How do you bring innovation to an industry built on caution and regulation? That’s the challenge in insurance development today. Rapid digitalization, rising customer expectations, and pressure to improve margins are forcing insurers to rethink how they operate. As a result, cloud adoption in insurance is gaining momentum, offering a way to modernize operations without sacrificing compliance or trust.

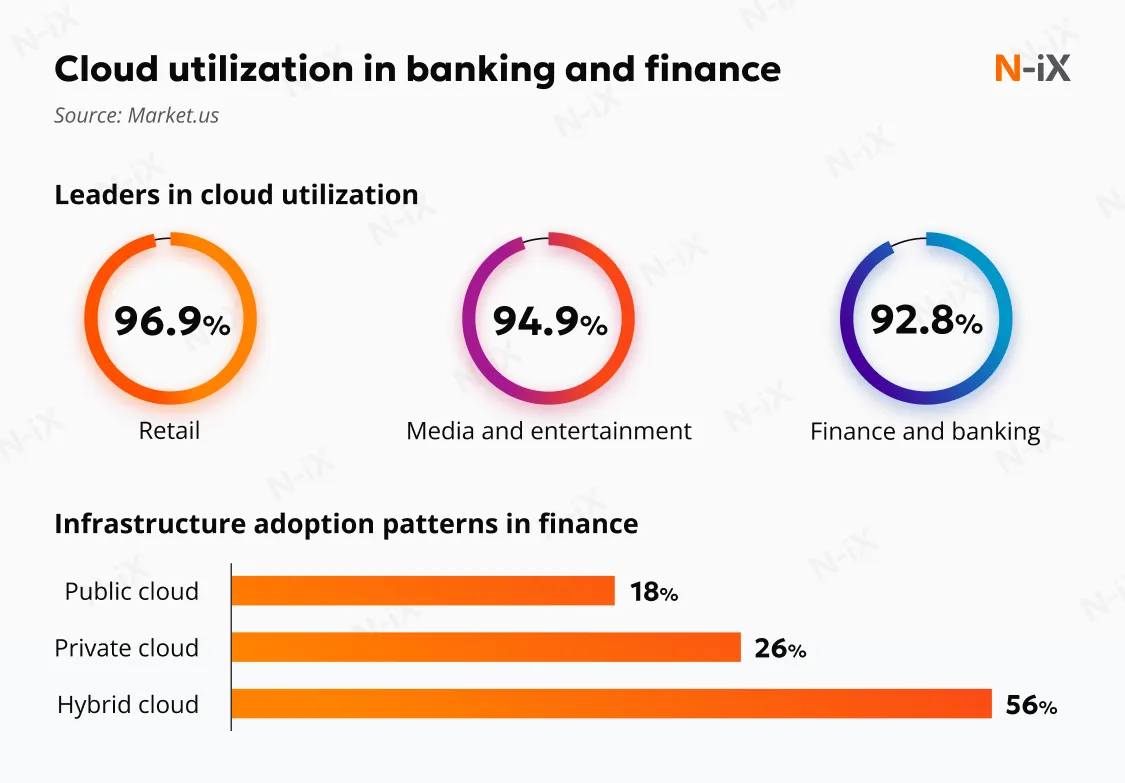

With 92.8% of organizations in finance and banking already using the cloud, insurers are now quickly following suit. For many, cloud technology is no longer a technical upgrade but a strategic tool to strengthen efficiency, resilience, and speed to market.

Explore our guide to discover why insurers embrace the cloud, what effective adoption looks like in practice, and how to approach this transformation.

How cloud adoption works and what changes it brings

When considering cloud adoption in the insurance industry, you’re stepping into a transformation that changes how systems, data, and processes connect. Here’s a closer look at the main architectural changes, adoption models, and migration options that shape this journey.

