At any given moment, sales are flowing through stores and digital channels, inventory is moving or stalling across warehouses, and promotions are distorting demand signals. It becomes nearly impossible to keep up with such amounts of data. Each system captures a slice of this reality, faithfully and in isolation. The data exists, but it does not cohere.

A data warehouse for the retail industry creates a consistent analytical representation of retail activity. Its function is to reconcile transactional data into stable, comparable facts that support decision-making. It integrates data from point-of-sale systems, ecommerce platforms, inventory and supply chain systems, pricing and promotion engines, and customer data sources. When implemented correctly, a retail data warehouse becomes the foundation for demand analysis, inventory optimization, pricing evaluation, and omnichannel performance management.

That is why many retailers eventually look beyond internal fixes. Not to outsource responsibility, but to shorten the distance between intent and execution. Effective data warehouse consulting brings structure to that process by aligning business decisions, data models, and delivery priorities.

What data warehouse changes for retail?

From reporting cycles to operational continuity

The first change is structural. Legacy retail warehouses were built around reporting cycles. Data arrived in batches, was aggregated, and surfaced in reports that described completed activity. That approach breaks down once retail accelerates. Promotions overlap, inventory shifts between locations within hours, and digital channels generate continuous signals. Modern retail warehouses are designed for motion rather than snapshots. Ingestion becomes constant, and the platform is engineered to absorb frequent change without repeated redesign of core logic.

From timestamps to business time

Analytical readiness also shifts. In older setups, advanced analytics lived downstream, separated from the warehouse by multiple extraction and transformation layers. According to Accenture, periods of disruption have shown a consistent pattern: retailers with mature, shared data platforms adapt faster, while those reliant on fragmented reporting struggle to respond in time. Data architecture increasingly determines operational resilience.

Modern retail warehouses are built to support analytical workloads directly. Retail data warehouse design standardizes, reconciles, and governs, allowing forecasting, optimization, and behavioral analysis to run on consistent inputs.

From forced structure to controlled flexibility

Retail organizations rarely struggle with data availability. The more persistent constraint is fragmentation across systems and functions, where data is produced in abundance but shared slowly and interpreted inconsistently across the value chain [2].

Consistent reconciliation across point-of-sale systems, digital channels, inventory platforms, pricing engines, and customer systems stabilizes performance metrics. Inventory positions become comparable across locations in near-real time. Enterprises with data warehouses can analyze customer behavior across channels without stitching together incompatible datasets.

Why retailers need a data warehouse in 2026?

Reporting on what happened yesterday, or even this morning, does not provide the lead time required to adjust pricing, rebalance inventory, or intervene in customer behavior before value is lost. By 2026, the ability to anticipate outcomes and act proactively will separate retailers that adapt from those that fall behind.

The constraint is not data availability, but the ability to turn data into reliable insight. Industry research shows that only 52% of retailers report being able to effectively extract insights from their data, up from 38% the previous year [1]. The remaining gap reflects structural issues in how data is modeled, reconciled, and governed.

The modern retail data warehouse is becoming the execution layer that supports AI-driven decision intelligence across commercial, operational, and financial domains.

1. To enable AI and Machine Learning

Advanced analytics, AI and Machine Learning rely on data that is consistent over time, traceable to source events, and resilient to operational noise. Retail data warehouses provide that foundation by enforcing coherent definitions across sales, inventory movements, promotions, pricing changes, and returns. Forecasting models trained on reconciled demand signals routinely outperform those built on partially aligned datasets, improving accuracy and materially reducing stockouts.

AI adoption also changes how data is accessed. Natural language interfaces backed by large language models are increasingly used to explore both structured and unstructured data. Their usefulness depends entirely on the quality of the underlying warehouse. Poorly modeled data produces fluent but unreliable answers. Warehouses designed for analytical workloads narrow the distance between raw operational data and decision logic, allowing automation to replace manual data preparation rather than amplify its weaknesses.

The real bottleneck in retail AI is not model sophistication, but the data warehouse beneath it. When sales, returns, promotions, and inventory are reconciled differently across systems, models inherit those contradictions. A data warehouse in retail built for operational reality is the prerequisite for any AI-driven decision-making in 2026.

2. To shift analytics from transactions to customer behavior

Retail data has traditionally been organized around transactions. Customer understanding emerged indirectly, reconstructed after the fact. That approach breaks down in omnichannel environments where behavior spans devices, locations, and fulfillment paths. A typical retail data warehouse restructures data to explicitly model identity, interaction history, and lifecycle states.

