Today, AI in wealth management is already delivering measurable impact. Companies are deploying generative AI to support advisors and planners, automating tasks such as meeting notes, compliance checks, CRM updates, and client follow-ups. This routinely saves advisors hours and shifts their focus to higher-value activities, such as building stronger client relationships.

Yet most organizations struggle to move beyond isolated AI wins. Fragmented data, legacy systems, conservative operating cultures, and regulatory uncertainty continue to slow adoption. Many AI initiatives struggle to scale or deliver meaningful returns, even as executives recognize AI's potential.

Achieving AI success today depends not only on advanced machine learning models and integrated data foundations. It also demands the right AI and ML expertise to implement them effectively and reliably across advisory, investment, and risk workflows.

Below, we outline the most impactful AI use cases in wealth management, focusing on where machine learning delivers measurable value across advisory, investment, and risk functions.

What is AI in wealth management?

Wealth management AI leverages technologies such as machine learning (ML), predictive analytics, natural language processing (NLP), and generative AI to automate and support tasks traditionally performed by financial advisors, including portfolio management and client communication. The objective is not to replace advisors, but to reinforce their decision-making. In fact, 73% of asset and wealth managers see AI as the most transformative technology over the next two to three years.

In practice, AI turns fragmented financial and market data into actionable insights. It can analyze transaction histories, client behavior, and external signals far faster than human teams, helping advisors anticipate market shifts, assess risk appetite, and personalize investment strategies.

In day-to-day operations, wealth management AI supports several core capabilities:

- Automated portfolio management: Continuous tracking of market movements, asset performance, and exposure for allocation and rebalancing, while advisors retain oversight.

- Personalized financial advice: Analysis of client history, goals, and risk profiles to scale tailored investment strategies without increasing workload.

- Risk assessment and monitoring: Near-real-time portfolio monitoring, scenario analyses, and early alerts on emerging threats.

- Fraud detection and compliance support: Automated reviews of transactions and activity to flag unusual patterns, reducing manual effort.

Overall, AI wealth management acts as a decision-support layer. It handles data-intensive analysis and surfaces insights, while advisors remain responsible for judgment, client relationships, and final decisions.

AI technologies behind wealth management

|

Machine learning (ML) |

Identifies patterns in market data, client behavior, and portfolios to support risk assessment, portfolio optimization, anomaly detection, and early warning signals. |

|

Predictive analytics |

Uses historical data to predict future outcomes, helping wealth managers anticipate market trends and adjust strategies. |

|

Natural language processing (NLP) |

Processes unstructured data from reports, emails, and news, turning text into actionable insights. |

|

Generative AI |

Automates documentation, client communications, knowledge retrieval, and decision support for advisors. |

|

Wealth management analytics |

Extracts actionable insights from data to optimize portfolios, evaluate performance, and tailor strategies. |

|

Robotic process automation (RPA) |

Automates repetitive administrative tasks, including client onboarding and compliance checks. |

|

Cognitive computing |

Simulates human thought processes to analyze complex financial data and support personalized advice and fraud detection. |

Core AI use cases in wealth management

Here are AI in wealth management examples that demonstrate how these technologies deliver business value across portfolio, advisory, and risk management.

Portfolio construction and risk management

AI continuously analyzes market data to support portfolio construction and risk management. In practice, this includes AI-assisted security selection, dynamic asset allocation, diversification analysis, and automated rebalancing aligned with client risk profiles and market conditions.

Example: BlackRock's Aladdin applies AI-driven risk analytics and scenario modeling to assess portfolio exposure in real time. By automating scenario analysis and rebalancing, firms reduce manual errors, cut rebalancing costs by 60-70%, and free 20-30% of operational staff time previously spent on data reconciliation and reporting, allowing portfolio managers to focus on strategic decision-making.

Personalized advisory at scale

AI enables personalized investment strategies by analyzing client goals, transaction history, behavioral patterns, and risk tolerance. This allows advisors to deliver tailored recommendations and portfolio adjustments at scale, without increasing manual workload or sacrificing consistency.

Example: Wealthfront's AI-powered platform continuously analyzes clients' saving and spending patterns, transaction history, behavioral signals, and stated risk tolerance to deliver thousands of personalized portfolio decisions annually per client. The quantified impact: $1 billion in estimated cumulative tax savings across Wealthfront's client base, with $145 million in losses acquired in 2024 alone.