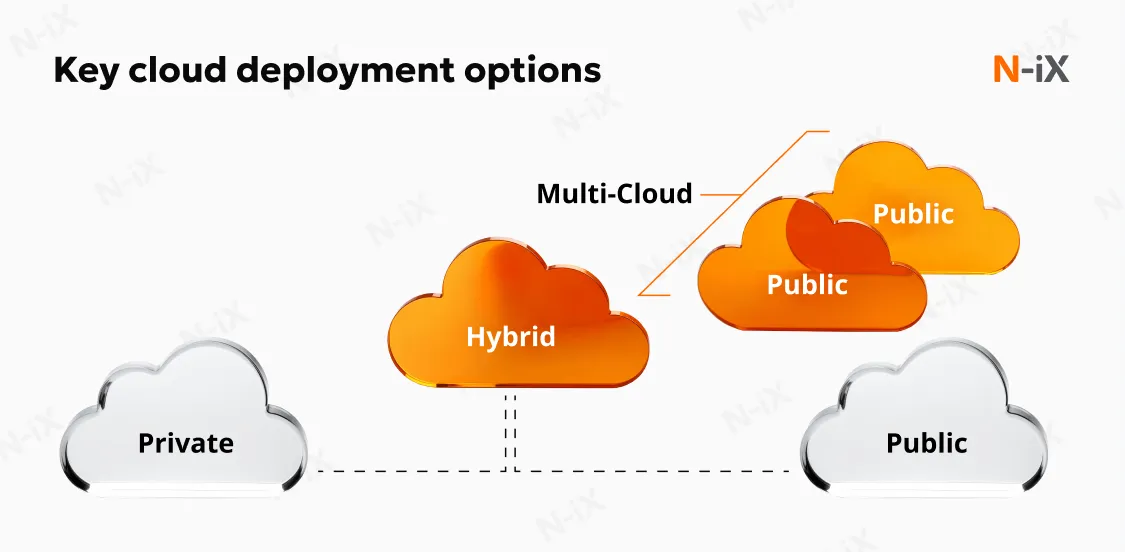

Modes of adoption: Public, private, hybrid, multi-cloud

There are several deployment options for insurance technology, each offering distinct advantages:

- Public cloud: These cloud platforms are owned and operated by third-party providers. They’re ideal for reliability, cost efficiency, and scalability to handle fluctuating demands.

- Private cloud: A private cloud is dedicated solely to a single organization. This model provides enhanced control and security, making it suitable for insurers with strict data privacy concerns.

- Hybrid cloud: A hybrid approach combines elements of public and private clouds, as well as on-premises infrastructures. It allows insurers to store sensitive data in private clouds while using public clouds for less critical workloads.

- Multi-cloud: Insurers may also opt for a multi-cloud approach, using services from multiple cloud providers to avoid vendor lock-in and optimize performance, security, and cost.

Our experts note that selecting the right model depends on your specific needs, especially with regard to data privacy, regulatory compliance, and operational flexibility.

Discover the key differences between multi-cloud and hybrid infrastructures

Core architectural changes and what moves to the cloud

When adopting the cloud, insurers often migrate several core applications and workloads, including:

- Policy administration;

- Claims processing;

- Customer Relationship Management (CRM);

- Underwriting engines;

- Analytics and data lakes.

Modern cloud-based architectures often involve microservices, APIs, and event-driven systems. Cloud computing in the insurance industry drives deeper integration across business functions, enabling insurers to innovate faster, respond to market changes, and deliver better customer experiences. This shift helps eliminate operational silos and makes data management more streamlined, providing a clearer view of the entire value chain.

