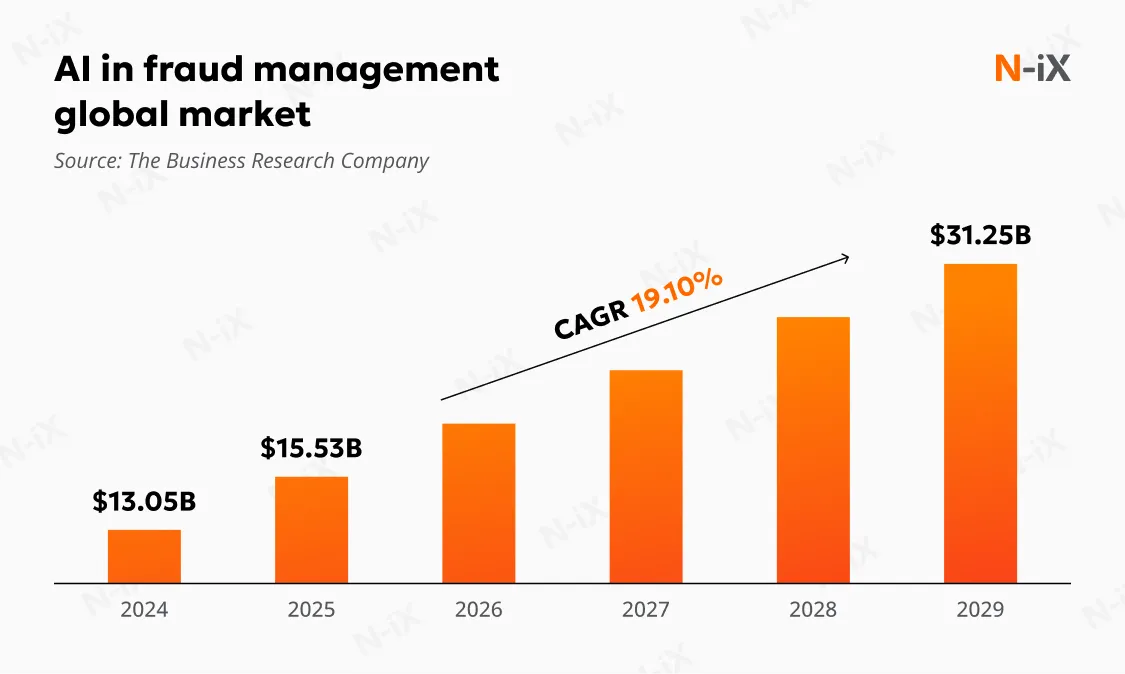

Financial fraud is getting more expensive. According to Yahoo Finance, in 2024 alone, it drained an average of 7.7% of annual revenue from businesses, totaling $534B across 1,200 surveyed companies. As schemes grow more sophisticated, traditional defenses struggle to keep up, leaving organizations searching for stronger, faster protection.

That’s where AI fraud detection comes in. With its ability to process massive datasets in real time and recognize subtle behavioral patterns, AI is changing how companies fight financial crime. It helps minimize losses, strengthen customer trust, identify suspicious activity faster, and adapt to new fraud tactics before they can inflict damage.

So, how can businesses implement AI responsibly and make it work in practice? In this guide, we explore proven strategies, industry use cases, and insights from our security experts to help you build smarter, safer fraud prevention systems.

What is AI fraud detection? How does it work?

