Financial technology is transitioning from rapid expansion to sustainable growth. Businesses face converging pressures around AI adoption, regulatory compliance, security integration, market expansion, and infrastructure modernization. Gartner and World Economic Forum (WEF) research show that 2026 marks the year when experimental fintech capabilities become essential business infrastructure. Companies that act now will gain advantages before these fintech trends become standard practice. Seven trends examined here will define fintech operations through 2026.

7 fintech industry trends to follow

1. AI reshapes finance jobs

AI adoption for operations and staffing ranks among the top fintech trends. Half of finance leaders plan significant investments in generative AI, while 80% of fintech companies already implement AI across multiple business areas like customer service, fraud detection, and process automation [1].

This widespread adoption is creating demand for entirely new job categories. Organizations need AI product managers to oversee AI tool development, model builders to create and maintain algorithms, and AI investigators to monitor systems for errors and bias. These roles require technical skills that didn't exist in traditional finance departments.

Enhance security and trust in finance with explainable AI—get the white paper!

Success!

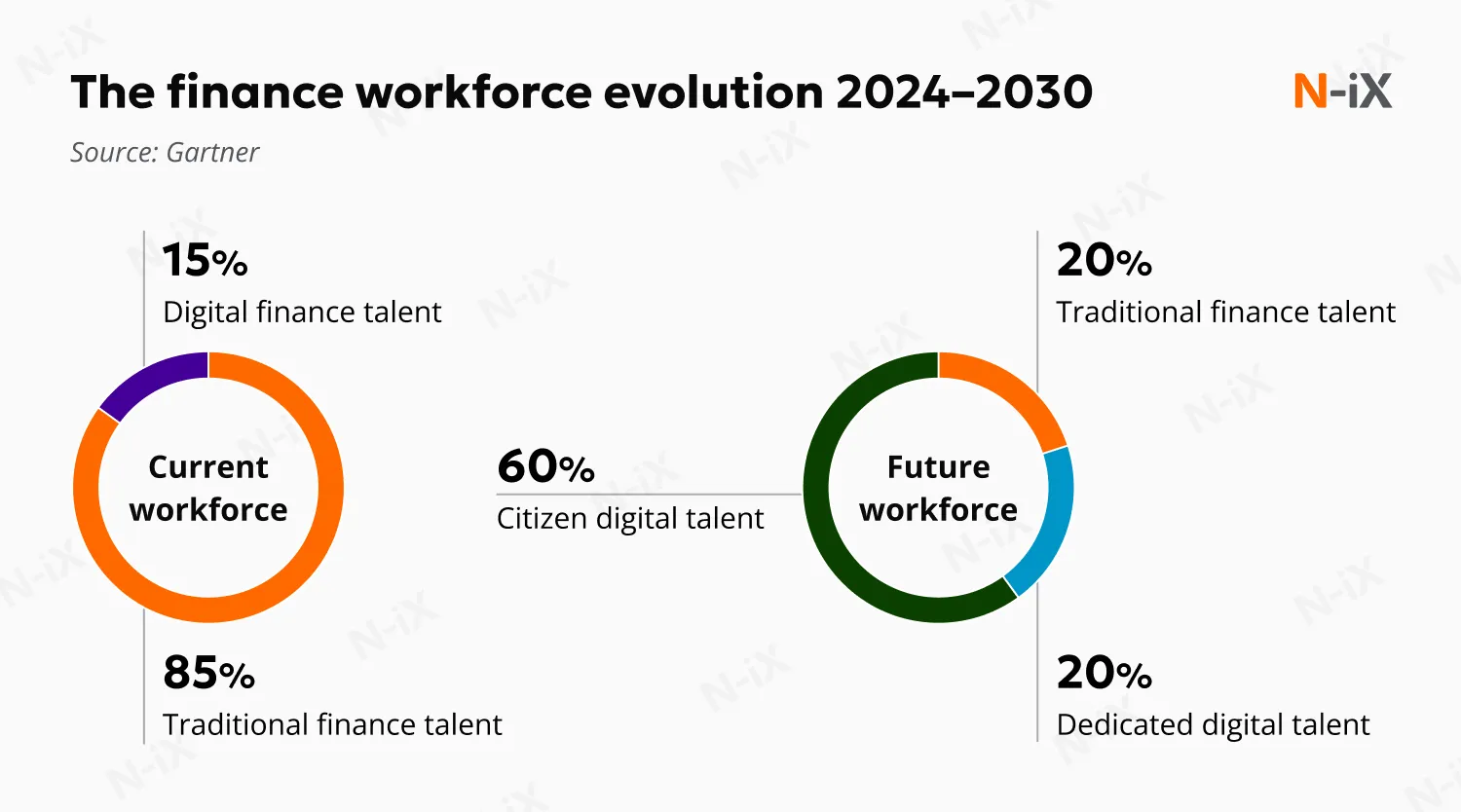

The workforce impact varies significantly between traditional finance and fintech companies. Gartner predicts finance teams could shrink by 50% by 2030 as AI automates routine tasks like data entry, reconciliation, and basic analysis [2]. However, fintech companies show a different pattern: half report no workforce changes despite heavy AI use, suggesting they use AI to enhance rather than replace workers.

This shows fintechs focus on growth, while traditional finance focuses on efficiency. Companies are trading some traditional roles for specialized AI positions. While entry-level accounting and analysis jobs may disappear, demand grows for people who can build, manage, and oversee AI systems. The transition requires careful planning to retrain existing staff and recruit new talent with AI expertise. Organizations navigating this transition successfully will gain competitive advantages through improved efficiency and decision-making capabilities.

