Agentic AI in finance is emerging as a strategic shift and a natural evolution of GenAI rather than a passing trend. Gartner estimates that 33% of enterprise software applications will include agentic AI by 2028, compared with less than 1% in 2024 [1]. Moreover, at least 15% of day-to-day business decisions will be made autonomously by 2028 [1].

Even customers will rely on AI agents since 20% of interactions at human-readable storefronts are expected to be handled by AI [1]. These expectations are reshaping the requirements of financial software, forcing financial institutions to make greater use of AI agent development services.

To understand how to respond to this shift, let’s look at agentic AI applications in finance and the steps to choose and adopt them effectively.

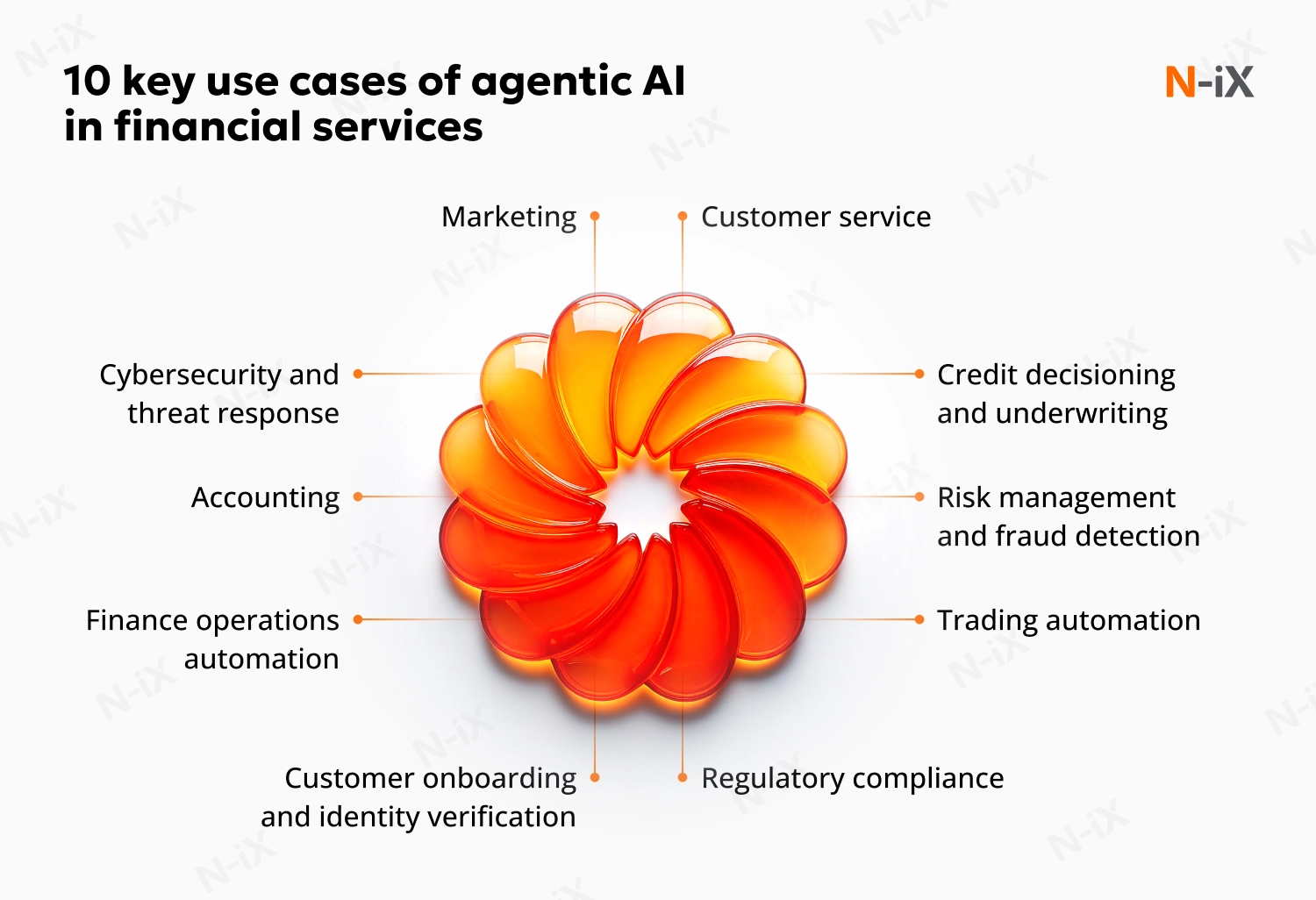

Top 10 use cases of agentic AI in finance

1. Customer service

AI agents in finance can manage routine customer interactions across chat, email, and phone. They recognize the intent behind a request, pull the correct data from core banking systems, and resolve everyday tasks such as balance inquiries, card replacements, or dispute updates. Human agents address more complex issues, but with all the context and suggested next steps already prepared by an AI.

This division of work allows banks to handle large spikes in requests without overstaffing and ensures human employees focus on cases where empathy or judgment is essential. According to Accenture, 39% of banking work hours could be fully automated, while another 34% could be augmented with GenAI support, together accounting for 73% of total work hours [2]. Agentic AI in banking enable companies to achieve 22-30% productivity improvements and revenue growth of up to 600 basis points over the next three years [2].

Business value: faster responses, 24/7 support, lower operating costs, and higher customer satisfaction.

2. Credit decisioning and underwriting

To decide whether to extend credit, under what terms, and with what risk profile, a bank requires collecting and validating borrower data, running risk models, and preparing recommendations for approval. When done manually, this work is time-consuming, inconsistent, and creates bottlenecks that limit the number of credit applications.

Harness AI to revolutionize credit risk management—download our comprehensive guide!

Success!

Here is an example of how N-iX helped automate these processes:

N-iX implemented an agentic AI in finance for a bank in the MENA region in two steps. The first was loan default prediction. Our team applied an ML model to large volumes of customer and transaction data so the bank could predict the likelihood of default earlier and more accurately than rule-based methods. This step allowed risk teams to act and refine lending criteria before problems escalated.

