The finance and banking industry undergoes tectonic shifts caused by the across-the-board digitalization of its routines. By now, banks and financial organizations have come to rely on high-tech systems and tools in all their internal workflows and client-facing operations. What sets businesses apart in a world driven by digital solutions? The answer is intelligent process automation in financial services.

This article explains the essence of intelligent automation in banking and finance, highlights the necessity of automation in the field, lists financial process automation use cases and benefits, and provides real-world examples of companies that have revolutionized handling their finance powered by intelligent automation (IA) software.

What is intelligent automation in banking and finance?

Like any other vertical, the finance and banking domain is rich in complex processes requiring significant effort (invoice handling, management of accounts payable and receivable, payroll administration, budgeting, financial reporting, fraud detection, and more). Their tackling is a difficult task that challenges the efficiency and productivity of the workforce involved in them.

Similar to what happens in other industries (insurance, healthcare, logistics, manufacturing, etc.), IA in financial services enables organizations to minimize manual efforts and human labor utilization by automating the lion’s share of their routines. With most simple and repetitive tasks entrusted to machines, human agents can focus on more complex and creative assignments, prioritizing high-level decision-making.

When we speak about intelligence process automation in banking and finance, we shouldn’t confuse it with robotic process automation (RPA). What’s the difference exactly? RPA is honed for automating narrow-scope tasks, such as data entry activity or other rule-based functions, and can be implemented within existing enterprise solutions by setting up dedicated bots. By contrast, intelligent automation in the finance industry centered on automating the entire workflow cycle, can be integrated across multiple IT systems, and leverages a cutting-edge toolset driven by artificial intelligence, machine learning, generative AI, and other disruptive technologies. Sometimes, RPA becomes an element of intelligent automation solutions.

Why enterprises should automate finance

The current landscape in the finance sphere is extremely complex. Financial organizations face the ever-growing volume of enterprise and customer data they must handle and an increased task scope. Companies often struggle to manage all these assignments efficiently by delegating them to employees. Why?

First of all, it takes human personnel a long time to do them well. Thus, if you want to step up the routines, you will need to reinforce your staff by adding new expenditure items to your company's budget. Secondly, no matter how hard they try, people are prone to making mistakes. With the surge in workload and the amount of information for processing, the number of errors attributed to the human factor soars. As a result, the company's productivity plummets, while the customer experience of your clientele suffers a setback, causing lower loyalty and greater churn. There is only one recipe to counter such adverse developments—harnessing a large-scale intelligent automation strategy.

