Retailers generate more customer and transaction data than almost any other sector. Every transaction, loyalty program interaction, location signal, and behavioral trace contributes to an extensive data asset. This information can be converted properly into new revenue streams, better customer experiences, and a sustainable competitive advantage. In modern retail, the data is often more valuable than the products on the shelf.

Data monetization in retail turns raw data into products, services, and insights to enable enterprises to create new revenue opportunities, deepen customer loyalty, and strengthen partnerships. Let's examine what retail data monetization means for enterprises, the advantages of applying it, and the strategies that work.

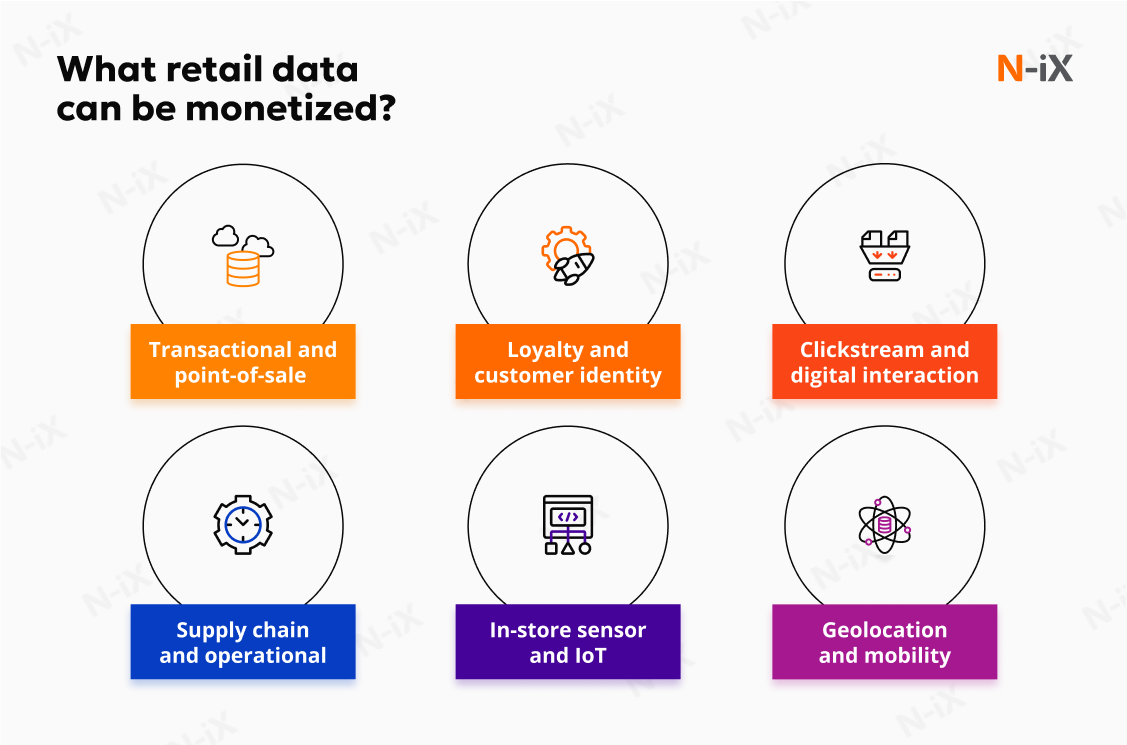

The most commonly monetized types of retail data

Retail generates some of the most diverse datasets in the economy. Yet only a subset has proven consistently monetizable at scale. These categories combine commercial relevance, regulatory defensibility, and practical usability for retailers and their partners.

Transactional and point-of-sale (POS) data

POS systems capture every completed purchase across channels: product identifiers, quantities, prices, discounts applied, and payment methods. When aggregated and anonymized, this data provides an authoritative view of demand trends, market share, price elasticity, and promotional effectiveness. Retailers rely on it to manage pricing and replenishment.

Loyalty and customer identity data

Loyalty programs link purchases to identifiable shoppers, creating longitudinal preferences, frequency, and engagement records. They also capture demographics and digital behaviors that pure POS data cannot provide. Access to loyalty insights enables precise audience activation and ROI measurement for suppliers.

Clickstream and digital interaction data

Ecommerce and mobile channels generate granular signals: search queries, product views, add-to-cart events, dwell time, and abandonment. Data monetization in retail enables enterprises to integrate this data with loyalty profiles and POS records to power recommendation engines and retail media targeting.

Supply chain and operational data

Retail operations continuously produce data on inventory positions, replenishment cycles, logistics flows, shrinkage, and out-of-stock events. Historically used only for internal efficiency, this data is now being packaged into supplier collaboration platforms. Retail data monetization can offer subscription access to operational dashboards or benchmarking services.