The second step was building a customer-facing AI agent that moved beyond prediction into execution. Starting as a simple FAQ chatbot, it evolved into a transactional assistant capable of handling balance inquiries, transfers, and bill payments. Over time, it became a digital colleague that answered questions, supported financial transactions, and guided customers through processes traditionally handled in branches.

Business value: The agent reduced the support team’s workload by 50%, cut operational costs by 70%, and lowered website traffic by 82% as customers turned to the AI agent first. Customers benefited from faster credit interactions and smoother day-to-day banking, while the bank improved decision accuracy, reduced defaults, and created a scalable foundation for more advanced AI-driven underwriting.

3. Risk management and fraud detection

Financial institutions face rising pressure from fraud, compliance demands, and the need to make instant decisions on transactions. Agentic AI in finance addresses these challenges by analyzing transaction streams, user behavior, and external signals in real time. Moreover, AI in risk management escalates only high-risk anomalies with evidence packs and suggested actions, while retraining on new fraud typologies to reduce false positives.

A strong example comes from an N-iX project with a UK-based fintech organization. The company previously relied on multiple ML models for fraud checks and customer risk scoring, which created latency of up to five minutes for some transactions. N-iX built a unified decision engine that centralized model execution, integrated a feature store, and enabled real-time fraud detection and transaction approvals. The new system cut latency to just 250 milliseconds, improved customer experience, helped increase its customer base by 20%, and boosted its net promoter score (NPS) by 35 points.

Business value: faster and more accurate fraud detection, reduced manual review workload, better customer trust, and measurable improvements in growth and satisfaction.

4. Trading automation

Trading desks rely on speed, precision, and compliance. AI agents continuously monitor live market data, simulate scenarios, and rebalance portfolios against predefined strategies. They can encode execution playbooks, such as urgency, venue selection, and order slicing, and generate trade proposals or execute transactions within pre-approved guardrails. Research copilots can further assist the process. They summarize market news or filings and link them to actionable trades.