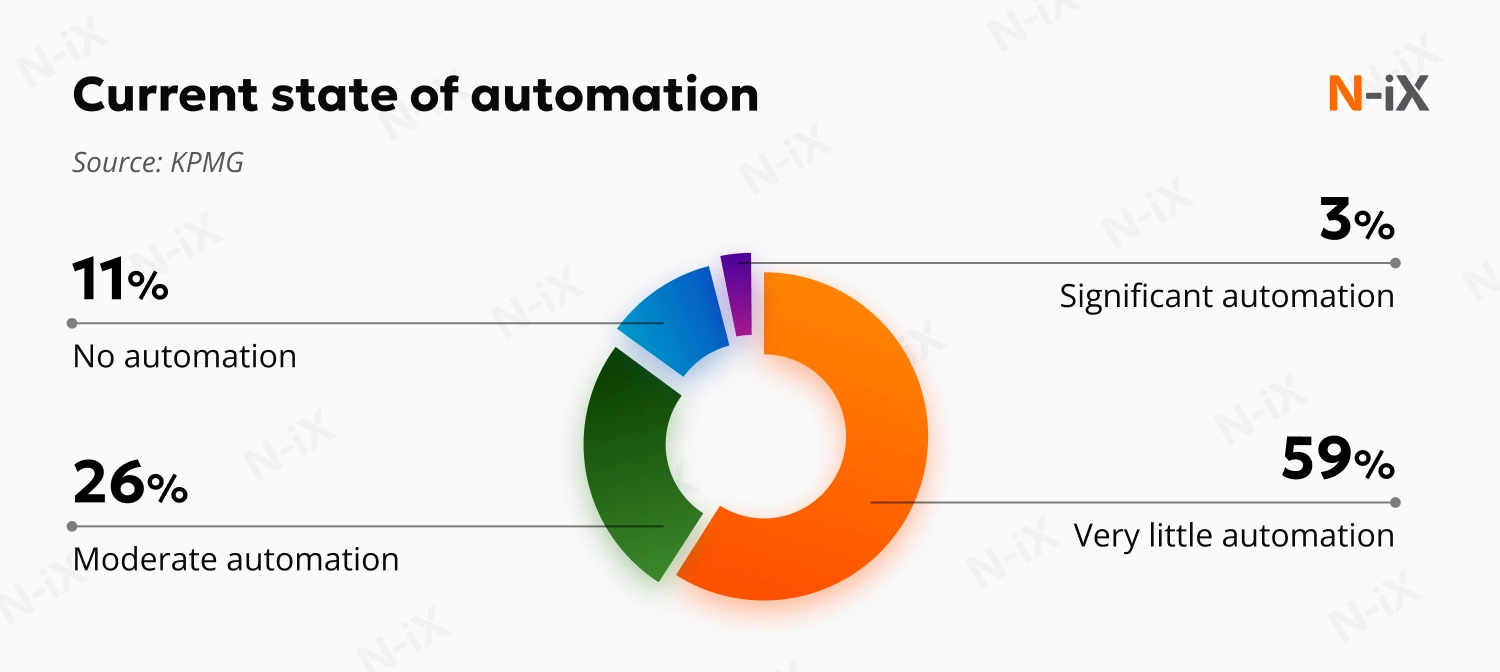

According to estimates, 80% of financial operations have a significant automation potential. Most C-suite managers realize that embracing automation can boost their internal workflows and enhance competitiveness. Moreover, 98% of CFOs claim that they have invested in IA initiatives. Yet, such efforts largely lack momentum, as the majority of companies acknowledge the limited scope of automation within their financial workflows.

At the same time, organizations that have ushered IA into their financial pipeline report a 90% reduction in processing time, a 70% decrease in processing costs, 95.5% operational accuracy, and a 250% ROI within two years on average.

However, to reach such impressive numbers, you need to have a clear vision of financial workflows to optimize with the help of intelligent automation.

How is IA used in finance?

Let’s consider some examples of how financial operations were improved by adopting intelligent automation technology.

Mortgage automation

Cenlar FSB had problems with handling wire processing operations. By implementing bots and optical character recognition tools, this largest mortgage sub-service provider in America could automate 85% of its wire payments, reducing errors and manual interference. The time for processing one wire was cut down to 16 seconds, thus stepping up productivity immensely.

Check processing

A North American bank wanted to shorten check processing time. As a result of automating its enrollment pipeline for a dedicated check program, the processing time dropped by 76% (from 7 minutes to 90 seconds), saving the organization 225 hours a month. Plus, a specialized bot ensured the absence of processing errors.

Invoice processing

A Fortune 500 financial enterprise needed a solution to automate its credit dispute process. The introduction of a tool for data entry, case creation, and document generation has accelerated the process dramatically, enabling the company to manage 200+ complaints per day and save more than 140 working hours per month. The total monthly savings amounted to $16,000, whereas resolution time was kept within 30 days.

Regulatory compliance

Another financial institution from the same category sought to revamp its services by transitioning to a Banking as a Service (BaaS) model. To comply with existing regulatory standards, it harnessed a set of extra-secure APIs. The result was a 150% spike in daily transactions and an 85% drop in transaction processing time, saving the enterprise $2.5M a year.

KYC optimization

Before implementing an automation project, a global fintech company received about 1,000 monthly alerts, and its staff spent 20 minutes per client to collect necessary information and fill out relevant forms. A specialized bot helped streamline and facilitate the Know Your Customer pipeline by automating case retrieval, data assembling, and template generation. As a result, up to 80% of KYC templates were filled in automatically, leading to considerable processing time minimization.

Internal audits

Sampling transactions, testing controls, generating audit reports, and other activities can be automated to a large degree, enabling specialists in the niche to conduct 20% more audits a year and accomplish them faster.

Contract management

Here, the most common activities to automate include key term extraction, updating contract data, and dispatching deadline and renewal alerts. This allows enterprises to accelerate processing by 20% and minimize errors.

Budgeting and forecasting

Automation in these workflows encompasses the extraction of historical data from financial systems, the retrieval of workforce-related data (headcount, salaries, etc.), the loading of all information into financial models, and the incorporation of market estimates and future trend predictions. Armed with such automated insights, experts can plan budgets effectively.

IT issue resolution

To boost the process, you can utilize automation tools that monitor the enterprise’s digital ecosystem, identify problems, send automated responses, generate service desk tickets, and even fix minor issues, like password resets, server restarts, or data backups, without human intervention.

Enhancing customer experience

A financial services organization from North America received 3 million loan and withdrawal inquiries annually, which posed a challenge for handling and resulted in prolonged processing times. The company onboarded a bot that records customer data from multiple apps in real time and enables customer service staff to focus on consumer needs. As a result, call time was reduced by 92.5%, which contributed to the spike in team productivity and customer satisfaction.