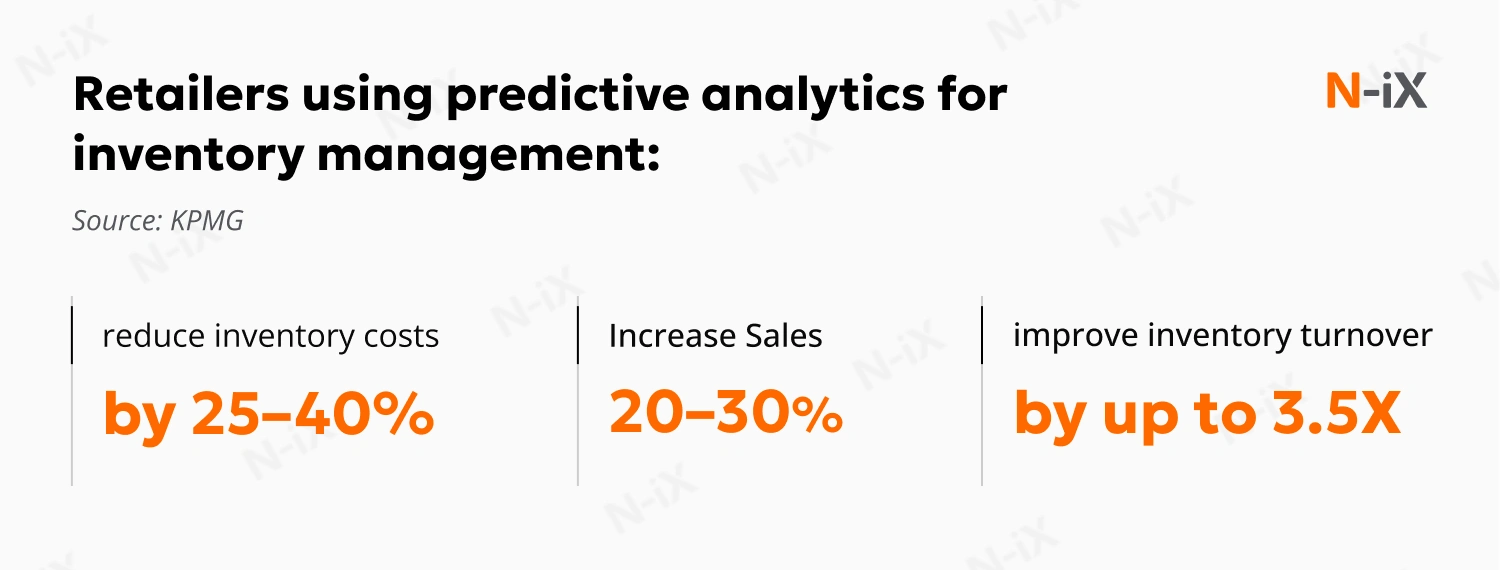

Evidence of this shift is already visible in financial performance. More than half of retail organizations report at least a 10% increase in profit following investments in data and analytics, according to KPMG research [1].

Unifying point-of-sale activity, ecommerce behavior, loyalty interactions, and service touchpoints stabilizes customer analytics. Recommendations, targeting, and retention analysis operate on reconciled behavior instead of stitched assumptions. Organizations that leverage data warehouse solutions for retail businesses achieve this level of coherence consistently outperform peers because personalization reflects observed patterns.

|

Transaction-focused |

Behavior-focused |

|

Isolated sales |

Unified journeys |

|

Post-fact analysis |

Lifecycle modeling |

|

Channel silos |

Omnichannel continuity |

|

Limited personalization |

Retention & LTV clarity |

3. To compress decision latency

Speed only creates value when accuracy is preserved. Traditional retail reporting pipelines introduce delays because reconciliation occurs downstream, after ingestion. Cloud-native data warehouse architecture for retail sector inverts that pattern that leads to enforcing consistency early.

Pricing and promotion decisions benefit most from a retail data warehouse model. Centralized, continuously updated datasets enable pricing logic to respond to competitor movements, demand elasticity, and stock levels without waiting for overnight refreshes. Inventory decisions incorporate near-real-time availability across locations and channels, reducing reliance on stale snapshots that mask emerging imbalances.

4. To support financial clarity and regulatory control

Margin pressure exposes the limits of surface-level profitability metrics. Data warehouses in the retail industry enable deeper financial analysis by integrating indirect costs such as marketing spend, labor, and fulfillment overhead into transaction-level views.