2. Governments rush to create AI rules

Financial regulators worldwide are working to establish AI governance frameworks while companies grapple with unclear and constantly changing requirements. The evolving fintech trends around regulatory compliance reflect the industry's struggle to balance innovation with oversight. Gartner predicts that AI governance will become mandatory under sovereign AI laws by 2027 [3], forcing all financial organizations to implement formal oversight systems. Compliance moves from voluntary adoption to legal obligations with financial penalties.

Current regulatory uncertainty creates significant challenges for financial firms. WEF research shows 77% of fintech companies view regulatory uncertainty around AI as a significant obstacle to growth and innovation [1]. Meanwhile, Gartner finds that only 37% to 57% of finance teams implement AI governance structures before starting AI projects [3]. This highlights a dangerous gap between AI deployment and proper oversight. Companies find it difficult to invest confidently in AI systems when rules remain undefined or vary dramatically between jurisdictions.

Despite these challenges, regulatory environments are gradually improving. The WEF found that 62% of fintech companies now rate their regulatory environments as adequate, suggesting that authorities are making progress in creating clearer guidelines [1]. Gartner data shows marked increases in adoption and investment in AI governance tools, indicating organizations recognize the need for structured oversight frameworks [3].

The regulatory maturation process involves balancing innovation with consumer protection and financial stability. Governments must create comprehensive rules to address AI risks while avoiding overly restrictive frameworks that stifle beneficial innovations. Achieving this balance requires ongoing dialogue between regulators, financial institutions, and technology providers to ensure rules remain practical and effective as AI capabilities evolve rapidly.