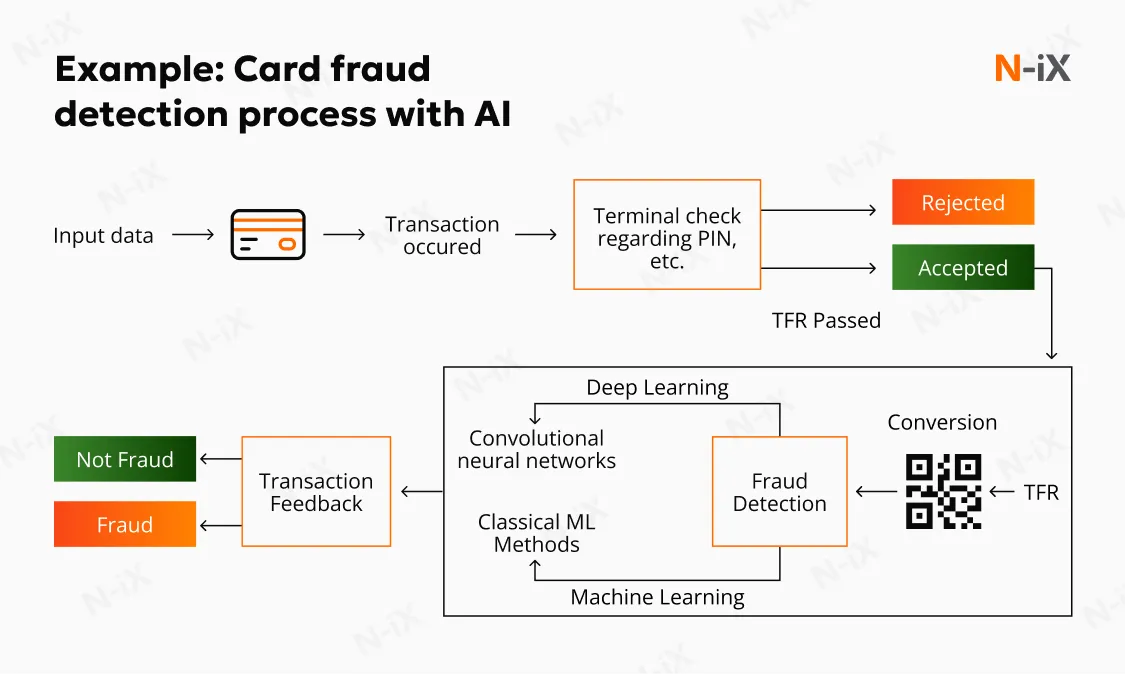

Artificial Intelligence fraud detection uses Machine Learning algorithms to spot fraudulent activity in financial services. These systems learn to distinguish legitimate behavior from suspicious patterns by analyzing large volumes of transaction data. They can detect risks and trends that human agents might miss, providing faster and more accurate oversight across accounts and payments.

This technology has emerged as a powerful tool because it continuously learns from new information, refining its rules to improve accuracy over time. Financial institutions integrate AI solutions into their workflows to automatically flag or block risky transactions, or prompt extra authentication when needed.

Let’s explore the core technologies and features that make these systems effective.

Key AI models and capabilities for fraud defense

- Supervised learning: These models are trained on labeled data containing both legitimate and fraudulent transactions, enabling them to quickly recognize patterns linked to known fraud tactics.

- Unsupervised learning: These models identify unusual or unexpected behaviors without predefined examples, helping uncover new fraud tactics that traditional systems might overlook.

- Deep learning and neural networks: By analyzing hundreds of variables at once, these systems detect subtle patterns and correlations invisible to standard fraud detection methods.

- Graph neural networks (GNNs): GNNs map connections between entities, uncovering hidden networks of related accounts or transactions that may indicate organized fraud.

- Behavioral analysis: AI models analyze transactional data (amount, account details) and behavioral data (time spent purchasing, user activity) to set a “normal” range. Then, they flag “out of range” data in real-time, focusing on users’ intent.

- Real-time analysis and dynamic rules: Algorithms assess transactions instantly and adjust detection rules on the fly, maintaining accuracy even as fraud tactics evolve.

- Predictive risk scoring: AI models assess the probability of fraud based on multiple factors, such as transaction amounts, frequency, location, and past behavior.

These capabilities are essential to fraud detection when implemented correctly. Just like high-performance engines, they are powerful but require the right conditions to operate safely and efficiently.

9 practices for implementing responsible AI fraud detection

To make Artificial Intelligence truly effective for fraud prevention, organizations need a clear strategy and disciplined execution. Our cybersecurity experts share key practices that help build AI systems that are secure, transparent, and built to evolve.