Fraud detection and risk monitoring

AI monitors transactions and behavioral patterns in near-real time to identify anomalies that may indicate fraud, financial abuse, or policy breaches. Machine learning models adapt to new fraud patterns over time, reducing false positives while improving detection accuracy.

Example: Feedzai protects over $8 trillion in annual payment volume, delivering a 62% improvement in fraud detection while reducing false positives by 73%. This reduces investigation costs by 30-40% and minimizes customer friction from unnecessary transaction declines, improving operational efficiency and client trust.

Advisor productivity and knowledge access

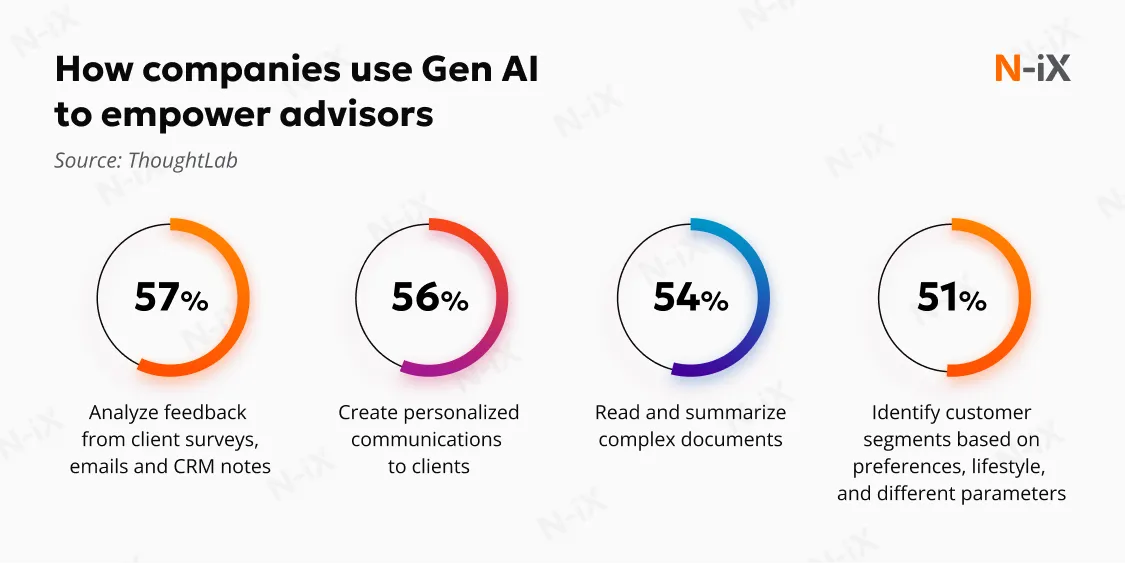

AI improves advisor productivity by embedding intelligence into daily workflows, including CRM systems, research tools, and client servicing platforms. Generative AI supports faster access to tax, product, and regulatory knowledge, while automation reduces time spent on administrative tasks.

Example: Charles Schwab uses generative AI to support over 3 million client service calls annually, reducing complex query handling time from 5-10 minutes to under 2 minutes. Across thousands of service professionals, this frees up 140,000+ hours per month and delivers a long-term 25% reduction in cost per client account, while improving first-call resolution and retention.

Sentiment and alternative data analysis

AI in wealth management uses machine learning to analyze unstructured data, including news, earnings commentary, and social sentiment. These models complement traditional fundamental and technical analysis, helping advisors identify emerging trends, shifts in investor sentiment, and early market signals that are difficult to detect manually.

Example: MarketPsych's sentiment analysis platform gathers signals hidden within unstructured data (e.g. data from thousands of news sources, earnings transcripts, and social media) by converting investment sentiment into investable signals. The solution scans all sectors, generating sentiment indices for individual securities and asset classes.

ESG analysis and alternative data integration

AI processes large volumes of structured and unstructured ESG (Environmental, social, and governance) data to make sustainability factors measurable, comparable, and actionable. Machine learning models help standardize inconsistent disclosures, assess ESG risk exposure, and integrate sustainability metrics into portfolio construction.

Example: Arabesque's AI-powered platform processes billions ESG data points daily, generating customized investment strategies in a few hours, a process that traditionally took weeks. This accelerates product launch timelines and enables scalable ESG integration without increasing research overhead.

AI-driven lead generation

AI enables data-driven prospecting by analyzing public data, digital signals, and relationship networks to identify high-potential clients. Advanced segmentation and predictive models help relationship managers prioritize outreach and tailor engagement strategies more precisely.

