Most of us still remember the world without digitized money transactions. At the time, cash and standard banking operations seemed to be quite convenient ways of paying for goods and services. Today our fast-paced world dictates new rules and technology has played the biggest role in this transformation. Fintech has redefined modern financial services bringing ease and immediacy to the concept. In this article, we’d like to dig into one of the most promising areas in mobile fintech development – mobile payments.

Mobile payments market overview

The high quality of e-payments we have today would be impossible without the technological advancements in mobile devices and their extensive adoption.

Recent research by Google indicates that in an average day, more than 1/4 of all users only use a smartphone, which is nearly 2X as many as those who only use a computer. Those who use a smartphone spend almost three hours per day on it. And according to Statista, the number of smartphone users is forecast to reach 2.6 billion by 2020.

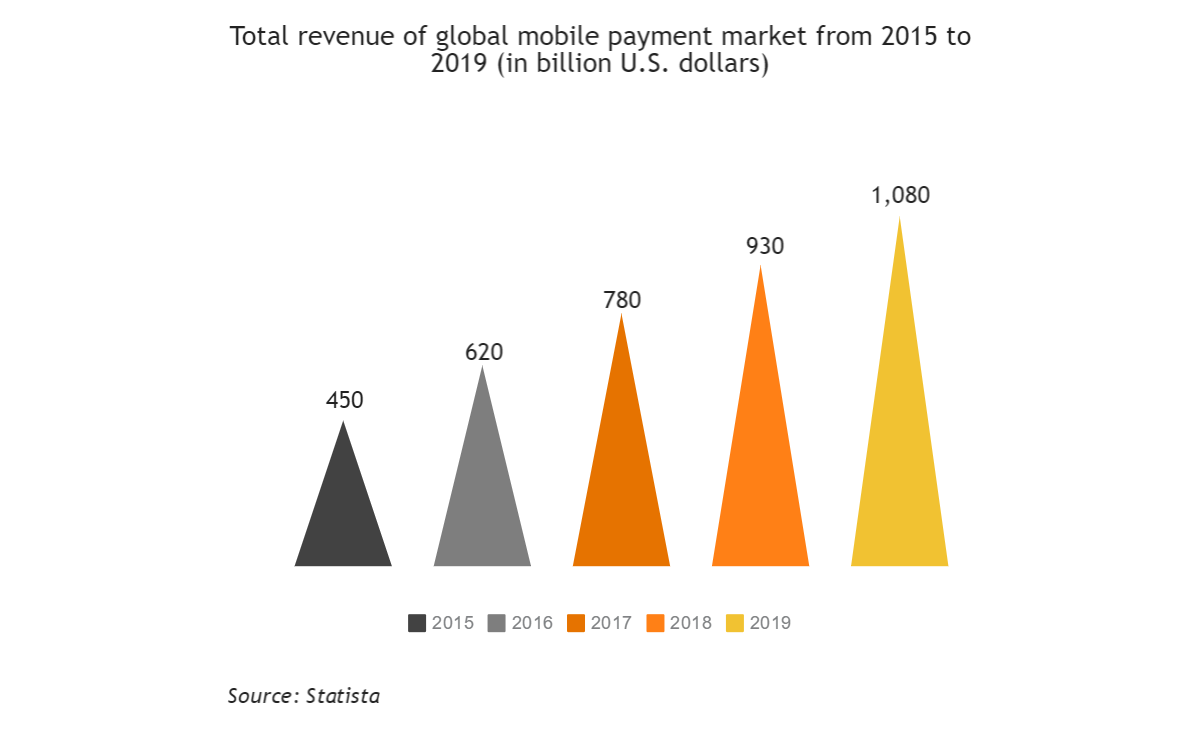

As for mobile payments, the global mobile payment revenue in 2015 was 450 billion U.S. dollars and it is expected to surpass 1 trillion U.S. dollars in 2019, while mobile commerce transactions will approach $20B by 2019.

Mobile banking

As reported by Federal Reserve, the adoption of mobile banking has increased in 2015. When asked about usage in the previous 12 months, 53% of smartphone users with a bank account said that they used mobile banking. The findings by established fintech companies like Adyen show similar results. Adyen Mobile Payments Index 2016 demonstrates that in the 1st quarter of 2016, 32% of global online payments on the Adyen payments platform were made on a mobile device. In addition, smartphones have become the preferred device for making online retail purchases. Earlier this role was occupied by tablets.

Peer to peer payments

P2P money transfers also hold their place in the mobile market. The report by Business Insider has revealed that mobile is increasingly used as a tool to transfer money. Globally, the volume of peer to peer payments is over $1 trillion. Around $5 billion of these transactions in the U.S are already conducted via mobile phones. BI estimates that mobile P2P transactions volume could reach $86 billion in the U.S. by 2018.