Explore our complete insurance digital transformation guide

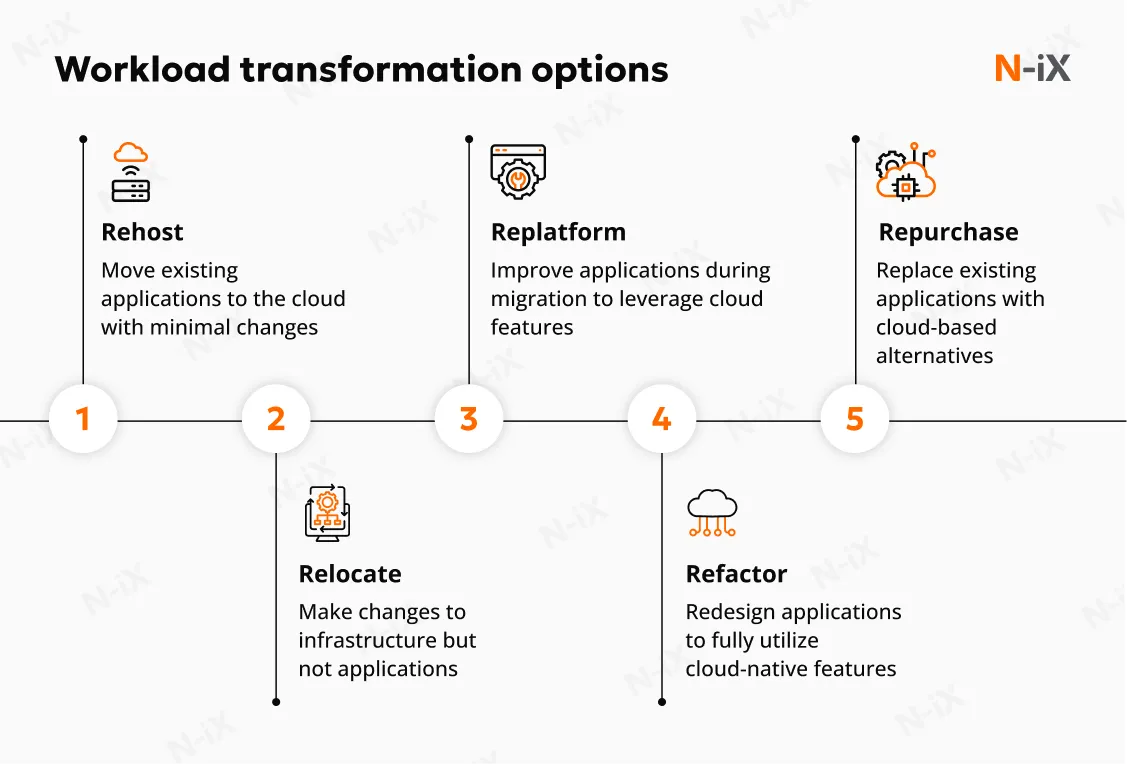

Migration options

When moving to the cloud, insurers have several migration strategies to choose from. The method selected depends on the existing infrastructure, desired outcomes, and long-term goals. Here are the most common approaches:

- Rehosting (lift and shift): Moving existing applications to the cloud with minimal changes. This is a fast and low-risk approach, but it doesn’t fully optimize cloud capabilities.

- Relocating: Shifting an application to the cloud without major modifications, typically involving changes in infrastructure but not the application itself.

- Replatforming: Making some improvements to applications during migration to take better advantage of cloud features, like scalability or cost efficiency, without a complete overhaul.

- Refactoring: Redesigning applications to fully use cloud-native features, such as microservices and containerization, offering greater flexibility and performance.

- Repurchasing: Replacing existing applications with cloud-based alternatives, often through software as a service (SaaS) solutions, to reduce maintenance costs and improve scalability.

As N-iX experts emphasize, while lift and shift is faster and less resource-intensive, it may not fully capitalize on the cloud’s potential. Each workload should be assessed carefully to determine the most appropriate migration approach based on its specific needs, long-term business goals, and the level of transformation required.

However, choosing the right migration path is only one part of the journey. To translate that technical shift into real business value, insurers need a clear strategy and the right practices in place.

9 tips for successful cloud adoption in insurance

Cloud adoption requires informed and well-timed decisions, rather than following a rigid blueprint. There’s no universal formula for success, but there are proven practices that make the journey smoother and outcomes stronger. Let’s take a look at several key recommendations from N-iX experts to help you get the most value from your cloud transformation.

1. Start with business outcomes and use case focus

Cloud adoption itself shouldn’t be the end goal. It should serve a clear business objective, such as strengthening data-driven decision-making or driving operational resilience. Start with business goals in mind to ensure cloud computing in insurance delivers measurable and lasting results rather than just technical progress.

Our experts also recommend identifying specific applications early on, whether it’s enhancing fraud detection, improving customer service, or streamlining claims management. Once those priorities are clear, you can determine how cloud technology supports each goal in practice. For example, if reducing claim processing times is a priority, cloud solutions can make it possible by automating workflows and providing real-time access to data.

2. Partner with a reliable cloud consulting company

Partnering with a trusted cloud consulting company can significantly facilitate your cloud adoption journey. With deep expertise in cloud technologies and industry-specific needs, a partner like N-iX can help you navigate the complexities of cloud migration, ensuring the process is efficient and aligned with your business goals. Rather than managing the entire transition on your own, you’ll benefit from expert guidance on best practices, risk mitigation, and optimization strategies.

3. Conduct a cloud readiness assessment

Before making the leap, conduct a comprehensive readiness assessment to evaluate your current IT landscape. This includes reviewing existing systems, workloads, skillsets, and the total cost of ownership (TCO). A thorough assessment helps identify what to move to the cloud, when to do it, and how to do it efficiently. This step is critical to ensuring that the cloud adoption process is well-planned and executed.

4. Ensure strong security and compliance

Cloud security in insurance is not only about protecting sensitive customer data but also ensuring compliance with regulatory requirements to maintain trust with clients and stakeholders. To achieve this, embed security in every phase of cloud adoption. Apply the “secure by design” approach, incorporating measures like data encryption, identity and access management (IAM), and zero-trust architectures.

5. Choose the right cloud architecture and provider

When choosing the right cloud architecture, it’s crucial to align it with your business needs. Consider factors like the level of control required, compliance, scalability, and cost efficiency. For example, a hybrid approach may suit organizations that need a mix of on-premises control and cloud flexibility, while public cloud solutions may offer cost savings for less sensitive workloads.

