A decade ago, Latin America was positioned in the global IT landscape primarily as a support hub, recognized more for cost-efficient operations. That picture has changed. Remote work rewired hiring norms, governments tightened data and IP protections, and a generation of engineers capable and eager for complex product work within staff augmentation in Latin America.

Today, the region is a hub for AI, cloud, data platforms, and product engineering. Mexico City and Guadalajara scale quickly, Bogota and Medellin supply experienced engineers, Sao Paulo and Buenos Aires push specialization, and San Jose offers established delivery centers with strong communication. With so many countries excelling in IT, finding the best Latin American country for staff augmentation in 2026 can be a bit challenging.

N-iX’s market analysts have prepared the most concise and actionable guide to the top five LatAm staff augmentation locations:

Brazil

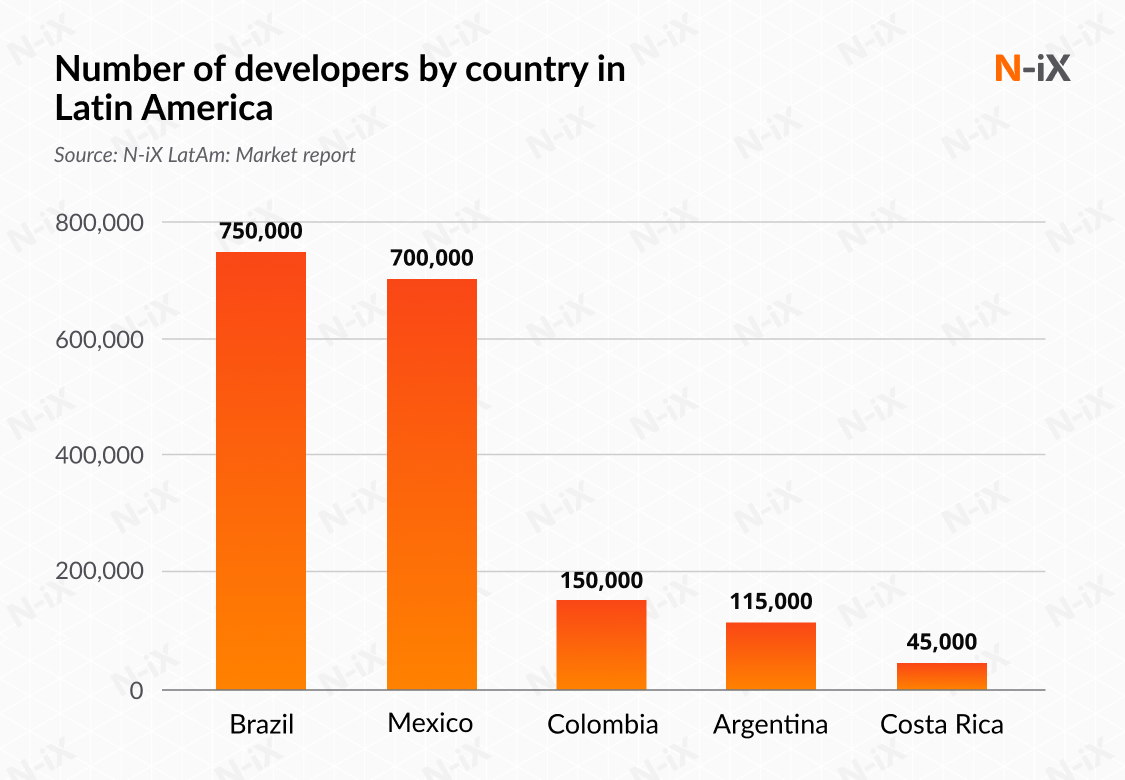

When building a particularly large team, Brazil is usually the go-to choice. This country has the largest pool of IT professionals, with over 750K ICT professionals. This extensive talent base enables the recruitment of tech experts with diverse skill sets. Sao Paulo ranks among the top 25 tech startup hubs globally and leads the way in Latin America, fostering mentorship, advancing developer expertise, and fueling Brazil’s growing talent ecosystem.