3. Security teams unite against sophisticated digital threats

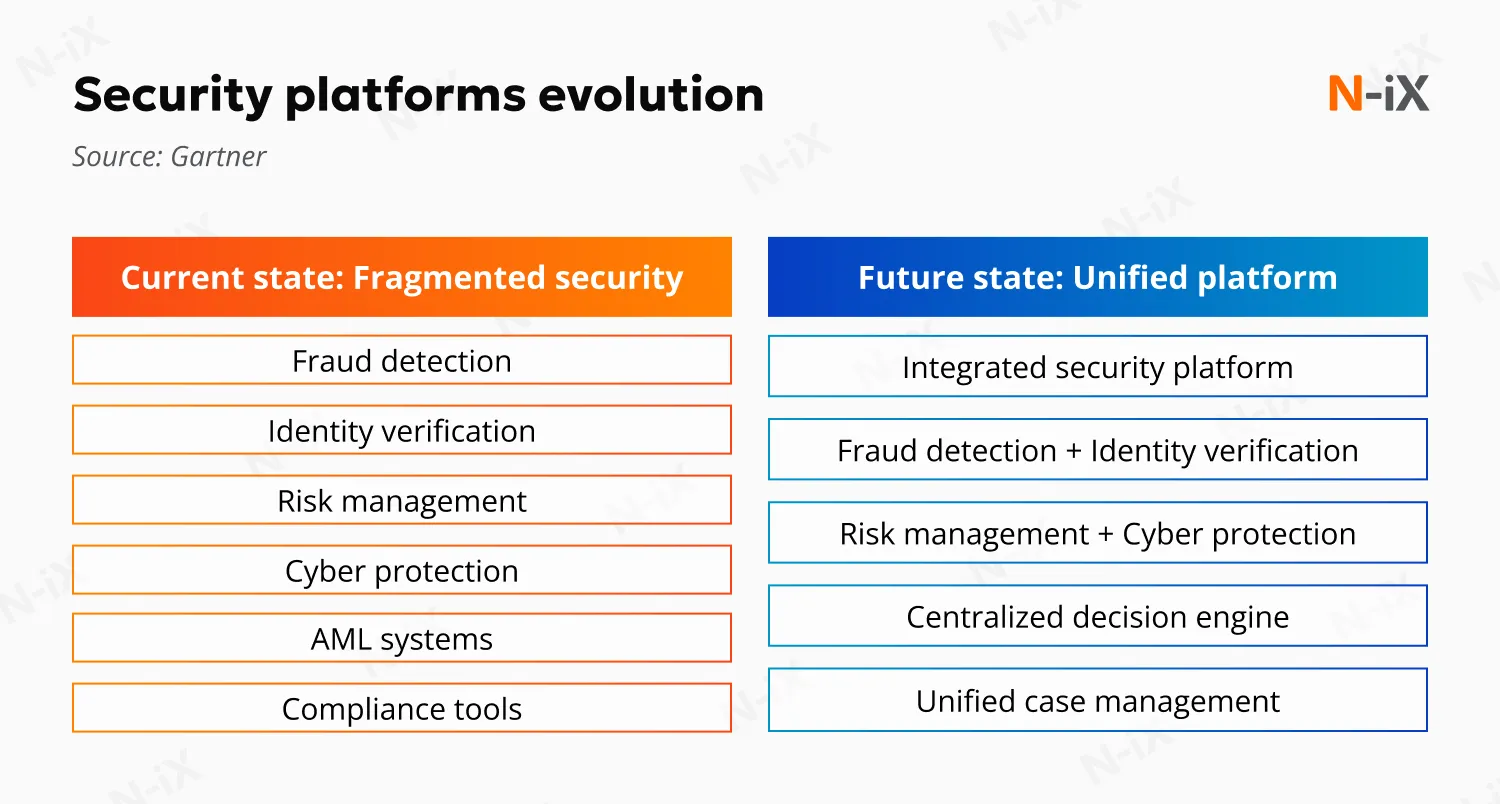

Financial companies are changing how they fight fraud and cyber attacks. They are moving away from using many separate security tools toward single platforms that handle everything. Such trends in fintech security reflect a shift in how organizations protect themselves and their customers. By 2029, more than half of security vendors will offer combined platforms that include fraud detection, identity checks, and risk management in one system, according to Gartner [4]. By 2031, half of large banks will move their fraud teams into their cybersecurity departments under the Chief Information Security Officer [4].

This change is happening because current security setups have serious problems. Companies use too many tools that don't talk to each other well. This creates gaps where threat actors can attack. WEF data shows 46% of fintech companies now use AI to catch fraud, making it the most popular AI security tool [1]. Another 31% use AI to spot attack patterns before they happen [1]. These numbers show fraud prevention drives most AI adoption in finance.

The threats are getting more complex. WEF research found 84% of fintech companies see data breaches as their biggest security risk [4]. AI-created fake videos and images concern 83% of companies [4]. Regular cyber attacks worry 79% [4]. These high threat levels explain why companies want unified security platforms instead of scattered tools.

Data sharing between security systems has become crucial. Gartner found that buyers now demand platforms combining information from multiple security tools into single workflows with centralized decision making. Companies can no longer afford the complexity of managing separate fraud detection, identity verification, and risk systems that don't work well together.

The organizational changes match the technology shifts. Security teams are taking over fraud prevention because both face similar digital threats that require similar technical skills. This merger makes sense since modern fraud often uses the same techniques as cyber attacks. Companies with unified security teams can respond faster and more effectively to threats that blur the lines between traditional fraud and cybercrime.

4. Financial services expand globally while targeting previously excluded groups

Financial technology companies are simultaneously expanding internationally and focusing on customers who traditionally lacked access to banking services. Fintech trends toward global expansion and financial inclusion create new revenue opportunities while addressing global inequality. WEF research shows fintech companies serve significant portions of underserved populations. Micro, small, and medium businesses comprise 57% of their customer base [1]. Low-income populations represent 47% of customers, while women account for 41% [1]. These numbers demonstrate that serving excluded groups has become a mainstream business strategy rather than charity work.

The revenue impact proves these customers are profitable. Low-income customers generated 43% of fintech revenue in 2023, up dramatically from 26% in 2022 [1]. This 17 percentage point jump shows companies can make money while expanding financial access. Senior customers contributed 28% of revenue, up from 20% the previous year. Rural and remote populations provided 36% of revenue [1]. These increases show that underserved segments drive real business growth, not just social impact metrics.