1. Understanding your needs and existing assets

Before implementing anti-fraud AI, it’s essential to understand your organization’s goals, data readiness, and risk profile. At this early stage, you’re looking to answer the following questions:

- What do you want to achieve? This can include reducing payment fraud, automating claims validations, improving identity verification, and so on.

- What infrastructure and data do you have in place? The capacity of your existing infrastructure determines how effectively AI models can be trained and integrated into your operations.

- What are your compliance requirements? Understanding relevant regulations and data protection standards will help determine the best deployment approach.

All these factors will guide your strategy and help create a realistic roadmap for implementation, but it can be difficult to navigate them alone. To ensure the process is smooth, consider partnering with a reliable tech company with expertise in cloud, data, and AI.

An experienced cloud consultant helps you assess your infrastructure, security requirements, and operational goals to design a tailored AI strategy.

With a partner like N-iX, this process includes evaluating the complexity of your fraud detection needs, data availability, and integration requirements. During the assessment, our experts review:

- Existing system performance: Our team examines transaction processing, scalability, and reliability to understand how AI can operate efficiently within the current infrastructure.

- Data quality and structure: We analyze datasets for completeness, consistency, and readiness to ensure accurate and effective AI model training.

- Regulatory compliance alignment: Our experts verify that current processes meet industry-specific standards for data privacy, reporting, and operational requirements.

- Security controls and access: We assess authentication, encryption, and monitoring measures to safeguard sensitive information and maintain system integrity.

- Workflow integration and automation potential: Our team identifies where AI can enhance operations, streamline tasks, and complement existing processes without disruption.

Secure your cloud with 10 best practices—get the guide now!

Success!

This initial evaluation ensures that your AI strategy is both practical and effective. For example, a retail business with high transaction volumes may find that a scalable third-party tool is the fastest way to start. At the same time, a financial institution with sensitive datasets may discover the need for a custom AI model that supports specific compliance requirements.

By working with a cloud consultant, you get the expertise and guidance needed to make informed decisions and maximize the impact of AI adoption.

2. Ensuring data readiness and governance

The effectiveness of any AI system begins with the quality of its training data. To make your models accurate and trustworthy, you need diverse, well-curated datasets that reflect real-world fraud patterns while remaining relevant to your business context. Data should be continuously cleaned, enriched, and validated to minimize bias and errors. And because these systems rely on sensitive financial or personal information, strong data security must underpin every stage of preparation and use.

When using custom-built solutions, your organization is entirely responsible for data processing. You must establish the infrastructure and governance necessary to collect, process, and secure large volumes of high-quality information while maintaining full compliance.

Third-party tools, on the other hand, often come with pre-trained models built on extensive historical datasets. They can accelerate deployment but introduce new challenges around transparency and control. Since many of these models function as “black boxes,” it’s essential to demand clear reporting, explainability, and proof of compliance from the vendor to maintain accountability and trust.

Discover how to establish effective data governance for AI systems

3. Investing in multi-layered tools

Fighting fraud effectively requires more than a single AI tool. Multi-layered systems combine different defenses to tackle a wide range of threats and adapt to evolving tactics. By integrating additional measures, you create a stronger, more responsive approach to threats. Key components to consider include:

- Multi-factor authentication;

- Risk-based authentication;

- Device fingerprinting;

- Behavioral analytics;

- Geolocation tracking;

- Real-time transaction monitoring;

- Account takeover prevention.

4. Starting with a PoC

Launching an AI initiative without proof of concept is like building a bridge without testing its foundations. A PoC helps organizations validate technical feasibility, data quality, and potential business impact before scaling to full deployment. It also allows teams to fine-tune models in realistic conditions and identify the best ways to integrate AI fraud prevention into existing systems.

One example of this comes from N-iX’s collaboration with Boohoo Group, a leading British online fashion retailer. The client sought to minimize the impact of fraudulent orders and boost operational efficiency by automating manual processes. To achieve this, we selected AWS to host the solution and developed a proof of concept using Amazon Fraud Detector. Our team trained the model to analyze real-time transaction data, flag suspicious activity, and estimate fraud probability.