Regulatory obligations reinforce the exact requirement for structure. Data protection and audit expectations demand traceability, access control, and lineage. A governed data warehouse for retail provides an auditable environment that doesn't disrupt analytical workflows. Risk management becomes part of the data foundation rather than an external constraint imposed after the fact.

5. To build resilience and scale

Retail volatility expresses itself unevenly. Seasonal peaks, promotional surges, and supply disruptions place asymmetric pressure on infrastructure. Modern data warehouses decouple storage and compute, allowing capacity to scale selectively without reengineering systems. Organizations that delay modernization accumulate structural risk, as infrastructure rigidity translates into slower response times and higher operational costs.

What does a retail data warehouse enable in practice?

Commercial and revenue intelligence

Revenue analysis in retail often stops at topline growth. That view hides the mechanics that actually determine profitability. A data warehouse for the retail industry enables commercial intelligence by preserving transaction-level detail and historical context across channels, regions, and time. Demand patterns can be analyzed by how they shift in response to pricing, promotions, availability, and local conditions. Cross-channel comparisons remain consistent because sales are reconciled against the same product, store, and calendar logic.

In one of N-iX's retail pricing transformations, fragmented pricing, promotion, and sales data made it challenging to understand margin impact across channels. By consolidating pricing logic and historical sales signals into a unified data foundation, the retailer reduced pricing inconsistencies and improved responsiveness to market changes. Pricing decisions shifted from retrospective analysis to controlled, data-backed adjustments.

Margin analysis goes beyond simple revenue minus cost calculations. When pricing changes, promotions, markdowns, and returns are modeled coherently, margin drivers become visible. It becomes possible to understand whether growth is driven by sustainable demand, promotional distortion, or assortment imbalance. Promotion and markdown performance can be evaluated against prior cycles using comparable baselines, including broader retail data monetization initiatives.

Inventory and supply chain visibility

Inventory analytics often fail because inventory states are interpreted differently across systems. A retail data warehouse resolves that inconsistency by modeling inventory movement as a lifecycle rather than a static balance. Stock imbalance detection becomes reliable because availability is evaluated across locations, channels, and fulfillment paths using the same definitions. Surplus and shortage signals surface earlier, while corrective actions remain feasible.

Inventory velocity and aging analysis benefit from preserved history. Slow-moving stock can be traced back to pricing decisions, promotional timing, or supply constraints rather than treated as an isolated problem. Aging metrics retain meaning even as assortments change, allowing comparisons across seasons and categories. Supply disruptions can be analyzed through downstream impacts on sales, margins, and service levels.

Customer and omnichannel insights

Customer predictive analytics in retail becomes reliable only when transactions, interactions, and fulfillment outcomes are reconciled into a single behavioral record. A data warehouse in retail enables that reconciliation by aligning online and offline activity, returns, exchanges, and service interactions around a consistent customer identity and lifecycle logic. Behavior is observed directly rather than inferred from partial signals.

Retention and lifetime value analysis benefit from this structure. Value calculations reflect actual purchasing and return behavior over time instead of optimistic projections based on limited windows. Attribution models gain credibility because journeys are reconstructed from real interactions across channels. Marketing, merchandising, and service teams share the same understanding of customer behavior, even when their objectives differ.

How to implement a data warehouse in the retail industry

Retail data warehousing succeeds or fails long before the first dataset is loaded. Most issues that later show up as "data quality," "wrong KPIs," or "low adoption" usually trace back to early implementation decisions: which business questions the warehouse is meant to answer, how retail events are modeled, and who owns definitions once the system goes live. At N-iX, implementation is defined as a productized delivery path with clear decision gates.