Strengths:

- Unmatched developer pool and tech ecosystem: Brazil provides extensive hiring capacity for large-scale projects. The country’s talent pool accounts for over a third of Latin America’s IT market.

- High tech proficiency and innovation leadership: Brazil ranks third in tech skill proficiency across LatAm and 14th globally in Coursera’s Global Skills Report, scoring particularly high in Data Science, technology, and professional certification rate.

- Time zone alignment with Western Europe: Brazilian tech hubs are located in the GMT-3 time zone, the most eastern of all Latin American countries. This allows smoother collaboration for offshore staff augmentation from Western Europe.

Weaknesses:

- English proficiency: Brazil sits at just 81st globally on the EF English Proficiency Index. Pearson's report from 2024 cites that only about 20% of Brazilians speak English, and 13% of those who say they have any knowledge self-describe as fluent.

- Time difference with the US and Canada: Brazil is the most Eastern of the Latin American countries. Sao Paolo and Rio de Janeiro are two hours ahead of the East Coast and five hours ahead of the West Coast. This time difference might make collaboration less smooth.

- Lagging behind in AI: The country awards fewer than 400 PhDs in AI produced annually, and the number of AI specialists hovers around 4,400, which may limit advanced AI staffing options.

Get a complete overview of the software development market in Latin America!

Success!

Read more: IT outsourcing in Brazil: market overview and prominent hubs

Mexico

Mexico enters the list of best Latin American countries for staff augmentation because of its vast talent pool, mature IT outsourcing sector, and strong developer performance. With more than 700K ICT professionals and around 500 outsourcing firms listed on Clutch, Mexico offers scale and capacity, since its market is dominated by larger providers.

Strengths:

- High expertise in emerging tech: Mexican developers placed 5th in Latin America with high proficiency in areas like AI/ML and Data Science.

- Strong data protection regulations: Mexico overhauled its private-sector privacy law in March 2025. The new LFPDPPP law moved oversight to the anti-corruption ministry, adjusted notice/consent rules, and set a path for specialized data protection courts. Implementation details are still evolving, but are already quite strong; however, cross-border transfers remain a gap. This can be mitigated with strong contractual clauses, which are always recommended in staff augmentation.

Weaknesses:

- High employer competition: 65% of Mexican companies report talent shortages; the competition for the most skilled developers is high, meaning it might be harder to fill positions compared to other locations.

- Relatively low English proficiency: Mexico ranks below the global average for English proficiency, excluding a few areas economically dependent on tourism.

- Moderate tech skills: Mexico’s overall global skill proficiency is moderate. It is not among the top performers globally. The country is 79th globally overall, 14th in Latin America. Practically, this means more training and onboarding might be needed. Projects requiring advanced analytics or ML might see delays or quality inconsistencies.

Colombia

Colombia has established itself as one of Latin America’s most promising destinations when it comes to qualified tech talent. More than 150K ICT professionals are based in Colombia, employed by over 360 software development companies. This scale reflects not just rapid industry growth but also a maturing ecosystem that appeals to global firms looking for nearshore partnerships.

Strengths

- Developer skill proficiency: Colombian developers rank among the top 50 globally in HackerRank’s assessments, and lead LatAm in problem‑solving and mathematics skills. Additionally, in Coursera’s Global Skills Index, Colombia ranks first in the region and 33rd globally with an 8% percentile tech proficiency. Coursera 2025 Skills Reports remarks on the high rate of AI adoption and training in Colombia.

- Government IP security commitment and AI initiatives: Colombia’s software development outsourcing companies’ AI services are supported by the government’s 2025 AI national policy (CONPES 4144), which invests in data infrastructure and ethical AI development. Additionally, the government has put in great effort into making Colombia meet the data and IP security standards of the EU and the US.

- Time zone advantage: Operating on GMT-5, Colombia aligns with US Eastern Time, enabling seamless real-time collaboration with North American teams.

Weaknesses:

- Ecosystem still scaling: While the talent pool is large and growing, it’s smaller than in Brazil or Mexico, which can limit hiring capacity for very large-scale projects.

