal use

Not all data is worth monetizing, and not all valuable data finds buyers. Organizations must carefully assess the economic utility of their datasets, test assumptions about external or internal demand, and calculate the cost of access, processing, and delivery. Defining the nature of value being delivered and whether it's tied to vertical use cases, cross-market reuse, or niche segments is essential. Even technically sophisticated data products fail to generate returns without a precise economic framing.

3. Calculating the operational cost of monetization

Even when data has clear commercial potential, its monetization may involve significant operational overhead. Data transformation, enrichment, delivery pipelines, licensing, legal review, and customer onboarding can erode margins if not accounted for early. One of the most underestimated aspects is maintaining performance SLAs and compliance across evolving customer expectations.

4. Prioritizing foundational readiness before commercialization

Attempting to commercialize data without a stable foundation often leads to rework, failure, or reputational risk. That's why companies focus early efforts on solidifying core data capabilities: end-to-end data architecture, data quality frameworks, governance policies, and clear ownership models. Metadata management, semantic layers, and golden-copy master data are non-negotiable components in preparing datasets for scalable, trustworthy use. Best practices also prioritize AI readiness, ensuring data is curated, documented, and managed.

5. Selecting the right business model and pricing architecture

The monetization model defines how value is exchanged and sustained. In this process, evaluating a spectrum of options from internal value creation and competitive differentiation to syndicated offerings and premium digital services is recommended. Pricing models must align with how consumers perceive and consume the data product. Flat pricing, tiered access, usage-based billing, and freemium entry points have strategic implications.

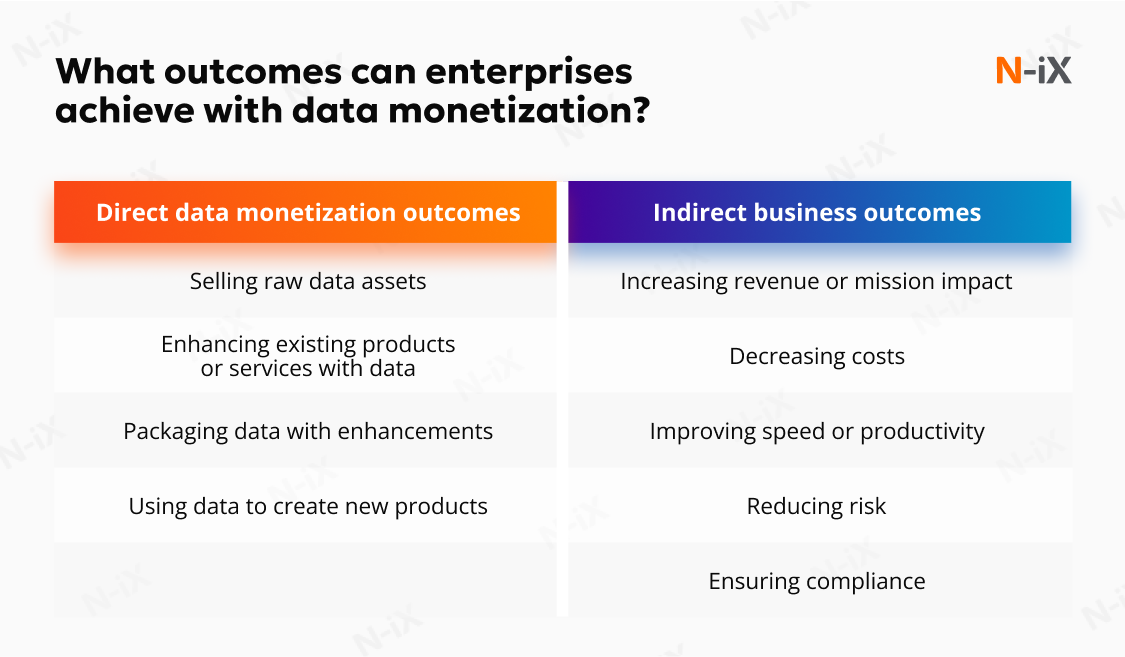

The choice of business model and pricing logic must reflect the value of the data and the intended outcome, whether that is generating external revenue or driving internal performance. This distinction helps structure data monetization around two primary outcome categories: external and internal.

External data monetization outcomes are:

- Selling raw data assets: Monetize proprietary datasets, media, algorithms, or intellectual property through direct licensing or resale.

- Enhancing existing products or services with data: Use analytics to add value to current offerings, improving customer engagement and insights.

- Packaging data with enhancements: Add processing, visualization, or enrichment layers to make raw data easier to consume and more valuable.

- Using data to create new products: Enter new markets or develop innovative services built around data, creating new revenue streams unrelated to past products.

Internal data-driven business models focus on using data internally to optimize operations and drive strategic improvements:

- Increasing revenue or mission impact: Boost customer satisfaction, sales, or mission alignment through better decision-making.

- Decreasing costs: Automate reporting, improve efficiency, and eliminate waste.

- Improving speed or productivity: Enhance decision velocity by allocating resources more effectively.

- Reducing risk: Avoid poor decisions that lead to financial or operational setbacks.

- Ensuring compliance: Meet data privacy and security obligations through governance and transparency.