In-store sensor and IoT data

Physical environments generate high-value behavioral insights through cameras, RFID, smart shelves, and beacons. These tools record footfall, traffic flows, and dwell times data that connect marketing activity to in-store outcomes. Monetization comes from offering suppliers objective performance reporting for campaigns or charging for premium shelf placements validated by sensor analytics. Combined with loyalty and POS data, IoT feeds create a helicopter picture of shopper behavior across channels.

Geolocation and mobility data

Mobile applications and geo-fencing capture movement patterns, store visits, and regional shopping behaviors. Retail IT enables drive-to-store campaigns, catchment analysis, and localized assortment optimization. For suppliers, it provides proof of campaign effectiveness by linking ad exposure to verified foot traffic and subsequent sales. Retail data monetization typically occurs through co-funded promotions or as part of retail media offerings.

Read also: What are the biggest opportunities of data monetization in healthcare in 2026?

Optimize retail efficiency with automation—find out how!

Success!

Why retailers need data monetization in 2026

Retail is a high-volume, low-margin industry. Every missed opportunity to use data directly affects profitability. Data monetization allows retailers to convert operational, customer, and transactional information into structured insights and revenue streams. The most effective implementations go beyond dashboards.

For executives and boards

Data monetization provides business leaders with a structural way to expand margins without relying solely on product sales. According to KPMG's Global Tech Report 2024, retailers that effectively leverage their data have seen profits increase by at least 10% year over year [1]. This, in turn, creates new revenue lines through retail media, supplier dashboards, and subscription-based data services. The growth of recurring, non-inventory revenue streams increases enterprise valuation.

For merchandising and category managers

Category managers are under pressure to deliver profitable assortments and effective promotions. Data monetization equips them with advanced, monetizable insights that strengthen supplier relationships. This enables:

- Supplier-funded insights, where campaign performance and ROI measurement are monetized;

- Category benchmarking, providing transparent data that drives better trade negotiations;

- Assortment optimization, aligning product mix with regional and seasonal demand;

- Price elasticity modeling, which helps to monetize supplier access to pricing insights that guide promotions.

For marketing and customer engagement teams

Marketing functions face eroding returns as third-party cookies disappear and personalization expectations rise. Monetization unlocks first-party data for both internal targeting and external revenue. This supports:

- Retail media networks that allow brands to advertise on retailer-owned digital and physical channels;

- Hyper-personalized loyalty offers, funded or co-funded by suppliers, which increase redemption and spending;

- Behavioral segmentation, where advertisers pay to reach micro-audiences defined by real purchase data.

For supply chain and operations leaders

Data monetization transforms supply chain intelligence into a value proposition, internally and externally. It improves efficiency while creating supplier-facing services. This delivers:

- Predictive demand signals that optimize production and distribution;

- Subscription-based dashboards that suppliers pay for to align supply with real-time demand;

- Lower waste and markdowns, paired with higher on-shelf availability.

Read more: Building an effective data monetization strategy

10 practical retail data monetization strategies

Retail data monetization can be grouped into three main strategies: improving, wrapping, and selling. Each creates value differently, and not all are equally viable in practice.

Improving is where most retailers begin, because it directly strengthens the core business. Here, data is applied to reduce costs or increase revenue through smarter decisions and operational efficiency. For example, churn models reveal which customers will likely leave, allowing tailored retention campaigns. Predictive analytics anticipate demand shifts before customers act, helping retailers adjust pricing or promotions.

Wrapping goes a step further by embedding data into products and services, enhancing their utility and perceived value. The IoT has made this approach more accessible. RFID tags, for instance, allow retailers to track items across the supply chain and offer consumers transparency on product origin or sustainability credentials. Wrapping also enables proactive engagement: data-driven replenishment reminders capture sales that would otherwise be lost, recommendation engines raise basket sizes, and subscription models create recurring revenue while strengthening loyalty.

Selling is the most direct and constrained model. It involves treating data as a product by selling access to aggregated insights. While this can generate revenue, it is increasingly limited by privacy regulations and rising consumer expectations around transparency. That is why most retailers see greater improvement and wrapping opportunities, where monetization reinforces the core business and customer relationships rather than risking compliance or brand trust.

1. Retail media networks and targeted advertising

Retail media networks have become one of the fastest-growing monetization models in the sector. By combining transaction histories, loyalty program data, and digital interactions, retailers create advertising platforms that provide suppliers with highly granular audience access. Unlike traditional channels, these platforms close the loop between exposure and purchase, allowing precise attribution of campaign performance. That is the reason why retail media margins often surpass those of the core retail business, and why global ad spend in this category has already exceeded one hundred billion dollars annually [1].