Business value: quicker reaction to market changes, reduced operational risk from manual intervention, higher desk productivity, and stronger adherence to risk budgets.

5. Regulatory compliance

Regulatory compliance involves heavy manual effort to monitor transactions, prepare evidence, and submit reports. AI agents codify regulatory logic, check transactions in real time against anti-money laundering (AML) and know your customer (KYC) requirements, and generate complete audit trails. Instead of just clearing alerts, agents assemble complete case files with evidence, rationale, and draft narratives for human reviewers. According to McKinsey, one compliance officer can supervise more than 20 AI agents in finance, translating into 200-2,000% productivity gains in financial-crime operations when workflows are redesigned around agents [3].

Business value: lower cost per compliance case, fewer reporting errors, faster regulatory responses, and greater transparency through searchable, auditable records.

6. Customer onboarding and identity verification

Onboarding new customers requires document capture, KYC checks, and identity validation. Agentic AI in finance parses identity documents, performs liveness and facial matches, screens against sanctions and politically exposed person (PEP) lists, and scores risk. Straightforward cases are processed instantly, while ambiguous ones go to compliance staff with side-by-side evidence and AI-generated recommendations. McKinsey reports that banks dedicate 10-15% of full-time equivalents (FTEs) to KYC and AML, with limited automation [3]. Moving to agent-driven, event-based reviews addresses this structural inefficiency.

Business value: shorter onboarding cycles, fewer customer dropouts, stronger identity assurance, and measurable savings in compliance labor hours.

7. Finance operations automation

Finance teams often spend significant time verifying that payments, invoices, and records match correctly. Agentic AI in finance automates these tasks, reconciling payments with purchase orders, tracking missing information, and flagging only unusual cases for human review.

For instance, Cognex used AI to overhaul its quote pricing review. Previously, ~90% of pricing quotes in one region required manual intervention and several levels of review [4]. The average number was 500 quotes per month, which meant ~1,600 manual reviews (around three reviews per quote) [4]. After deploying the AI model, 90% of manual reviews were eliminated, leaving only 10% of cases that required human judgment [4]. The system was implemented in six months, which is proof of quick adoption and measurable efficiency gains.

Business value: accelerated cash cycles, reduced error rates, lower operational costs, and scalable finance operations that do not depend on proportional increases in headcount.

8. Accounting

The financial close often takes weeks as teams check records, resolve mismatches, and prepare reports. Agentic AI in accounting speeds up this work by pulling data from different systems, spotting errors, and drafting reports with clear explanations of variances. Instead of spending time on manual checks, controllers receive focused alerts with suggested fixes, making the process more efficient and reliable.

Business value: faster financial close cycles, more accurate reporting, easier audits, and more time for finance professionals to focus on planning and analysis.

Read more: How AI agents for data analytics transform business operations

9. Cybersecurity and threat response

Financial institutions face constant pressure from increasingly sophisticated cyberattacks. Agentic AI can strengthen defenses by monitoring network activity, access patterns, and transaction flows in real time. When anomalies are detected, agents automatically trigger containment measures such as session terminations, account locks, or step-up authentication, before escalating only the most complex cases to human security teams.

A study by the University of the Cumberlands exemplifies how effective an agentic AI in cybersecurity may prove. In this study, software engineers combined blockchain technology, multi-factor authentication, and an AI agent into a security architecture. Adding agentic capabilities led to a 90% reduction in fraudulent transactions and improved breach detection accuracy to 98%, showing how autonomous agents can dramatically increase resilience against emerging digital threats [5].

Business value: shorter response times, fewer successful intrusions, reduced operational downtime, and more substantial customer confidence in the security of digital banking services.