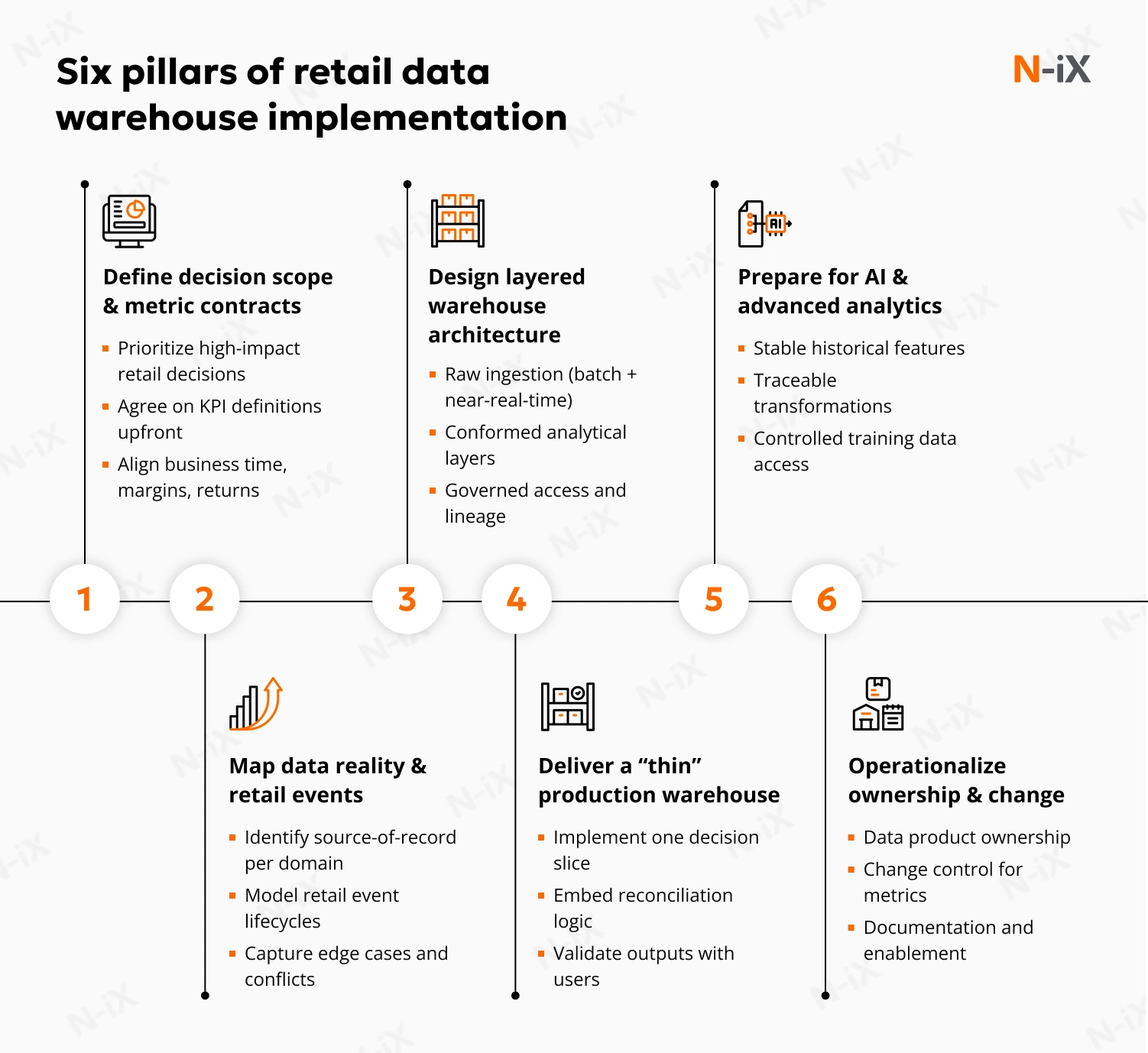

1) Start with decision scope and metric contracts

Retail warehouses often begin as an attempt to "unify data." That goal is too broad to deliver value quickly and too vague to prevent divergence later. The practical starting point is a decision scope: a small set of high-stakes, high-frequency decisions the business wants to improve within 8-12 weeks.

Typical starting scopes include:

- promotion performance and markdown control;

- inventory availability and imbalance across locations;

- margin drivers and true profitability by SKU/channel;

- omnichannel customer behavior and retention drivers.

For each scope, N-iX defines metric contracts before modeling: what counts as a sale, how returns are treated, how margins are calculated, how time is aligned to trading calendars, and how product/store hierarchies are handled. These contracts become the backbone of trust. Without them, downstream dashboards and AI models simply amplify inconsistency.

2) Map retail data reality and design the canonical event model

Retail systems describe different truths for different purposes. POS captures executed transactions. Ecommerce platforms capture orders and behavioral signals. ERP and inventory systems track stock states that may lag physical reality. Pricing and promotion engines reflect planned intent, not always what occurred at the shelf or checkout.

N-iX implementation work starts with a data reality map:

- source-of-record per entity (product, store, customer, price, inventory);

- event lifecycles (order → fulfillment → return/exchange/cancel);

- latency and reconciliation rules (which system wins when values conflict);

- critical edge cases (partial fulfillment, split shipments, negative quantities, corrections).

