Technologies like AI, edge computing, and Open RAN are redefining connectivity, turning telecoms from utility providers into intelligent digital service platforms. At the same time, cybersecurity and sustainability are shaping priorities for 2026. Many operators rely on telecom software development services that enable faster innovation, network automation, and service scalability to keep pace with this evolution. This article explores the ten most relevant telecom industry trends defining competitiveness, innovation, and long-term growth in the global communications sector.

Telecom technology trends in 2026

1. AI-native networks and automation

AI is no longer an add-on to telecom networks, but is becoming the foundation of operations. AI-native networks are built from the ground up with intelligence at their core, unlike older AI-enabled systems that only apply analytics or automation in specific areas.

AI is the central control system in these next-generation networks, managing everything from performance optimization and fault detection to customer experience. This shift is driven by industry pressure to manage increasing network complexity from 5G, IoT, and emerging 6G technologies, as well as growing competition from fast-moving digital players.

Explore generative AI use cases in telecom—download the white paper!

Success!

How do AI-native networks actually work?

Moving toward AI-native networks requires cloud-native infrastructure, microservices-based design, unified data fabrics, and large-scale MLOps pipelines. These elements allow telcos to train, deploy, and scale AI models across their ecosystems. The result is a network that learns, adapts, and improves in real time. AI agents can collaborate across domains, enabling self-healing, self-optimizing, and eventually zero-touch operations, where human intervention becomes minimal.

How does AI-native transformation impact telecom business models?

AI-native transformation is one of the telecom trends that delivers significant operational and financial gains. It reduces downtime, improves service quality, cuts maintenance costs, and enhances customer experience through proactive support. At a strategic level, it opens new revenue streams in data monetization, AI-driven analytics, and network-as-a-service models. However, full adoption requires overcoming legacy system constraints, fragmented data, and skills gaps, making a phased, iterative approach the most effective path forward.

Read also about the use cases of agentic AI in telecom

2. Cloud-native and edge integration for digital services

Telecom operators are redefining how they build and deliver digital services through cloud-native transformation. Instead of relying on rigid, monolithic systems, they adopt microservices-based architectures deployed in containers and orchestrated across hybrid or multi-cloud environments. This model allows rapid scaling, faster deployment cycles, and significant cost optimization. By virtualizing network functions (VNFs) and embracing software-defined networking (SDN), telcos can roll out new features or upgrades in minutes rather than months-streamlining innovation and improving operational agility. As one of the defining telecom industry trends, cloud-native transformation is changing how operators modernize infrastructure and deliver intelligent, scalable services across global networks.

What does cloud-native transformation mean for telecoms?

Cloud-native design is the foundation for modern telecom agility. It enables telcos to automate network management, improve fault tolerance, and support continuous service delivery. Combined with edge computing, it moves processing power closer to end users: whether at 5G base stations, regional data centers, or enterprise sites. This minimizes latency and supports real-time applications like industrial automation, AR/VR, connected vehicles, and smart infrastructure.

How does edge integration reshape telecom business models?

Edge integration turns telecom operators into digital service platforms capable of locally hosting AI workloads, IoT analytics, and enterprise applications. This shift expands their role beyond connectivity, allowing them to deliver network-as-a-service (NaaS) and on-demand computing resources to industries. It also opens new monetization paths while strengthening partnerships with hyperscalers and enterprise customers in emerging digital ecosystems.

3. Cybersecurity and data privacy enhancements

The telecom industry faces a growing cybersecurity and privacy crisis, intensified by the convergence of 5G, IoT, and AI-driven systems. As networks expand in scale and complexity, so does the attack surface. Telecom infrastructure is a prime target for ransomware, data breaches, and state-sponsored attacks. In 2024, several major operators faced large-scale disruptions, signaling an urgent need for stronger, more adaptive defenses.

What does advanced cybersecurity mean for telecoms today?