Learn more about AI for threat detection and response

10. Marketing

Marketing and sales teams in financial institutions face two recurring challenges: qualifying leads accurately and tailoring outreach at scale. Agentic AI addresses both by orchestrating prospect data from CRM systems, external datasets, and prior interactions. Agents can build dynamic prospect profiles, highlight cross-sell opportunities, and generate outreach drafts that comply with regulatory guidelines. Campaigns can then be continuously optimized as agents run uplift experiments and upload results to next-best-action models for relationship managers.

Business value: improved lead quality, more precise targeting, stronger cross-sell economics, and measurable revenue growth driven by campaigns that adapt in real time.

Discover more about explainable AI in finance

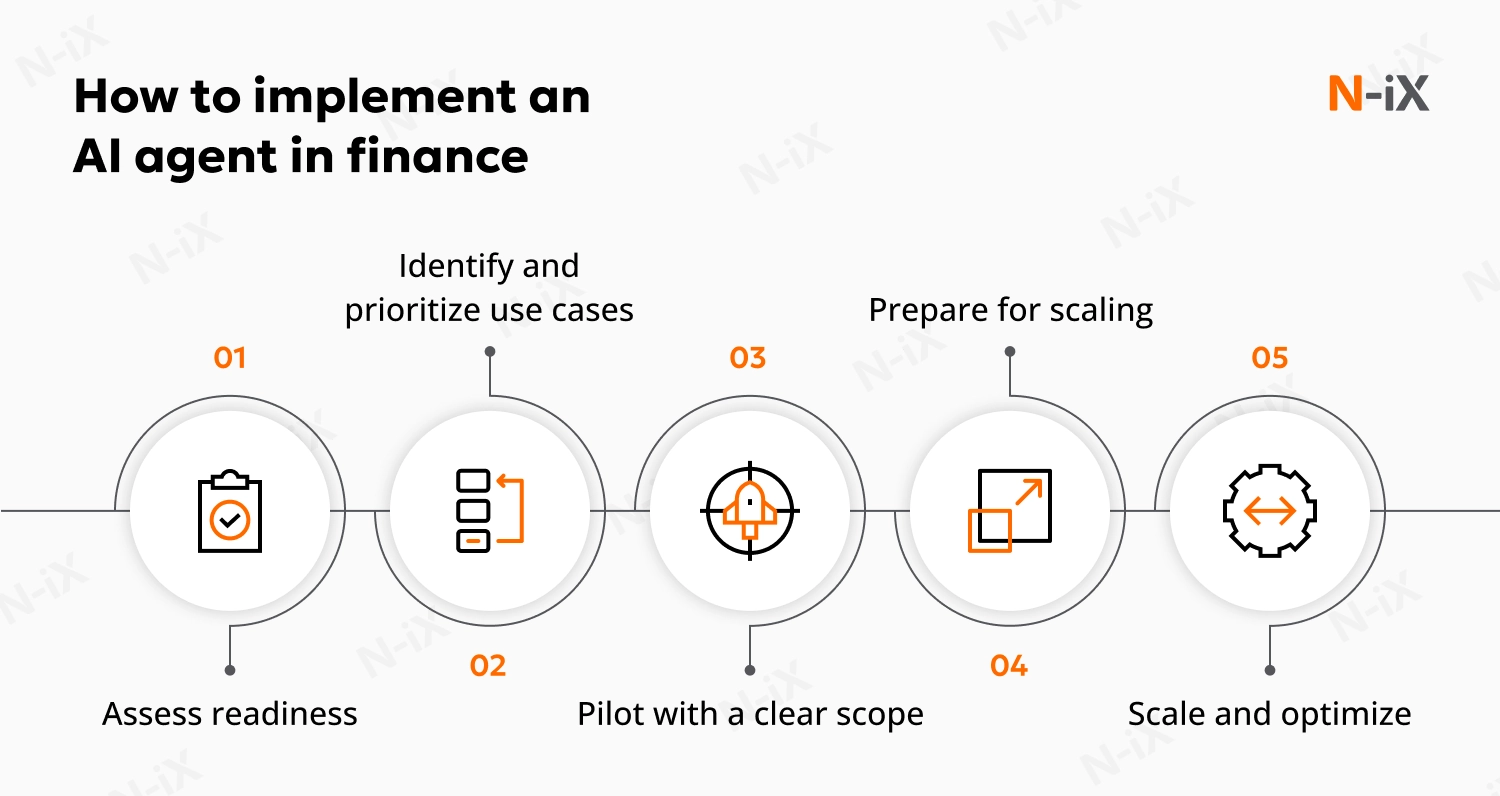

How to choose and implement agentic AI use cases in finance

Despite an average spend of $1.9M on GenAI initiatives in 2024, fewer than 30% of AI leaders report a positive impact on ROI [6]. Low-maturity organizations often fail to identify suitable AI agent use cases and approach projects with unrealistic expectations, while 57% admit their data is not prepared for AI [6]. Even more mature firms encounter bottlenecks, particularly in securing skilled professionals to scale adoption.

N-iX is a trusted partner for financial institutions navigating these challenges. Drawing on 23 years of experience in AI, data, and financial software development, we help organizations move beyond experimentation to value delivery. Let us share best practices for selecting agentic AI applications in finance and implementing them at scale.

1. Assess readiness

Organizations should begin by evaluating their data infrastructure, governance practices, and workforce skills. Gartner notes that 56% of organizations with high GenAI readiness outperformed their revenue and profit targets, unlike the 37% of peers with low-readiness [7]. This self-assessment creates the baseline from which financial institutions can prioritize the right use cases and scale them successfully.

2. Identify and prioritize use cases

The next step is to focus on processes that are repetitive, data-intensive, or prone to human error. Functions such as onboarding, compliance checks, or payment reconciliation often deliver early wins. Selecting use cases with measurable outcomes ensures leadership buy-in and accelerates adoption.

3. Pilot with a clear scope