This pilot proved the value of applying AI to complex retail environments, helping Boohoo Group reduce losses from fraudulent orders while modernizing its broader technology ecosystem.

Read the full case study: Increasing efficiency through automation and modernization for a leading global retailer

5. Establishing a cross-functional fraud management team

Effective AI fraud detection requires close coordination across departments, as fraud risks often span multiple functions. Create a cross-functional team that brings together IT, data science, customer service, legal, and operations to align strategies and share insights. This collaboration ensures fraud prevention remains consistent with broader business goals and compliance standards.

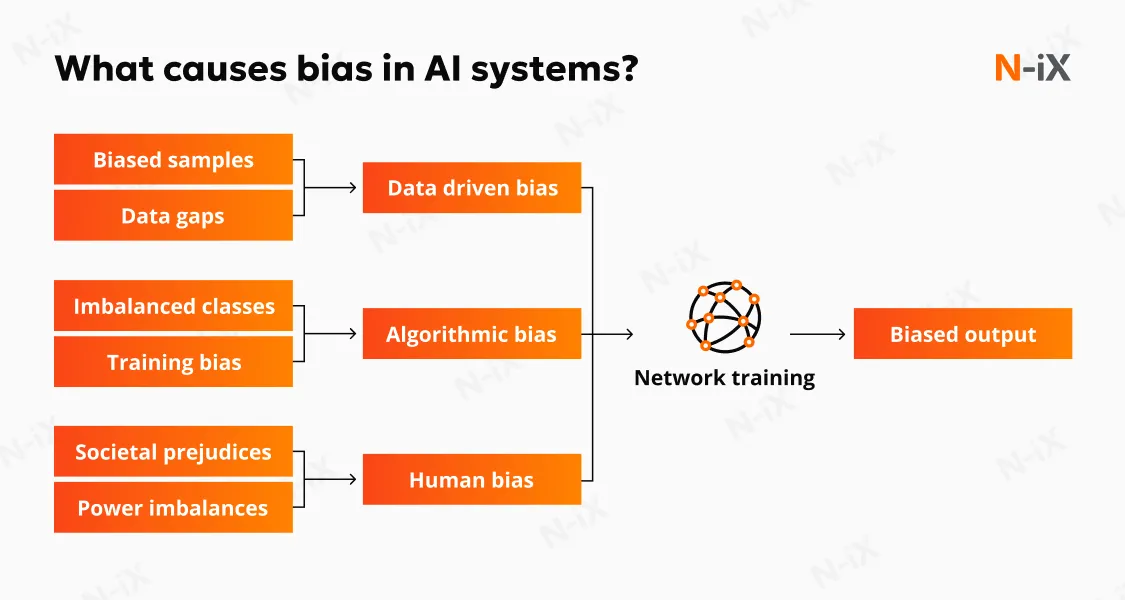

6. Prioritizing fairness and bias mitigation

Bias and fairness concerns can emerge if fraud detection AI is not carefully monitored. Regularly test and verify a random sample of decisions to ensure the system doesn’t unfairly target any particular group. By identifying and correcting biases, organizations can deliver impartial outcomes while maintaining the effectiveness of automated fraud detection and protecting both customers and business reputation.

Learn more about other risks associated with AI and how to mitigate them

7. Mandating transparency and explainability

Transparency and explainability are critical for effective fraud prevention. Systems should provide clear, user-friendly reporting and show why specific conclusions are made. This ensures your teams can verify alerts and identify potential errors efficiently.

Artificial Intelligence for fraud detection must also offer interpretable results. For example, a flagged payment should include a clear explanation, such as an unusual transaction amount or location. This transparency lets your analysts quickly assess risk and take appropriate action while maintaining accountability.

Read more: What is explainable AI (XAI)?

8. Ensuring ethical data usage

Ethical data usage starts with clear, transparent policies for collecting and storing information. To ensure data is handled responsibly, implement practices that comply with privacy regulations and industry standards. Use secure storage, strict access controls, and regular audits to enforce these practices, protect sensitive data, and maintain customer trust.