Telecoms are adopting AI-enabled Threat Intelligence Platforms (TIPs) that go beyond static, rule-based security. These systems continuously analyze traffic patterns, detect anomalies in real time, and predict potential breaches before they occur. Using Machine Learning for automated detection and response, operators are moving toward "zero-touch" cybersecurity, where systems self-diagnose and mitigate threats without human intervention. However, this advancement fuels an AI arms race. Attackers also use generative AI to craft intelligent malware, deepfake phishing, and automated vulnerability scans.

How will enhanced cybersecurity and privacy shape telecom operations?

Stronger cybersecurity and transparent data practices are becoming central to customer trust and regulatory compliance. Operators must invest in end-to-end encryption, extended detection and response (XDR) tools, and AI governance frameworks to ensure algorithmic transparency and fairness. With privacy concerns growing around technologies like ISAC and AI-native monitoring, telecoms must find the right balance between innovation and responsibility. They must protect network integrity while safeguarding users' digital rights in an increasingly connected world.

4. Edge computing and ultra-low latency services

Multi-access Edge Computing (MEC) represents a shift from processing data in distant cloud centers to computing directly at the network's edge. MEC drastically reduces latency and network congestion by placing servers at cell towers, local hubs, or regional data centers. This proximity to users allows faster data processing, making it indispensable for next-generation applications such as autonomous vehicles, immersive AR/VR, real-time gaming, smart manufacturing, and remote healthcare. As one of the most impactful telecom industry trends, MEC enables telecoms to deliver high-performance, low-latency digital services that improve customer experience and enterprise connectivity.

What does edge computing mean for telecoms?

At its core, MEC transforms telecom operators from simple data carriers into real-time digital service enablers. It allows them to run compute-intensive workloads closer to customers, ensuring near-instant responsiveness and better reliability. For example, autonomous vehicles use MEC to process collision avoidance decisions in milliseconds at nearby cell towers rather than waiting for data to travel to distant cloud servers. By integrating MEC with 5G networks, telecoms can support mission-critical services and enable new use cases that were impossible with centralized architectures. Global leaders like Verizon, AT&T, and Vodafone are already investing heavily in MEC zones and partnerships with cloud providers to achieve this.

How does edge integration change telecom business models?

Edge computing opens up entirely new revenue streams: from offering low-latency platforms for enterprises to hosting AI and IoT analytics as on-demand services. It positions telecoms as technology partners to industries, not just connectivity providers. However, scaling MEC requires overcoming challenges like high infrastructure costs, managing distributed security, and establishing common standards across vendors and ecosystems.

Read more: Edge computing AI: Bringing real-time intelligence to connected devices

5. Open RAN and vendor diversification

The global telecom landscape is shifting toward Open Radio Access Network (Open RAN) architectures, marking a decisive move away from proprietary, single-vendor systems. Open RAN enables interoperability between hardware and software from different suppliers, giving telecom operators greater flexibility in building and scaling their networks. This approach helps reduce dependence on a handful of major equipment providers and strengthens supply chain resilience, a key concern after recent geopolitical and logistical disruptions. The U.S., Japan, and European governments heavily fund Open RAN research and deployment to promote secure, diverse, and cost-efficient telecom infrastructure.

What does Open RAN mean for telecom networks?

Open RAN disaggregates network components, such as radios, baseband units, and software layers, allowing them to communicate through open standards. This modularity lets operators mix and match solutions, accelerating innovation and competition in a previously closed ecosystem. Major telecoms like Vodafone, Telefónica, and Rakuten Mobile are already rolling out large-scale Open RAN networks.

How does vendor diversification shape telecom business strategy?

Opening the market to new entrants and startups, Open RAN lowers infrastructure costs and fosters faster deployment of 5G and future 6G networks. It encourages local manufacturing, enhances cybersecurity oversight, and positions telecom operators to innovate faster while maintaining greater control over their network evolution.