Geographic expansion complements this inclusion focus. WEF data shows that 55% of fintech companies plan to grow internationally within 12 months [1]. Another 22% are considering scaling but have decisions on hold [1]. Advanced economies show stronger expansion appetite, with 60% planning international development compared to 49% in emerging markets [1]. By region, 67% of Middle East and North Africa companies plan to diversify geographically, followed by 64% in Europe and 60% in the US and Canada [1].

Different business types pursue different growth strategies. Digital banking and savings companies lead in international scaling at 73%, followed by wealth management firms at 65% [1]. Digital payments companies plan to grow internationally at 58% while digital lending remains more local, with 34% not focusing on global markets [1]. This variation reflects different regulatory complexities and market opportunities across financial services.

However, expansion faces significant barriers. Complex regulatory and licensing requirements block 68% of companies trying to expand internationally [1]. Adapting products to local markets challenges 58% of firms [1]. Establishing local partnerships creates problems for 48% of companies [1]. Access to capital limits 40% of emerging market companies compared to 32% in advanced economies [1]. These obstacles explain why expansion appetite doesn't always translate into successful international growth.

Regional differences in customer acquisition show adaptation strategies. Sub-Saharan Africa companies serve the highest proportion of underserved segments, with 62% serving small businesses, 68% serving low-income customers, and 66% serving rural populations [1].

5. Financial systems shift to connected cloud-based platforms

Financial technology infrastructure transforms as companies abandon isolated systems for connected, cloud-based platforms that communicate seamlessly. Infrastructure transformation has become one of the most significant fintech industry trends, reshaping how financial services operate and deliver products to customers.

The movement toward cloud-based solutions is accelerating rapidly across all types of financial organizations. Gartner data reveals changes in technology preferences, with cloud-based ERP systems becoming the leading technology across their finance technology analysis [3]. Meanwhile, on-premises ERP systems show the most significant decline, with almost 20% of companies planning to discontinue their use [3]. This represents a 38-place drop in value rankings for on-premises systems, demonstrating how quickly the industry is abandoning older infrastructure approaches [3].

Integration capabilities are becoming essential competitive advantages rather than optional features. Gartner research indicates that 80% of automation platforms will offer AI-assisted development by 2027, reducing costs and enabling more citizen developers to build solutions [3]. Additionally, 62% of ERP spending will focus on applications with generative AI capabilities by 2027, up from just 14% in 2024 [3]. These numbers show how AI integration drives infrastructure decisions, with organizations choosing platforms incorporating intelligent automation rather than requiring separate AI tools.

The business impact of this infrastructure evolution extends beyond technology departments. WEF data shows that 93% of fintech companies view open banking and open finance frameworks as relevant to their future success [1]. Companies prioritizing technology solutions and infrastructure report this as their primary partnership motivation 48% of the time, followed by enhanced credibility and trust at 34% [1]. Such partnerships enable organizations to leverage shared infrastructure rather than building duplicate capabilities.

The infrastructure transformation also enables new business models and revenue streams. Companies using integrated platforms can offer embedded finance solutions more easily, with 52% of fintech companies rating embedded finance among the most relevant trends for the next five years [1]. Cloud-native architectures support rapid scaling and international expansion, which 55% of fintech companies plan within the next 12 months [1].

6. Traditional banks and fintechs form strategic alliances for mutual growth

The financial services industry is witnessing increased cooperation between traditional banks and fintech companies, transforming competitive relationships into strategic partnerships that benefit both sides. Fintech trends toward collaboration represent a pivot from disruption to ecosystem integration. WEF research reveals that 84% of fintech companies now partner with incumbent financial institutions [1]. This demonstrates that the industry has moved beyond zero-sum competition toward ecosystem-based growth where different players contribute complementary strengths.

Technology capabilities drive most of these partnerships, with 48% of fintech companies citing technological solutions and infrastructure as their primary collaboration motivation [1]. This reflects the reality that traditional banks possess regulatory expertise, customer trust, and capital resources. At the same time, fintechs bring innovative technology, agile development capabilities, and fresh approaches to customer experience. API integrations represent the most common partnership structure, used by 52% of collaborating companies, enabling seamless data sharing and service integration without requiring complete system overhauls [1].