Example: Finantix applies AI to relationship networks and public data to guide personalized outreach, improving advisor win rates. For firms with large relationship teams, this translates directly into higher conversion rates without expanding sales headcount.

Discover more about AI in fintech: Use cases and best practices

Business value of AI in wealth management

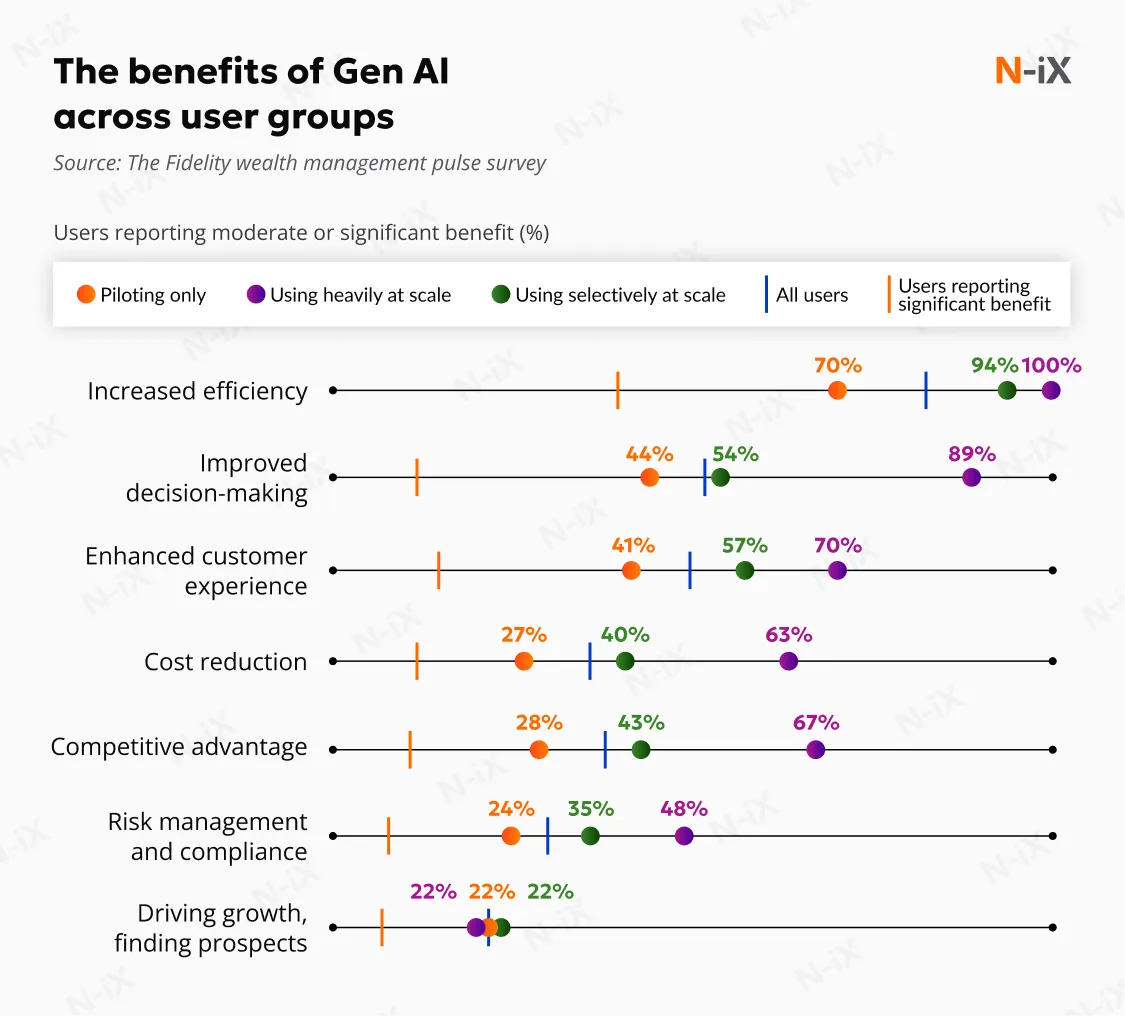

AI in wealth management is moving from experimentation to execution. According to F2 Strategy, AI adoption among wealth management firms grew 23% since 2023, driven primarily by registered investment advisors (RIAs) and large advisory firms. As adoption accelerates, companies are realizing tangible operational and competitive benefits.