Rather than attempting enterprise-wide implementation, leading firms start with limited pilots. Case studies show that six-month implementation cycles are typical for invoice reconciliation or anomaly detection [4, 8]. Pilots allow teams to validate value, refine workflows, and build internal confidence before scaling.

4. Prepare for scaling

Once the pilot delivers results, organizations must strengthen data pipelines, refine governance, and integrate the AI agent into existing platforms such as ERP, CRM, or core banking systems. At this stage, human-in-the-loop oversight remains critical to maintain compliance and trust.

5. Scale and optimize

When the foundations are ready, AI agents can be scaled across business functions and geographies. Ongoing monitoring, retraining on new data, and structured feedback from business teams are essential to maintain performance. Institutions that approach scaling this way capture benefits beyond cost efficiency, including stronger revenue growth, higher customer satisfaction, and improved risk control.

Conclusion

Organizations adopting agentic AI in finance already experience speed, accuracy, and scalability gains while reducing manual effort and costs. At the same time, success depends on realistic expectations, strong data foundations, and careful prioritization of use cases. Those that approach adoption systematically are best positioned to capture improvements not only in efficiency but also in revenue growth, customer trust, and risk resilience.

N-iX helps banks and financial institutions to capture the value of AI agents. With 2,400 specialists, including 200 data experts, we have delivered 60 AI and data projects worldwide. Our expertise spans governance frameworks, regulatory alignment, and the integration of agentic capabilities into complex financial software ecosystems. We ensure that agentic AI is not just deployed but embedded into operations as a lasting driver of performance.

References

- Gartner. Top Strategic Technology Trends for 2025: Agentic AI

- Accenture. Banking in the age of generative AI

- McKinsey & Company. How agentic AI can change the way banks fight financial crime

- Gartner. AI-Based Quote Pricing Review

- Shah, S. P., & Deshpande, A. V. Enforcing Cybersecurity Constraints for LLM-driven Robot Agents for Online Transactions

- Gartner. The 2025 Hype Cycle for Artificial Intelligence Goes Beyond GenAI

- Gartner. AI Agents Assist Humans to Enhance Digital Commerce Performance

- Gartner. ERP Embedded AI for Finance Processes

Have a question?

Speak to an expert