- English proficiency gaps: Tech professionals in urban centers often speak English well, but Colombia still ranks around 75th globally. Some staff augmentation companies, including N-iX, offer English language courses to help their developers stay ahead of the curve.

Argentina

Argentina is the third-largest tech market in Latin America, with around 115K software developers and over 450 companies. Like other Latin American countries, its IT market is experiencing rapid growth, powered by a combination of tech skills and high English fluency.

Strengths:

- English proficiency: Argentina ranks second in Latin America (coming only after Suriname) and 28th globally in English Proficiency, with a high score of 562, well above the global average.

- Good technical education: University of Buenos Aires is the highest-ranked Spanish-speaking university in the region and ranks 71st globally. Particularly strong in engineering, computer science, law, and economics. It’s known for producing Nobel laureates and founders of major Latin American tech firms.

- Cultural proximity: Argentina stands out among other Latin American countries as it is more aligned with the American or British culture, especially in power distance, long-term orientation, and expected work-life balance.

Weaknesses:

- Cost of living: In recent years, the cost of living in Argentina has dramatically increased compared to other Latin American countries. For example, the cost of living in Buenos Aires is 27.6% higher than in Sao Paulo and 47% higher than in Medellin

- Currency volatility: Fluctuations in peso value can introduce cost unpredictability and developer turnover. While the outsourcing partners almost always calculate the costs in USD and mitigate these issues, there’s never a way to tell for sure what developer compensation is going to be in pesos.

Costa Rica

Costa Rica is a mature nearshore hub for digital services in Latin America. Its labor pool stands at 45K ICT professionals, and while smaller, Costa Rica is one of the best Latin American countries for staff augmentation.

Strengths:

- Focus on innovation: The government provides English-skills scholarships for secondary students, and a new AI specialisation in vocational education. The National AI Strategy 2024–2027 prioritizes ethical AI, education, 5G, and establishing a national AI center. The country scored 70 in the Innovation Index, coming second in the region.

- Time zone alignment: Costa Rica shares its working hours with the central US, providing smooth cooperation with all of North America.

- Excellent English: Among major outsourcing hubs, local English proficiency levels come second only to Argentina.

Weaknesses:

- Limited talent pool: The absolute talent pool is smaller than in Mexico or Brazil, and employers report growing skills mismatches, especially in knowledge-intensive services and high-tech manufacturing. Conservative estimates put the STEM talent shortfall at 8K specialists (OECD).

- Less competitive rates: The cost of living in San Jose, the capital city, is significantly higher than in other Latin American IT hubs, with an index comparable to or even higher than in Central and Eastern Europe. Additionally, Costa Rica’s monthly minimum wage is about $725 as of January 2025, versus Colombia's at roughly $324.