Benefits of intelligent automation in finance: ROI, time, accuracy

As we've described intelligent automation use cases in finance, let's explore the real benefits it brings to your financial workflows.

|

Metrics |

Before IA implementation |

After IA implementation |

|

Invoice processing time |

Between 7 and 25 days |

50% less, typically within 3 days |

|

Audit performance time |

3 months |

20% less |

|

Manual errors |

5-10% |

0.5% |

|

Financial reporting time |

Up to 25 days |

Several hours |

|

Compliance reporting time |

Several weeks |

Several hours |

|

Fraud detection rate |

65-70% |

20% more |

|

Average ROI |

- |

250% within two years |

However, before embracing intelligent automation, you may wonder whether IA tools will see eye to eye with your current enterprise infrastructure.

Integration with ERP and CRM

No software operates in isolation, which is also true for IA systems. To ensure their efficient functioning, you should seamlessly integrate them into your existing IT environment and the third-party platforms you utilize in your pipeline.

Conventionally, modern businesses rely on SaaS ERP and CRM solutions, so synchronizing them with intelligent automation tools is mission-critical. How can you do that? If you implement custom IA tools, you should set up a network of APIs to let them play well with Salesforce Sales Cloud, HubSpot CRM, Microsoft Dynamics 365, SAP, Oracle NetSuite, or any other SaaS system.

However, some SaaS platforms come with embedded automation facilities. For instance, Oracle Integration Cloud features Oracle Process Automation—a cloud-based service equipped with visual tools in a low-code environment honed for creating processes and managing pipeline applications. Thanks to it, users can leverage pre-built integrations and reusable business rules to automate repetitive tasks and streamline workflows.

Implementation timeline: When will you see results?

Implementing intelligent process automation in banking is a complex process that can’t be completed overnight. To see it through, you should determine the project's scope and objectives, conduct an out-and-out audit of the existing situation to expose inefficiencies and bottlenecks, select the proper tools, run a pilot project, optimize it, upscale it gradually, and evaluate its success.

How long does it take? Simple systems with straightforward workflows can be upgraded with IA tools within two weeks, whereas more complex tasks require between two and three months to automate.

As you can see, the process of developing and implementing a robust intelligent automation solution involves many nuances and niceties to consider. That is why it is wise to delegate it to vetted professionals in the domain.

Unlock intelligent automation in finance with N-iX

We have been present in the IT outsourcing market for 23 years, providing IA services and solutions that deliver tangible outcomes. Among 2,400+ experts that work for N-iX, there is a sizable pool of software engineers who have an in-depth understanding of financial workflows and can craft bespoke intelligent automation and RPA solutions to streamline and facilitate billing and invoicing, document processing, business process management, fraud detection, regulatory reporting, KYC routine, and customer service.

The IA financial solutions we build are based on AI-driven technologies and low-code development platforms, enabling us to create state-of-the-art intelligent automation tools and chatbots. They seamlessly integrate into your current ecosystem with minimal business pipeline disruptions, manifesting superb performance and high-quality results. Additionally, we offer professional consulting services to help you effectively adopt intelligent automation and manage IA solutions efficiently.

Check out the following case study to evaluate our expertise in the niche.

Real example of IA implementation

A large British fintech and neobanking company specializing in prepaid cards and current accounts hired N-iX to centralize its decision-making workflow for handling transactions. Since the organization had over one million customers and regularly processed billions of pounds in payments, it needed a powerful system that could handle peak transaction volumes while remaining compliant with AML and anti-fraud regulations.

The company’s existing ecosystem relied on 15 machine-learning models spread across multiple platforms, which caused data silos problems. Other infrastructure elements didn’t have access to these models, and the deployment pipeline was totally manual, requiring active participation from the in-house IT department during releases.

To address the issue, our qualified and certified experts crafted a cloud-agnostic ML-fueled tool that automated transaction processing, cut down on manual work, and optimized OPEX. Besides, it was configured to recognize risky or fraudulent transactions and red-flag those that weren’t based on the customer’s credit history and score, email, IP address, login attempts, and other transparent data.

The implementation of the automation solution yielded measurable results. The enterprise expanded its customer base by 20% and increased its NPS score by 35 points.

If you want to follow suit and revolutionize your financial workflows via their intelligent automation, drop us a line.

Final thoughts

Intelligent automation in financial services has evolved from a unique innovation into a bread-and-butter necessity for organizations with big-time aspirations. IA tools enable enterprises to automate a plethora of financial workflows, such as check and invoice processing, mortgage operations, regulatory compliance, KYC routine, auditing, budgeting, customer service, you name it. The outcomes include manual labor reduction, error minimization, and increased efficiency and productivity.

However, to develop and implement a top-notch intelligent automation solution, you should integrate it properly into your current IT infrastructure and hire a competent vendor to execute the project within time and budget.

Have a question?

Speak to an expert