6. Sustainability and green network technologies

Sustainability has become a central focus for telecom innovation as operators confront rising energy costs, stricter environmental regulations, and growing pressure to decarbonize their networks. Telecom infrastructure accounts for nearly 2% of global electricity use, pushing companies to adopt energy-efficient and low-carbon technologies [1]. To reduce emissions and operational expenses, networks are being redesigned with AI-driven power management, liquid-cooled data centers, and energy-optimized base stations. Equipment manufacturers are also advancing circular antenna designs that can be reused or recycled, extending hardware lifecycles and minimizing waste. Sustainability is one of the telecom industry trends that is here to stay, affecting how networks are engineered, powered, and maintained.

What does sustainability mean for modern telecoms?

Sustainability in telecom is moving beyond compliance toward strategic value creation. Operators increasingly invest in renewable energy sources, build carbon-neutral supply chains, and embed green engineering principles into network design. European and Asian carriers are setting the pace by integrating solar and wind power into operations and committing to net-zero targets by 2035. Even cloud-native network architectures contribute by dynamically allocating computing resources, reducing idle capacity, and improving energy efficiency.

How does sustainability impact telecom business strategy?

Green transformation opens new business opportunities. Eco-efficient networks attract environmentally conscious consumers, strengthen ESG partnerships, and enable access to government incentives tied to climate goals. Telecom companies that embed sustainability into their technology roadmaps are positioned as both digital innovators and responsible global citizens, building long-term competitiveness in the evolving telecom landscape.

7. Fixed wireless access (FWA)

Fixed Wireless Access is rapidly emerging as a key growth driver for telecom companies seeking new revenue beyond traditional consumer services. FWA provides high-speed broadband to homes and businesses using 4G and 5G wireless signals instead of physical cables. It's convenient when fiber installation is slow, costly, or impractical. The global FWA market is projected to reach $655.55B by 2033, up from $145.34B in 2024, at a CAGR of 18.22% [2].

What makes FWA an important telecom innovation?

FWA bridges the connectivity gap by delivering broadband over the air, allowing telecoms to connect underserved or remote locations without laying new infrastructure. It also supports redundant connectivity, ensuring operations continue if the primary wired internet fails, and enables temporary deployments for construction sites or events. Advanced capabilities like network slicing let businesses reserve dedicated bandwidth segments, guaranteeing performance and reliability for critical operations.

How does FWA impact telecom business models?

FWA transforms telecoms from local service providers into flexible broadband enablers for multiple industries. Retailers, construction firms, hotels, and agricultural enterprises are already adopting FWA to power rural stores, manage job sites, host events, and enable smart farming. This versatility makes FWA a cornerstone of telecom growth strategies, opening new markets while maximizing existing wireless infrastructure.