A practical example is creating a retail media network where suppliers pay for sponsored product placement across a retailer's ecommerce site, mobile app, and even digital in-store displays. Campaign performance can then be measured in impressions and in actual units sold. Beyond banner ads or sponsored search results, advanced models integrate in-app promotions, digital receipts, and even in-store digital displays, all targeted with first-party data. Suppliers willingly fund these campaigns because the return is measurable, immediate, and tied to real transactions.

2. Loyalty program optimization and personalized rewards

Loyalty programs generate some of the richest customer datasets available to retailers. When these datasets are combined with Machine Learning, they evolve from transactional tracking tools into personalization engines. Instead of generic discounts or static point systems, retailers can deliver dynamic rewards and tailored experiences based on individual purchase behavior, lifestyle indicators, or channel preferences.

The impact is quantifiable. Well-designed personalization initiatives embedded into loyalty programs can raise revenue and profit by several percentage points. More importantly, they create recurring opportunities for monetization. Data monetization in retail offers suppliers access to anonymized audience segments for joint campaigns, sells sponsored placements in personalized recommendation feeds, or provides predictive insights about how specific cohorts respond to new products.

What makes this especially powerful is the reinforcing cycle: each personalized interaction generates new data, improving future targeting, which drives higher redemption and retention rates. This cycle steadily transforms loyalty programs into multi-sided ecosystems.

3. Customer segmentation and targeted promotions

Segmentation is one of the most established practices in retail, but its sophistication has increased dramatically with the integration of spatial and contextual data. Traditional demographic clusters are now enriched with geolocation signals, enabling offers and promotions that are both highly targeted and contextually relevant.

For example, promotions can be triggered when a customer enters a particular catchment area, while regional purchasing trends can inform localized assortment planning or pricing strategies. Retailers are also using geospatial analytics to decide where to allocate limited inventory or how to adjust store layouts in response to traffic patterns. Location-based targeting allows suppliers to run campaigns that drive clicks and physical visits, with the added ability to measure lift in basket size or category penetration.

One of N-iX success stories involved redesigning the search engine for a luxury store chain: improving query matching, autocomplete, and product availability visibility. This improved the customer experience and drove measurable increases in online sales through better product discovery.

4. Product recommendation engines and cross-selling

Recommendation engines influence what customers buy, how much they spend, and how suppliers invest in retail partnerships. A well-designed recommendation engine uses collaborative filtering, transaction histories, and contextual signals to suggest real-time relevant products.

The benefit is twofold. First, it increases customer basket size by surfacing items that align with immediate needs or adjacent preferences. Second, it creates monetization opportunities by allowing suppliers to sponsor recommendation slots or fund product pairings. For example, a supplier might invest in ensuring that their new product appears in "frequently bought together" suggestions alongside a complementary staple.

In-store personalization grows through dynamic shelf displays, personalized app notifications, or targeted checkout suggestions. Suppliers fund these initiatives because they can see direct cause-and-effect between recommendation exposure and sales performance. In this model, recommendation engines evolve from internal optimization tools into externally monetizable assets.

5. Churn prediction and customer retention campaigns

Customer attrition is one of the most expensive problems in retail because acquiring a new customer typically costs several times more than retaining an existing one. Data-driven churn prediction models allow retailers to detect early warning signals of disengagement to decline purchase frequency, shrink basket sizes, or a change in product categories. By anticipating these shifts, companies can design targeted retention campaigns that address specific risks.

For example, predictive analytics can segment at-risk customers into micro-groups and tailor interventions accordingly: personalized discounts, exclusive product access, or proactive customer service outreach. Over time, these interventions can reduce churn rates significantly and improve customer lifetime value.

6. Supply chain and inventory optimization

Supply chain data monetization management extends beyond efficiency gains into new value creation. With advanced forecasting models, retailers can integrate historical transaction data, real-time sales patterns, seasonal variables, and external signals such as weather or local events to align procurement with demand.

Advanced supply chain intelligence also includes scenario modeling, where AI systems simulate the impact of supplier delays, transportation bottlenecks, or raw material shortages. This enables more resilient planning and reduces costly disruptions. Retailers can further monetize these capabilities by offering suppliers predictive demand forecasts or replenishment insights, helping them optimize their production schedules and marketing campaigns.

In one project improving product allocation, N-iX used ML models to forecast demand for newly introduced fashion items, achieving over 50% improvement in forecasting accuracy and reducing product deficits to under 5%. That translated into significant cost savings and more precise inventory deployment.