Mobile money in the emerging markets

The latest research by GSMA shows that mobile money is widely used in the emerging markets. The mobile payments solutions eliminate many challenges of the users in these regions where mobile devices are the primary technology. GSMA data indicates that mobile money is now available in 93 countries via 271 services. What’s more, mobile money providers processed just over a billion transactions in December 2015, which is more than double what PayPal processed globally. Moreover, Mastercard study suggests that Africa and the Middle East are going to be the hottest mobile money markets by 2020. More than 70% of consumers are ready to pay with their smartphones in these regions.

Therefore, mobile payments market is growing steadily all around the globe. The innovations in the sphere get into many aspects of our daily financial activities. This is all possible thanks to the latest technological advancements introduced by major players on the market.

Technologies that power mobile payments

Digital Wallet

There are several key technologies that fostered the development of mobile payments.

Digital wallet system was among the first innovations that brought the convenience of digital transactions to our computers and mobile phones. It stores everything we would carry in a traditional wallet – money, our bank accounts information, credit cards, shopping loyalty cards, an ID, a driving licence etc. The companies that successfully introduced the first generation of digital wallets to consumers were PayPal and eBay. Today we have a whole variety of digital wallets such as Google Wallet, Apple Passbook, Lemon Wallet, Square Wallet, Isis, Venmo etc. Because of the diversity, the adoption of digital wallets didn’t go as well as expected. The problem is that merchants are reluctant to invest in the technology they are not sure their consumers will use. On the other hand, consumers can’t use the e-wallet if the store doesn’t support the technology. So it’s like a vicious cycle that we ultimately need to break. See an overview of how banks can use fintech technologies in a post on digital transformation.

Near Field Communication (NFC)

Near Field Communication is another technology that didn’t only extend the possibilities of digital wallets but also gave new possibilities to mobile payments. It is a wireless communication that works within a range of only a few centimeters. Google Wallet was the first e-wallet to use this tech. It enabled users to pay for any product or service just by tapping a mobile phone to a terminal and entering the PIN. It’s really convenient and takes a few seconds. However, developers faced the same old challenge of accessibility. Not so many stores support NFC so the users can’t fully enjoy the innovation.

Yet Google has recently made another advancement that makes the experience of a contactless payment even better. At the beginning of 2016, they presented Hands Free – a mobile payment app that allows you to keep your smartphone in your pocket. It uses either Bluetooth or Wi-Fi and works at longer distances from the point of sale.

Biometrics

Another advancement that aims to speed up our mobile payments and make them more secure is biometrics. All of us wonder from time to time how we can keep all these different passwords in our heads. With this technology, we may verify our transactions by our unique biological traits. These may be the usual fingerprint scanning, retina pattern authentication, voice recognition, hand geometry, facial recognition, earlobe geometry etc.

Alibaba, Mastercard and Google are all starting to implement facial scanning trying to disrupt the industry with “selfie mobile payments”. Yet the most significant biometric innovation in mobile payments has been the implementation of TouchID. It’s worth mentioning that PayPal was among the first to introduce fingerprint authentication on Android mobile devices.

Latest findings confirm that users are ready to adopt the technology. According to Juniper Research, by 2019, there will be around 770M biometric authentication apps downloaded a year. Moreover, the number of biometrically authenticated transactions will reach 5B by 2019 compared to 130M we had in 2015.

Visa Research on biometrics

As reported by Visa, European consumers are eager to use biometrics when making a payment. 73% of respondents consider two-factor authentication that combines biometrics with a payment device to be a secure way to confirm an account holder. Moreover, 51% say that biometric authentication for payments could create an easier and faster payment experience than traditional methods. 2016 Visa survey also indicates that customers are primarily interested in using the technology in the following payment situations:

- 48% want to use biometric authentication for payments when on public transport;

- 47% want to use it when paying at a bar or restaurant;

- 46% want to use it to purchase goods and services on the high street;

- 40% want to use it when shopping online;

- 39% when downloading content;

Therefore, the adoption of biometric verification by consumers plays a vital role in the future of mobile payments. And at the same time, fintech developers should come up with innovations that would bring convenience to the consumers.

Blockchain

This revolutionary technology, which we explore in more detail in our other posts, opens up unique opportunities for mobile payments. This distributed ledger allows people to exchange money without any intermediaries. In addition, it offers the highest level of security as every node in a chain contains the information, or a hash of the previous block. Thus, it makes any hindering with the blockchain virtually impossible keeping users information protected. Its applications in fintech go beyond payments and money transactions. It is the major technology behind cryptocurrencies like Bitcoin and Ether. So many fintech developers try to compete and also cooperate with banks in creating solutions for currency exchange, P2P transfers, financial data storage, trading platforms etc.