Based on this, a canonical retail event model is developed. Retail performance becomes explainable only when the warehouse can represent how events actually unfold over time.

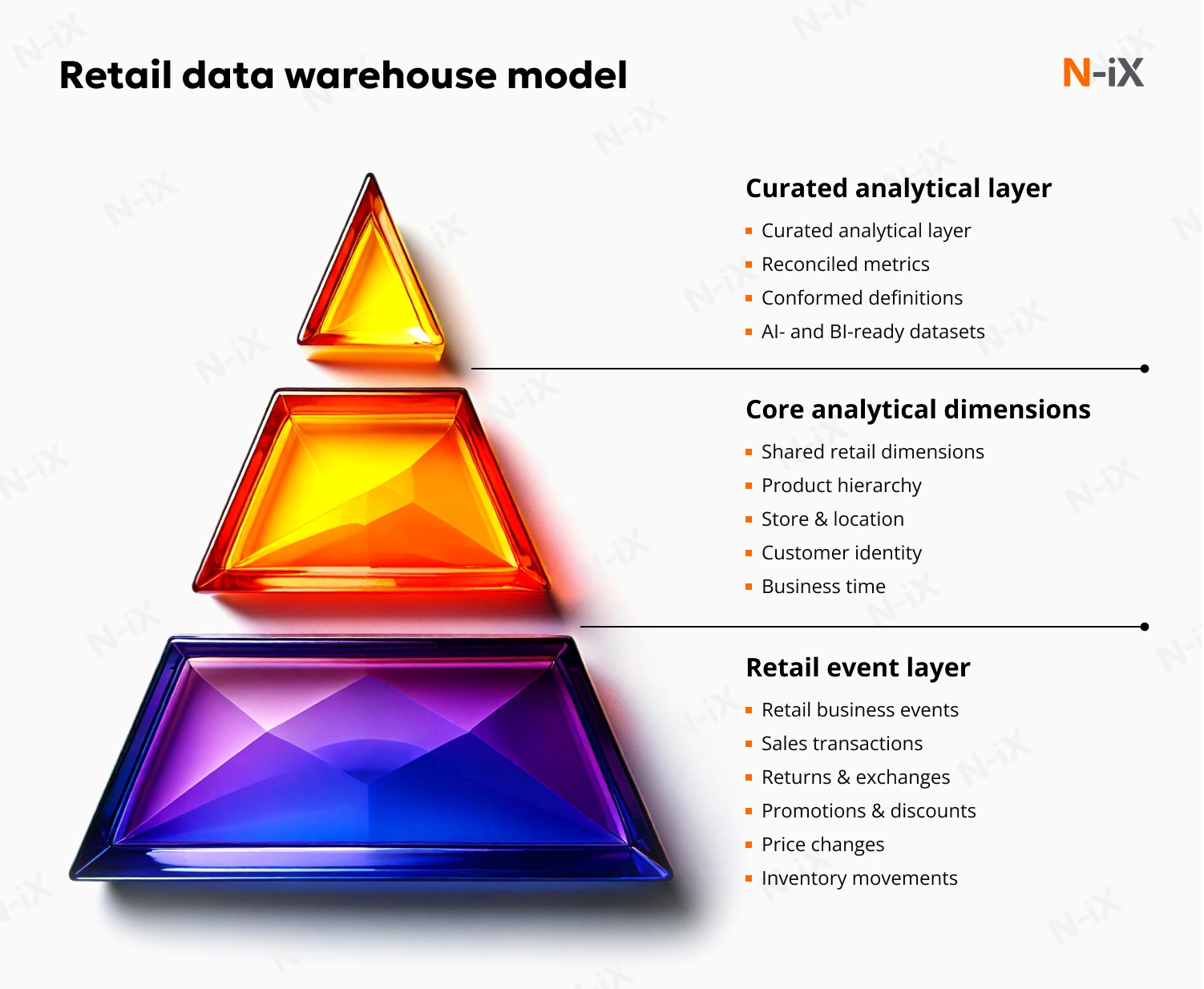

3) Choose an architecture that separates raw capture from trusted analytical layers

Retail organizations need both flexibility and stability. Raw data should be captured with minimal friction for traceability and future use, but business-facing analytics must sit on curated layers with enforced semantics.

A typical N-iX target architecture includes ingestion for batch and near-real-time flows, a raw/landing zone for auditability and replay, standardized and conformed layers, curated marts aligned to decision domains, and governance controls. We select cloud platforms such as Snowflake, BigQuery, and Redshift based on workload patterns, concurrency requirements, data-sharing requirements, and the broader ecosystem. The platform choice matters, but the separation of layers matters more.