Read more: Top software development companies in Latin America: 2026 selection

Summary

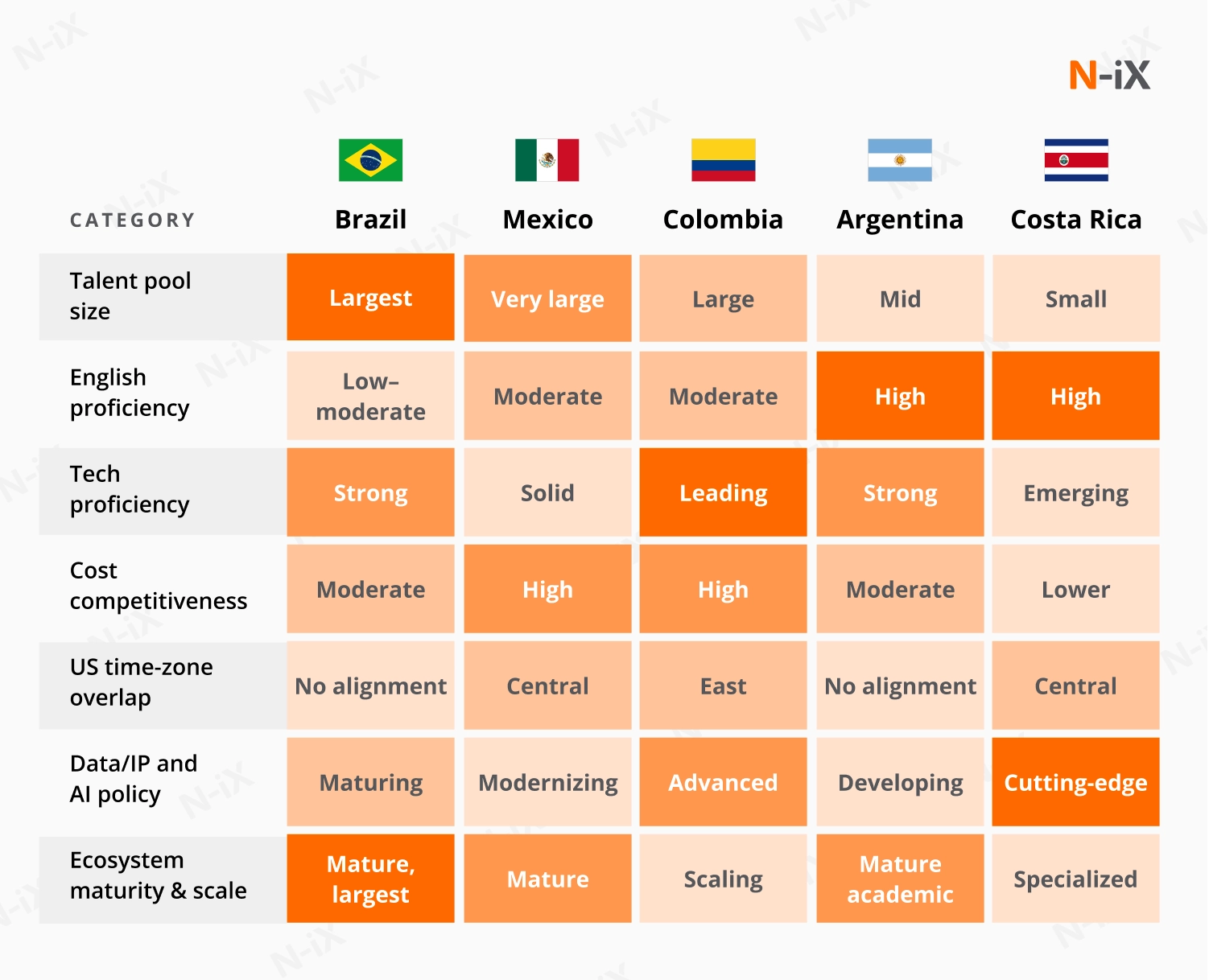

For raw scale and ramp speed, choose Brazil. For top communication readiness, choose Argentina. For the best balance of skills, policy, cost, and US-East overlap, choose Colombia. For peak US-wide time overlap and polished delivery centers, choose Costa Rica. For proximity and a large talent pool, Mexico is a strong generalist with breadth and legal modernization. Find the best Latin American country for staff augmentation for you:

Why partner with N-iX to augment your team in Latin America?

N-iX is a global software engineering partner with an R&D center in Medellín, Colombia, and a strong employer brand that attracts senior talent across Latin America. N-iX has over 2,400 specialists onboard with expertice spanning cloud, AI/ML, data analytics, IoT and embedded, UI/UX, cybersecurity, and more. With over 70 recruitment specialists and 23 years in the market, N-iX runs proven pipelines and a strong employer brand in Colombia to staff skilled developers fast, filling between 80 and 100 roles each month with a 96.5% probation pass rate to scale your team quickly.

References

- Tech Industry in Latin America: Market report, N-iX 2024

- Apenas 13% dos brasileiros com conhecimento em inglês se consideram fluentes, revela pesquisa, Pearson

- QS World University Rankings

- OECD Economic Surveys: Costa Rica 2025

- Current Cost Of Living Index mid-2025

- Country Comparison tool, Hofstede's cultural dimensions

Have a question?

Speak to an expert