The partnership benefits extend beyond pure technology sharing. Enhanced credibility and trust motivate 34% of partnerships, which is particularly valuable for fintechs seeking to build customer confidence in regulated financial services [1]. Product and service innovation drives another 34% of collaborations, allowing traditional banks to offer modern digital experiences while fintechs gain access to established customer bases and regulatory frameworks. Access to capital and funding accounts for 33% of partnerships, with access to customer segments ranking equally important at 33% [1].

Partnership structures vary significantly based on business needs and regulatory requirements. Technology provider relationships account for 41% of collaborations, followed by funding agreements at 36% [1]. Co-branded products represent 22% of partnerships, prevalent among insurance companies at 26%, digital lending firms at 26%, and digital banking companies at 25% [1]. Data sharing agreements, agent banking arrangements, and joint ventures account for 11% to 14% of partnerships, showing the diversity of collaboration models emerging across the industry [1].

The partnership trend aligns with broader industry recognition that collaboration creates more value than competition alone. Only 16% of companies report having no partnerships, concentrated mainly in Latin America at 29%, Europe at 21%, and Sub-Saharan Africa at 18% [1]. This low percentage of non-partnering companies suggests that strategic alliances have become essential for sustainable growth and competitive positioning in modern financial services.

7. Digital identity systems become core financial infrastructure

Digital identity and authentication systems have evolved from security add-ons to essential infrastructure powering account opening, fraud prevention, and core business operations. WEF research shows 60% of fintech companies prioritize integrated electronic Know Your Customer (eKYC) and anti-money laundering platforms above payment systems (48%) and open data projects (43%), making digital identity the most critical technology investment [1].

These systems automatically handle customer verification, regulatory compliance, and risk management without human intervention. About 25% of fintech companies use digital account opening for customer acquisition [1]. Among these companies, 71% develop capabilities internally rather than outsourcing, viewing digital identity as a core competency rather than a commodity service [1].

Identity verification has become central to modern security through "identity-first" approaches that make customer identity the foundation for cybersecurity protection. This shift represents one of the key technology trends in financial services, changing how organizations approach security and risk management. Digital identity systems continuously assess risks, monitor transactions, and detect threats throughout customer relationships, not just during onboarding.

Regulators increasingly mandate robust digital identity capabilities. Know Your Customer processes are becoming fully automated through AI systems that verify identities, assess risks, and maintain compliance records. This automation is essential for international expansion across different regulatory jurisdictions. Blockchain technology enables portable identities that work across multiple financial service providers.

Companies investing in comprehensive digital identity infrastructure now position themselves to meet future regulatory requirements while reducing costs and improving customer experiences through faster, more accurate verification processes.

Act now: Set up your fintech for growth in 2026

In 2026, the fintech sector will favor organizations that adopt a comprehensive approach to transformation, rather than piecemeal adoption. Converging fintech trends will reshape competitive dynamics across the industry. AI will become operational infrastructure, not experimental technology. Regulatory compliance will shift from voluntary best practices to mandatory requirements with significant penalties. Security will demand unified platforms instead of fragmented point solutions. Market expansion will focus on the profitable inclusion of underserved segments. Infrastructure will require cloud-native, API-first architectures for competitive survival.

These trends interconnect and accelerate each other. AI-powered fraud detection requires integrated security platforms. Regulatory compliance demands sophisticated governance systems. International expansion needs interoperable infrastructure. Financial inclusion relies on AI-driven personalization and risk assessment. Companies attempting to address these changes separately will struggle with complexity, costs, and competitive disadvantage.

Growth requires coordinated implementation across all areas simultaneously. Organizations must build AI capabilities while ensuring regulatory compliance, integrate security systems while expanding markets, and modernize infrastructure while maintaining operational stability. The interconnected nature of technology trends in the financial services industry demands comprehensive planning and execution. Partnering with a reliable technology provider becomes essential for navigating this transition effectively. Companies that begin comprehensive transformation now will establish sustainable competitive advantages that will compound over time.

Sources:

- Propson, D., & Zhang, B. (2025, June). The Future of Global Fintech: From Rapid Expansion to Sustainable Growth (Second Edition). World Economic Forum & Cambridge Centre for Alternative Finance.

- Gunaydin, H., & Stickles, B. (2025, August 1). Finance 2030: The Finance Workforce at Frontier Firms. Gartner.

- Helsel, M., Duffy, N., & Marion, M. (2025, February 12). 2025 Finance Technology Bullseye Report. Gartner.

- Ayoub, D., Redshaw, P., O'Neill, S., & Sharma, V. (2025, January 30). Emerging tech: The future of online fraud prevention. Gartner.

Have a question?

Speak to an expert