Equally important is selecting the right cloud provider. Compare services, pricing structures, and industry-specific capabilities to ensure the platform aligns with your goals. Whether opting for AWS, Azure, or Google Cloud, make sure the provider’s offerings support your operational needs, provide adequate security, and scale with your growth.

Choose the right EU sovereign cloud provider—get the report!

Success!

6. Prepare for effective cost management

Managing cloud costs effectively is crucial in ensuring that cloud adoption in insurance drives long-term value. N-iX experts recommend establishing a clear cost management framework early on. By monitoring cloud resources, tracking usage patterns, and implementing FinOps, you can align your spending with business objectives. Regular optimization and cost forecasting also help avoid unexpected expenses while ensuring the cloud environment supports your operational needs efficiently.

Read more: 3 essential practices to control cloud expenses

7. Design a gradual modernization strategy for legacy applications

Legacy systems can present a significant barrier to cloud adoption. Avoid attempting a “big bang” transformation and consider an incremental migration approach, modernizing your systems gradually. Using microservices, API gateways, and containerization can help integrate legacy systems with new cloud technologies smoothly, reducing the risk of disruption during the transition.

8. Foster effective change management

Adopting cloud computing in the insurance sector requires more than just technology; it demands a culture shift. Our experts highlight the importance of preparing your teams for change through training and clear communication. Encourage collaboration between IT and business units to ensure alignment. By supporting your staff through this transition, you can increase adoption rates and foster a more agile and innovative environment as cloud capabilities become deeply integrated into daily operations.

9. Measure and iterate

Once cloud adoption is underway, it’s important to measure progress regularly. KPIs, such as time to market, cost per user, and system uptime, can help you track your cloud performance and make timely adjustments.

As you evaluate the results and refine your cloud strategy, it’s also helpful to keep the bigger picture in mind. Understanding how cloud adoption impacts insurance technology and your business will help you align your efforts with long-term goals and stay ahead in a rapidly evolving market.

Key advantages of moving to the cloud

Insurers need to find the right balance in a highly regulated and data-heavy industry: innovate fast without compromising reliability or customer trust. Cloud adoption in insurance has become a practical way to achieve that balance. It gives you the tools to modernize legacy systems, test new digital services, and stay resilient in a market that’s changing faster than ever.

So why are more insurers making the move? The key reasons include:

- Scalability and flexibility: The cloud allows you to scale resources instantly as demand fluctuates. Whether you’re dealing with a surge in claims or processing thousands of renewals, you can expand or reduce capacity without expensive infrastructure upgrades.

- Faster innovation cycles: Cloud platforms accelerate product development. What used to take months can now be done in weeks. Cloud infrastructure also provides the foundation for AI and Machine Learning, enabling faster experimentation with predictive models and personalized products.

- Data-driven decision-making: Centralized, easily accessible data improves visibility across your organization. It helps you identify risk patterns, detect fraud earlier, and make confident decisions supported by real-time insights.

- Operational resilience: The cloud strengthens business continuity through redundancy, automated backups, and disaster recovery. Even when disruptions occur, your core systems remain available and responsive.

- Enhanced security and compliance: The importance of cloud security in insurance cannot be overstated. With built-in encryption, identity and access management, and continuous monitoring, leading cloud providers help safeguard sensitive data and maintain compliance with industry regulations.

- Cost optimization: Moving from heavy capital investments to flexible subscription-based models gives you more control over spending. This approach frees up resources that can be reinvested into innovation or better customer experiences.

Why N-iX is the right partner for cloud adoption in insurance

As cloud computing in insurance becomes increasingly essential, applying it effectively will define the leaders of tomorrow. At N-iX, we understand the complexities and opportunities of moving to the cloud. Here’s how we help insurers navigate this transformation with confidence and precision:

- Our partnerships with top cloud providers, including AWS, Microsoft, and Google, ensure your cloud strategy is built on a solid foundation.

- We bring over 400 cloud engineers and 300 tech experts with deep financial services domain knowledge to guide you through every stage of cloud adoption.

- With 23 years of experience and over 250 delivered finance projects, we help you avoid common pitfalls, accelerate time to value, and ensure your cloud environment is fully integrated into your operations, seamlessly supporting growth and innovation.

- N-iX supports more than 25 active finance clients, helping them modernize legacy systems, migrate to the cloud, and build new cloud-native applications.

With the right strategy, cloud adoption helps you reach new levels of efficiency, agility, and customer satisfaction. Let N-iX help you make the most of it.

Have a question?

Speak to an expert