8. Satellite and Non-Terrestrial Networks (NTN)

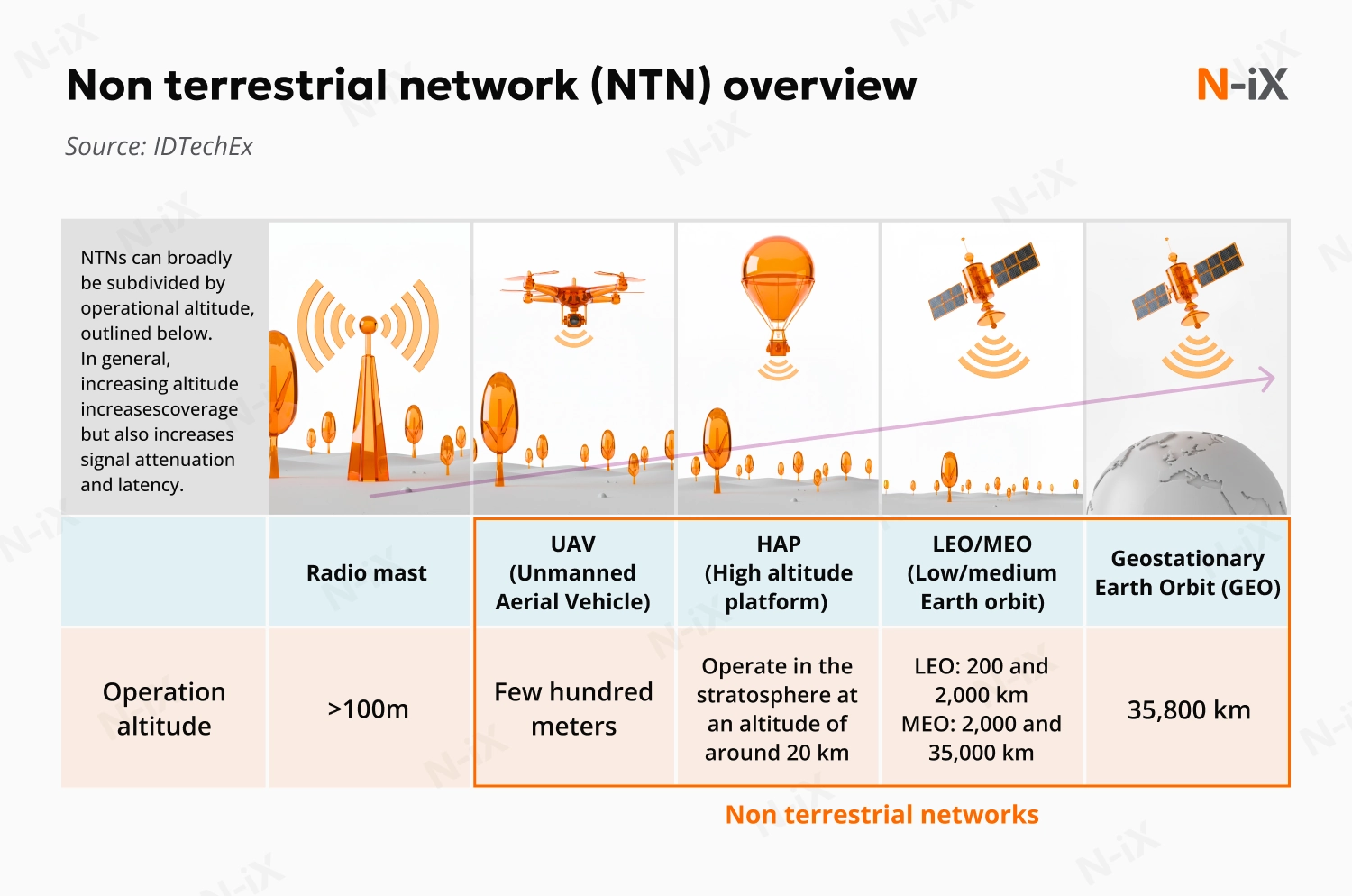

Non-Terrestrial Networks (NTN) mark an evolution in global connectivity, expanding telecom coverage beyond the limits of terrestrial infrastructure. Instead of relying solely on ground-based towers, NTNs use satellites, drones, and high-altitude platforms to deliver communication services anywhere on Earth. The most significant milestone is the Direct-to-Cell (D2C) satellite service, which enables ordinary smartphones to connect directly to satellites, and no specialized devices or antennas are required. The concept has gained momentum with the dramatic drop in satellite launch costs, allowing thousands of low-Earth orbit (LEO) satellites to be deployed economically.

What do satellite and non-terrestrial networks mean for telecoms?

These networks are redefining coverage and resilience. Early deployments, like T-Mobile's partnership with Starlink, are already offering emergency text messaging in regions beyond standard coverage. As technology matures, 6G-era NTNs will support broadband-grade data speeds, enabling seamless global communication, from ocean vessels to remote mining sites. The ability to "connect the unconnected" could bridge digital divides in developing economies and ensure network continuity during disasters or infrastructure failures.

How will NTNs change the telecom industry?

NTNs create massive opportunities for new service models and partnerships across telecommunications, aerospace, and defense. Telecoms can extend connectivity to new markets, support global IoT networks, and develop hybrid terrestrial-satellite services for enterprises. Yet, scaling NTNs requires overcoming bandwidth constraints, signal latency, and interoperability challenges across diverse orbital layers and vendors. Commercial viability will depend on balancing coverage, performance, and cost.