Enhancing advisor impact

Time savings translate directly into advisor impact. Fidelity estimates that if an advisor reallocated just five additional hours per week to client and prospect support, revenue could increase by up to 27%. For an advisor generating $1 million annually, this represents a potential $270,000 uplift.

This is where generative AI delivers measurable value. Among firms using GenAI at scale, more than two-thirds report saving at least one hour per week, while nearly 10% save between five and ten hours. Even firms still piloting AI solutions are seeing meaningful time savings, reinforcing AI's role as a practical productivity lever rather than a future promise.

Scaling personalized advisory

By analyzing financial histories, behavioral patterns, and goals, AI enables tailored recommendations for every client. Firms can provide highly personalized services at scale, extending boutique-level advisory to a larger and more diverse client base without adding staff. AI is helping banks deliver personalized investment strategies, enhanced client interactions, and proactive risk management, enabling advisors to focus on high-value decision-making.

Driving competitive advantage

Automating processes and unifying fragmented data reduces operational costs and improves execution speed. Companies gain agility, efficiency, and reliability, positioning themselves ahead of competitors while maintaining compliance and service excellence. Deloitte's research shows that 69% of senior executives expect AI to transform operations, and by 2028, 52% of firms anticipate commoditization of products, highlighting the strategic need for value-added, AI-enabled services.

Read more: Fintech trends reshaping the financial industry in 2026

What complicates AI adoption in wealth management?

While AI offers tremendous potential, its adoption in wealth management poses several challenges. These include issues around model accuracy and bias, data privacy concerns, and the need for transparent decision-making. Addressing these challenges requires a thoughtful approach to governance, data quality, and regulatory compliance.

AI accuracy, bias, and trust

AI models can produce biased or inaccurate results if trained on incomplete or unbalanced data. In wealth management, this can lead to flawed investment recommendations or inconsistent client treatment, both of which directly affect trust and regulatory compliance.

N-iX solution: We design AI solutions with built-in validation, bias detection, and continuous testing mechanisms. Models are regularly evaluated against real-world scenarios, and decision logic is monitored to ensure outcomes remain aligned with investment policies, risk frameworks, and regulatory expectations.

Data privacy and regulatory compliance

AI in wealth management relies on large volumes of sensitive client and market data. This raises concerns around data privacy, security, and compliance with regulations such as GDPR and financial reporting standards.

N-iX solution: Our team designs data pipelines that limit AI access to only the information required for each use case. We implement encryption, access controls, and audit trails from the outset, helping you meet regulatory requirements while maintaining control over client data.

Model transparency and explainability

Many advanced AI models operate as "black boxes," making it difficult to explain how decisions are made. In finance, a lack of transparency can limit adoption and create issues with regulators and clients who expect clear reasoning behind investment decisions.

N-iX solution: We prioritize explainable AI approaches that balance performance with transparency. When projects require more complex models, our engineers add explanation layers that show key factors behind recommendations, giving advisors and risk teams a clear basis for decision-making.

Managing unstructured financial data

A significant portion of valuable financial information comes from unstructured sources such as news, reports, emails, and market commentary. This data is often inconsistent, noisy, and difficult to use effectively.

N-iX solution: Our engineers apply NLP and data engineering techniques to clean, structure, and enrich unstructured data. They train AI models to recognize financial terminology and extract relevant signals, enabling wealth managers to incorporate external insights into investment and risk decisions.

Proof of concept and controlled AI adoption

Deploying AI directly into live wealth management environments without validation can cause unnecessary risk. Companies need to confirm that AI solutions deliver measurable value before scaling them across portfolios and clients.

N-iX solution: We support clients through structured proof-of-concept initiatives that test AI models in controlled environments. These pilots evaluate performance, usability, and integration with existing systems, allowing companies to identify issues early and build internal confidence before full-scale deployment.

Conclusion

As AI continues to evolve, wealth management companies stand at the brink of a transformative shift. By automating time-consuming tasks and delivering personalized, data-driven insights, AI is enhancing the advisor-client relationship and driving efficiencies. However, while AI promises significant improvements in portfolio management, risk monitoring, and customer service, its successful integration depends on addressing challenges such as data privacy, model transparency, and regulatory compliance.

At N-iX, we support wealth and financial services companies in building these capabilities. With 200 data and AI engineers and over 60 delivered data and AI initiatives, our teams design production-ready AI and machine learning solutions grounded in real operational constraints. We combine wealth management analytics, ML, and enterprise AI architectures to help organizations move from experimentation to reliable execution without compromising governance, performance, or regulatory expectations.