6. Proactively manage legal, ethical, and compliance risks

Some sovereign data strategies encourage treating data as a monetizable asset, while others contribute to a fragmented global trade landscape [4]. This divergence creates conflicting and often confusing regulatory guidance, which can hinder organizations from fully capitalizing on data monetization opportunities.

Monetizing data requires full accountability for how that data is used by internal teams, external partners, or end users. Legal and regulatory complexity is increasing, driven by privacy laws, intellectual property concerns, and international data transfer restrictions.

Organizations must integrate governance and compliance from the outset to manage these risks effectively, including embedding legal review, consent tracking, access controls, and policy enforcement into the data product lifecycle. Additionally, establishing clear AI ethics principles and operationalizing them through frameworks for explainability, auditability, and transparency is critically needed to ensure trust and mitigate reputational risk.

Explore more details about: How to create a data strategy roadmap

What are the strategic and operational risks and how does N-iX mitigate them?

Data monetization offers high potential, but not without significant risks. Below, we detail the most critical barriers and how N-iX helps mitigate them across engagements.

Inability to demonstrate quantifiable business impact

A frequent barrier to scaling data monetization is the inability to connect data initiatives to measurable financial or operational value. Enterprises often launch internal data marketplaces or productization efforts without clearly defined success metrics, resulting in limited stakeholder engagement and insufficient ROI visibility.

How we address it: Within data strategy consulting, we co-design monetization initiatives explicitly focusing on measurable outcomes. N-iX integrates business impact modeling from the outset, leveraging frameworks such as data product lifecycle management, hypothesis-driven use case validation, and real-time KPI tracking to ensure ongoing justification for investment.

Loss of control over proprietary or sensitive data

When enterprises expose datasets to third parties, the risk of misuse, IP leakage, or reputational harm increases substantially. Without strong access controls, terms of use, and governance enforcement, even anonymized or aggregated data can be reidentified or exploited beyond its intended scope. These risks are amplified in B2C industries, where customer trust is paramount.

How we address it: We design secure data-sharing environments that enforce strict access protocols and policy-based controls. Our legal and compliance teams define usage terms, audit mechanisms, and contractual guardrails to maintain data sovereignty.

Legal fragmentation and evolving compliance standards

Global data monetization faces a fragmented legal environment, with jurisdictions differing in treating personal data, cross-border flows, and data ownership. Enterprises risk exposure to fines, litigation, or operational shutdowns if their monetization strategies conflict with data protection laws or fail to meet sector-specific compliance requirements.

How we address it: Compliance is embedded into every layer of our monetization architecture. N-iX maintains deep familiarity with global data regulations and sectoral standards, advising clients on risk-aware architecture, lawful data sourcing, and audit-ready governance. We implement data cataloging, consent management, lineage tracking, and jurisdiction-based routing.

Data quality and AI readiness

Low-quality data undermines the entire monetization effort. Incomplete, outdated, inconsistent, or poorly labeled datasets can lead to erroneous insights, regulatory exposure, and broken customer trust. According to Gartner, Organizations with AI-ready data infrastructures are significantly more likely to achieve their data monetization goals than those lacking AI readiness [4].

How we address it: N-iX begins every engagement with a data maturity and quality assessment. We apply structured data profiling, automated cleansing tools, and governance rules to raise consistency and reliability. For AI monetization use cases, we ensure training datasets meet accuracy, labeling, and lineage standards required for production-grade models.

Fragmented access and integration barriers

Many organizations operate in fragmented data environments like structured data in ERP systems, unstructured documents in siloed repositories, and real-time data in streaming platforms. Without unified access and integration, valuable data remains inaccessible for reuse or external packaging.

How we address it: Our teams design scalable integration pipelines using modern data architectures. We standardize formats across data sources, eliminate duplication, and create semantic layers allowing secure and compliant sharing across departments or with external partners.

Key takeaways

Whether monetization is internal (e.g., operational efficiencies, risk reduction) or external (e.g., new services, ecosystem partnerships), the path forward should be deliberate. It must consider technical feasibility, regulatory conditions, and evolving market demand. Every step from deciding whether to pursue internal or external monetization, structuring AI-powered data products, and ensuring legal compliance requires alignment between leadership, legal, operational, and technical teams. Without that alignment, even the most promising use cases stall.

At N-iX, we've helped enterprises across telecom, manufacturing, fintech, and other industries modernize their data. With 200+ data experts, 7 system architects, and over 60 completed data projects, we've seen what works and what fails.

Our teams have helped companies from Fortune 500 like Gogo, Redflex, and Cleverbridge modernize legacy data systems, design governance frameworks, and launch monetizable data products. We move fast, building teams in under six weeks and staying compliant with the most demanding regulations, from GDPR and HIPAA to ISO 27001. For enterprises looking to move beyond data as a cost center and toward data as a revenue driver, N-iX offers both the experience and the capacity to make it happen.

Data alone doesn't generate revenue. A strategy does. And the sooner it's designed and executed, the more competitive advantage it creates.

References

- Fueling growth through data monetization - McKinsey

- A better way to put your data to work - Harvard Business Review

- What do D&A leaders need to know about data products? - Gartner

- Hype cycle for data, analytics and AI leaders and programs in 2025 - Gartner

Have a question?

Speak to an expert