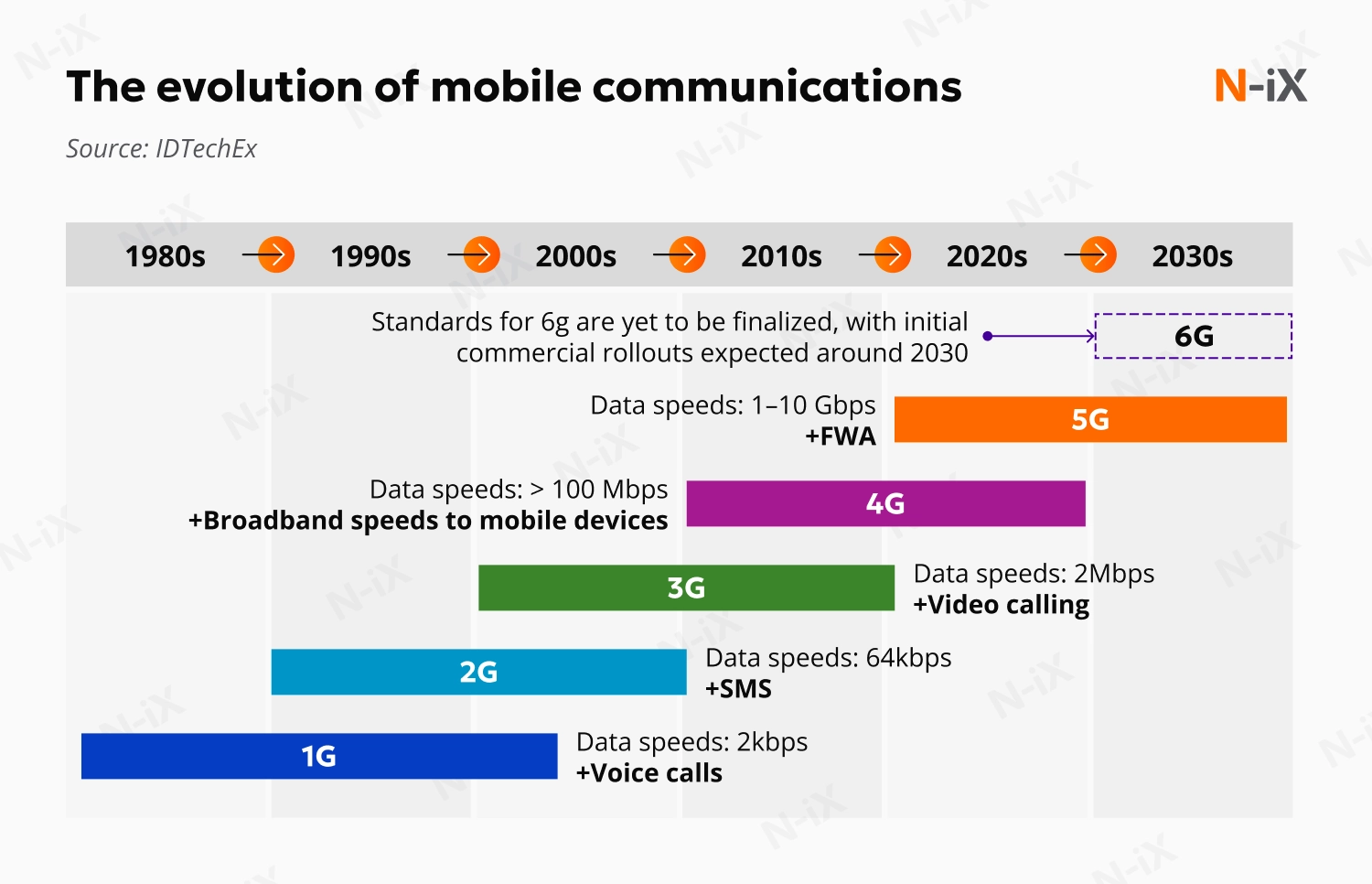

9. 6G early adoption and terahertz communications

The telecom industry is already laying the groundwork for 6G networks, expected to roll out commercially around 2030. Unlike incremental upgrades seen in previous generations, 6G will mark a radical leap. It will deliver terabit-per-second speeds, microsecond latency, and AI-native architectures that enable real-time intelligence across devices and environments. It will primarily use the cmWave spectrum (7-15 GHz) for wide coverage and experiment with sub-terahertz bands (above 100 GHz) for ultra-high-performance use cases. One of the most forward-looking telecom industry trends, 6G redefines how data, sensing, and intelligence will converge within next-generation networks.