7. Dynamic pricing and promotion planning

Pricing is one of the most direct levers of profitability, yet it remains under-optimized in many retail organizations. AI-driven dynamic pricing engines analyze vast datasets to recommend price changes that maximize margin without alienating customers. Retailers can also tailor promotions dynamically, adjusting them in real time to reflect store-level inventory, customer profiles, or regional demand.

Operational AI use cases extend beyond pricing. Workforce scheduling, store layout optimization, and energy consumption management are increasingly influenced by predictive analytics. By embedding AI across these operational layers, retailers can reduce waste, improve efficiency, and create additional monetization opportunities. For example, suppliers may co-fund promotional slots optimized by AI models because they deliver higher ROI than static campaigns. In this way, operational AI becomes both a cost-reduction and revenue-generation tool.

8. Supplier collaboration through shared insights and dashboards

Retailers hold one of the most valuable assets for consumer packaged goods (CPG) companies: visibility into customer behavior at the point of sale. Sharing aggregated, privacy-compliant insights with suppliers allows retailers to monetize their data without selling raw information. Dashboards that track product performance, basket composition, or promotional effectiveness provide suppliers with actionable intelligence they often cannot generate independently.

This partnership can be further enriched by benchmarking, where suppliers compare product performance against category averages or competitor benchmarks. Retailers can monetize this by offering tiered access to basic dashboards as part of standard supplier agreements, with advanced benchmarking or predictive analytics available as premium services.

9. Risk management and fraud detection

Fraud is a persistent risk in retail, spanning payments, returns, loyalty programs, and even employee operations. Retail data monetization in this context does not come from selling information but from transforming loss prevention into measurable financial value. Retailers capture vast amounts of transactional, behavioral, and operational data across stores, ecommerce platforms, and payment systems. Advanced analytics and anomaly detection models can identify suspicious activities such as irregular refund requests, unusual shopping patterns, or abnormal inventory movements.

For example, by monitoring transaction velocity or comparing shopping behaviors across channels, algorithms can flag potential card fraud or identify organized return fraud rings. Video and sensor data can be combined with sales records to detect shrinkage or employee collusion. The monetization effect lies in avoided losses, reduced insurance costs, and the potential to provide fraud-detection services to suppliers or financial partners.

10. Data as a Service (DaaS) and Insights as a Service (IaaS)

Retailers are specially positioned to commercialize the breadth of their customer and transaction data by offering structured access to third parties. Data as a Service provides anonymized, privacy-compliant datasets through APIs, marketplaces, or subscription models. Insights as a Service takes this further by layering analytics, modeling, and visualization on raw data.

For instance, a retailer may offer suppliers dashboards that benchmark brand performance against category peers, track the effectiveness of promotions, or highlight regional demand trends. These services typically operate on recurring revenue models with high margins, far exceeding the profitability of inventory-based monetization. The long-term opportunity is to expand these offerings into data marketplaces, where anonymized datasets from multiple retailers and verticals can be aggregated.

Final thoughts

Many businesses can continue operating successfully without turning their customer or operational data into a separate revenue stream. However, for organizations with the right scale, data maturity, and supplier ecosystem, ignoring the opportunity means leaving measurable value on the table.

High-performing companies are three times more likely than peers to say data monetization contributes more than 20% of company revenues [2]. Even modest gains of one or two percent in revenue at margins far higher than the core business can reshape financial performance in an industry where profitability is often measured in single digits.

When executed responsibly, monetization can increase return on investment, which leads to strengthening the business without disrupting its core operations. At N-iX, we combine data engineering, advanced analytics, and domain knowledge to design practical strategies and modernize data foundations. If competitors are already turning first-party data into higher-margin revenue streams through loyalty-driven personalization, retail media, or Data as a Service, can your business afford to leave that value untapped?

FAQ

What is retail data monetization?

Retail data monetization is the process of converting the information retailers generate from sales transactions, loyalty programs, and supply chains into measurable outcomes. It can take two forms: internal monetization focuses on using data to improve efficiency, decision-making, and customer experience. External monetization extends these insights to suppliers, partners, and advertisers through data-driven products and services.

Why is retail data monetization important in 2026?

The relevance of monetization has grown because traditional retail margins remain thin, while the industry produces more data than it uses. When properly managed, it improves personalization, strengthens loyalty programs, makes supply chains more efficient, and creates new revenue opportunities such as retail media networks and supplier services.

Which technologies enable retail data monetization?

Modern monetization depends on cloud platforms that consolidate information across the business, Artificial Intelligence, and Machine Learning to deliver predictive and personalized insights, and privacy-preserving environments. In physical stores, IoT sensors and computer vision enrich the data pool with behavioral insights.

References

- From data overload to data-driven decisions in retail - KMPG

- Fueling growth through data monetization - McKinsey Global Survey

Have a question?

Speak to an expert