For example, a large retailer struggling with slow analytics and manual reconciliation modernized its data platform as part of a broader automation initiative. By centralizing data ingestion and standardizing analytical layers, we reduced operational overhead and improved data reliability across reporting and planning workflows. Our modernization solution created a scalable foundation without disrupting ongoing retail operations.

4) Build the first value slice as a production-grade "thin warehouse," then expand

Large retail programs fail when they try to model everything at once. The better pattern is a thin warehouse: a narrow, production-grade implementation that delivers trusted metrics for a defined decision scope, then expands iteratively.

N-iX typically delivers an initial slice that includes:

- a minimal set of sources required to answer the chosen decisions

- a canonical model for the key retail events in scope

- reconciliation rules and metric definitions embedded into the model

- a small set of validated outputs used by business teams (dashboards, operational reports, or data products)

The objective is to prove that numbers reconcile, edge cases are handled, and governance is workable. Expansion then happens by adding new domains without rewriting the foundations.

5) Make the warehouse AI-ready by designing for traceability and feature stability

Retailers often request AI enablement early, but AI fails when underlying features are unstable. "AI-ready" in practice means: reproducible history, consistent definitions, and traceable transformations.

N-iX prepares the warehouse for ML by storing event history with proper slowly changing dimensions, ensuring feature inputs remain consistent, documenting and versioning transformations, and enabling controlled access to training and inference datasets. The result is a foundation on which forecasting, personalization, and pricing models can be operationalized without constant retraining due to upstream inconsistencies.

6) Operationalize adoption with ownership, documentation, and change control

A data warehouse is successful when teams stop arguing about numbers. That only happens when ownership and change control are explicit.

N-iX typically helps establish:

- a data product ownership model (who owns which domains and definitions)

- a change process for metric logic and models

- documentation that matches how teams work

- enablement for analytics and business users to reduce dependency bottlenecks

Implementation is the start. The durable advantage comes from maintaining a warehouse that stays coherent as retail complexity grows.

Why go with N-iX for data warehouse implementation?

Retail data warehousing becomes genuinely effective only when it is built with a deep understanding of retail operations, data behavior, and decision dynamics. That combination is challenging to assemble internally while simultaneously running day-to-day trading operations.

N-iX works with retail organizations precisely at this intersection, where data engineering, retail domain expertise, and long-term operating models meet. More than 200 data engineers, architects, and analytics specialists have delivered 60+ enterprise-scale data warehouse implementations across retail, telecom, manufacturing, finance, and digital commerce. Our work as retail data warehouse consultant spans design, modernization, cloud migration, governance, and AI enablement, with hands-on expertise across Snowflake, Amazon Redshift, Google BigQuery, Azure Synapse, and modern lakehouse architectures.

If your data warehouse in retail is expected to support pricing decisions, inventory allocation, customer analytics, and AI initiatives, now is the time to reassess its design. A conversation with N-iX is often the fastest way to determine whether your current foundation can scale or will become the following constraint.

FAQ

What is a retail data warehouse?

A data warehouse in retail is designed to model retail operations, including sales transactions, returns, promotions, pricing changes, inventory movement, and seasonality. Unlike generic data warehouses, it preserves retail-specific event lifecycles and historical context rather than flattening data into simple aggregates. The difference becomes critical as retailers scale across channels and regions.

When does a retailer actually need a data warehouse?

A retailer typically needs a data warehouse when reporting becomes slow, metrics conflict across teams, or analysts spend more time reconciling data than analyzing it. Other signals include difficulty supporting omnichannel analytics, unreliable inventory insights, and blocked AI or forecasting initiatives due to inconsistent data. At that stage, incremental fixes to existing systems usually increase complexity rather than resolve it. A centralized, retail-aware warehouse becomes necessary to restore trust in data.

Can a data warehouse in retail industry support AI and ML initiatives?

Yes, but only if it is designed with traceability, consistent definitions, and stable historical data. AI models depend on reconciled inputs across sales, inventory, pricing, and customer behavior; fragmented data reduces model reliability regardless of algorithm quality. A data warehouse for retail provides the structured foundation needed for forecasting, personalization, and pricing optimization. Without it, AI initiatives often stall or produce inconsistent results.

References

- From data overload to data-driven decisions in retail - KPMG

- Reinventing Retail by closing the data value gap - Accenture

Have a question?

Speak to an expert