What will 6G bring to the telecom landscape?

6G aims to overcome the shortcomings of 5G by being built as a standalone, AI-driven network from the start. It will integrate sensing and communication (ISAC) capabilities, allowing networks to detect environmental changes. These features will power future applications such as holographic communication, remote surgery, and industrial automation. To achieve this, 6G relies on breakthroughs like Silicon-Germanium and Indium Phosphide semiconductors, antenna-in-package designs, and Reconfigurable Intelligent Surfaces (RIS) that dynamically control signal paths and improve coverage.

How will 6G shape telecom business opportunities?

6G's promise extends beyond connectivity. It will enable new digital ecosystems where telecoms act as intelligent service orchestrators. Combining AI-native operations, edge computing, and non-terrestrial networks such as direct-to-cell satellites, operators will reach previously unconnected populations and industries. However, the business case depends on creating viable, monetizable services that justify the heavy investment, an important lesson learned from the early challenges of 5G deployment.

10. Integrated sensing and communications (ISAC)

Integrated sensing and communications (ISAC) represents one of the most impactful directions in next-generation telecom. It allows networks to transmit data and sense the physical environment using the same radio waves. In essence, networks gain radar-like capabilities. They can detect motion, measure distance, or map surroundings. One of the most recent telecom technology trends, ISAC transforms communication networks into distributed environmental sensing systems that extend their function far beyond data transmission. While commercial rollout is expected closer to 2030 alongside mature 6G systems, early research and trials are underway.

What does ISAC mean for telecom innovation?

ISAC blurs the line between communication and perception. Telecom networks can support new applications by embedding sensing functions into base stations and antennas. These include drone navigation, smart city traffic monitoring, immersive AR/VR experiences, and infrastructure protection. Major players like Ericsson, Huawei, Nokia, and Qualcomm drive global R&D efforts, with European governments heavily funding academic and industrial collaborations.

How could ISAC reshape telecom business models?

ISAC introduces a new layer of intelligence that could make telecom networks key enablers of autonomous systems and spatial computing. However, challenges remain: ensuring precise sensing accuracy, synchronizing data across vast networks, and addressing privacy concerns about environmental monitoring. The long-term opportunity lies in monetizing sensing-as-a-service and integrating ISAC into industrial automation, logistics, and defense ecosystems. This could potentially redefine telecom's role in the physical-digital convergence.

Wrap-up

The telecom industry is amid structural change, driven by advances in AI, automation, edge computing, and sustainable engineering. Networks are becoming programmable and adaptive, with cloud-native and open architectures replacing legacy systems that once limited agility. Operators are rethinking how they manage data, energy, and connectivity. They prioritize efficiency, interoperability, and long-term resilience. The growing use of intelligent software, edge infrastructure, and green technologies redefines how telecoms deliver value. These ten telecom industry trends highlight the tangible shifts in telecommunications today, from network design and operations to the services that connect people and industries worldwide.

Telecom companies can navigate this transformation more effectively by partnering with an experienced technology provider. With its deep engineering expertise, advanced software capabilities, and industry insight, N-iX helps operators accelerate innovation, enhance network performance, and stay competitive.

References:

- McKinsey & Company. "The case for committing to greener telecom networks." Article. February 26, 2020.

- Research and Markets. "Fixed Wireless Access Market by Type, Operating Frequency, Demography, Technology, Application, Countries and Companies Analysis 2025-2033." Report. 2025.

Have a question?

Speak to an expert