Players on the mobile payments market

The adoption of mobile payments greatly depends on the solutions developed by major players on the market. At the same time, too much variety and inconsistency may stifle the expected growth. Right now major banks and financial services corporations, technological giants like Apple and Google, and fintech startups offer users a wide choice of mobile payment apps. We hope that evolution of the sphere will naturally bring the most convenient solutions to the top.

Fintech developers in the mobile payments landscape

No matter how hard the banks and tech corporations try to corner the mobile payments market, fintech startups bring the most serious disruption to the finance and banking sector. According to CBInsights, funding to payments startups exceeded $3.5B in 2015. Powa Technologies, Adyen, Klarna, Affirm, One97 Communications are some of the most well-funded payment startups. For instance, Stripe – PayPal’s biggest contender – is valued at $5 billion. There is actually a myriad of solutions in mobile payments that aim to suit every user need. Square helps you handle digital receipts and sales reports. IZettle is a mobile payments company that provides small businesses with portable POS solutions. Revel Systems offers an iPad point of sale technology for restaurants and retail businesses. Zoop is a mobile payment platform that enables users to process electronic payments remotely. And the list goes on and on.

The solutions offered by fintech startups grow in popularity because they offer faster and cheaper services. In addition, they have the flexibility to adapt faster to the changing market and meet users’ needs. The possibilities fintech developers create for users are especially valuable in the emerging markets and the international communities. For instance, Lebara Money – the solution N-iX developed for Lebara – allows to make reliable, peer-to-peer money transfers aimed to meet the needs of migrant workers and international communities. The service is integrated with Lebara Mobile which helps migrants get cheaper phone calls around the globe.

Mobile payment solutions by tech giants

So firstly there are leading tech companies that aim to monopolize the e-payments market using their wide influence. Google rushed to the market with their Google Wallet which was one of the first mobile wallets that used NFC. Yet it’s only available on certain mobile devices and only in the US.

As usual, Apple sat tight studying the mobile payments landscape and preparing their own solution. Eventually, they came up with Apple Pay, the technology integrated into Apple devices, namely latest versions of iPhone and Apple Watch. It has great user experience as combines NFC, tokenization for mobile payments with the help of Visa and MasterCard and TouchID sensor. However, like other competitors the company faced the challenge of merchant adoption. The NFC terminals are still not widespread, even in the US. So the users can’t fully enjoy the technology. Besides, it’s not available for the owners of older iPhone models.

It’s a usual practice that big tech corporations acquire fintech startups. This is exactly what Samsung did to gain an advantage in mobile payments. To cover a bigger share of the market, the company bought LoopPay. This payment startup developed Magnetic Secure Transmission Technology which is used in many POS readers that don’t support NFC. Thus Samsung Pay has a competitive advantage offering users both NFC and MST support.

Banks and financial services corporations

Banks are fighting tooth and nail to stay in the technological race and appeal to clients that prefer electronic money transactions. If they don’t have the capacities or the expertise to develop their own app, they partner with or acquire fintech startups. For instance, Zapp, a British mobile payments startup established partnerships with such major banks as First Direct, HSBC, Nationwide, Metro Bank and Santander.

Another fintech company that successfully cooperates with banks is Paym. It provides mobile money services to the clients of Britain’s nine major banks, namely Santander, Bank of Scotland, Barclays, Halifax, Cumberland Building Society, Lloyds Bank, HSBC, Danske Bank and TSB Bank.

It’s worth noting that Visa and Mastercard have considerably fostered the development of the sphere when they started to support cloud-based mobile payments in early 2014. MasterCard introduced MasterPass digital wallet. Around 250,000 merchants in 24 countries supported the technology in 2015. Later on, they partnered with PAY.ON making the service even more accessible. V.me – a digital wallet by Visa – appeared in 2012 and in two years was transformed to Visa Checkout. To use this app, you need to create an account including your card info. When you make payments online in stores that support the technology, you may instantly make your purchase.

Wrap-up

All in all, fintech developers offer consumers a variety of different services and apps. Yet there are still many unexplored possibilities on the e-payments market. The sphere still lacks the unicorn solutions that would offer customers great convenience and user experience, security, and, ultimately, uniformity. For now, we switch between payment types depending on a situation and a type of transaction. However, we envision that the ultimate winners in the mobile payments race will help us get rid of this mess. We won’t need a multitude of apps for different payment needs and the checkout will take seconds. If banks, mobile devices manufacturers and fintech developers establish a closer cooperation, we’ll see this future much sooner.