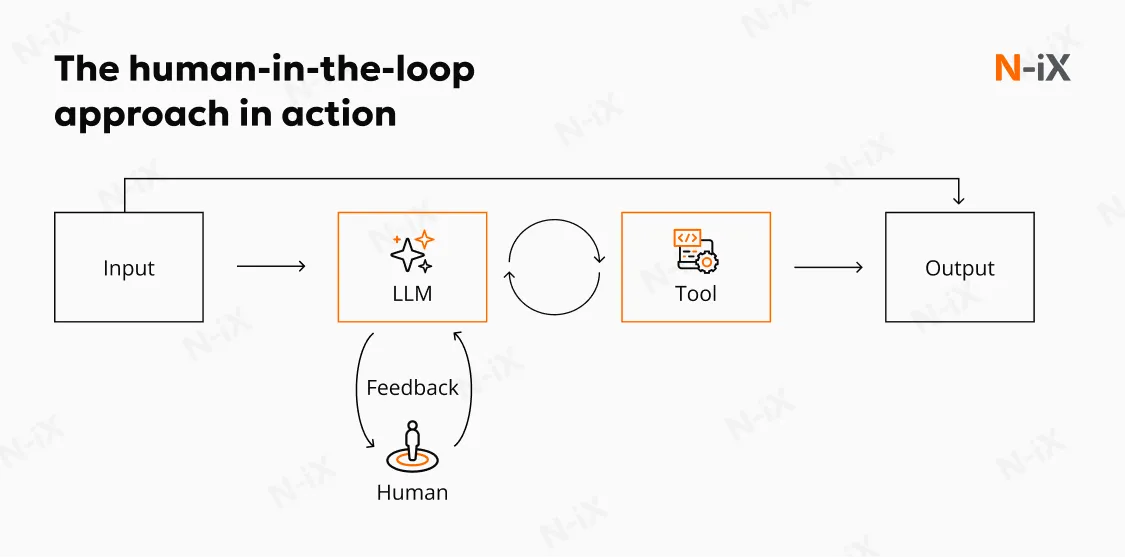

9. Embedding human oversight

Even the most advanced AI systems can make errors or miss subtle patterns, so human oversight remains critical. Incorporate a human-in-the-loop approach to ensure analysts stay involved in reviewing flagged transactions, validating model decisions, and providing feedback to refine algorithms over time. Establish clear processes for escalation and decision-making, ensuring that human judgment complements AI outputs.

N-iX experts also recommend regularly back-testing AI results against simpler rule-based models. This process compares AI predictions with straightforward rules to highlight anomalies, explain unusual outcomes, and keep your fraud detection system accurate and reliable.

Industries using AI fraud detection to stay secure

The real impact of AI in fraud detection becomes clear through practical applications. The following use cases show how organizations across industries apply Artificial Intelligence to prevent losses, improve efficiency, and strengthen customer trust.

Financial services and payments

Banks and payment providers rely on AI to monitor millions of transactions in real time, identifying suspicious patterns across multiple metrics. This helps prevent payment fraud, account takeovers, and identity theft while improving the speed and accuracy of responses.

AI also supports regulatory compliance. For example, it can streamline Know Your Customer processes by analyzing ID documents for inconsistencies and enhance Anti-Money Laundering efforts by flagging potentially illegal transactions or unusual behaviors.

The impact of AI in banking fraud detection is proven and measurable. According to Nvidia, American Express improved fraud detection by 6% using advanced AI models [1]. PayPal increased real-time fraud detection accuracy by 10%, demonstrating how AI can strengthen security and operational efficiency across financial services [2].

Read more: Cybersecurity in banking: Key threats, solutions, and best practices

Government and public sector

Government agencies increasingly turn to fraud detection using AI to protect public funds and improve operational efficiency. Federal departments analyze large volumes of transactions and records to identify suspicious patterns and prevent improper payments, check fraud, and other financial misconduct.

The US Department of the Treasury reports that, in 2023, its Office of Payment Integrity recovered over $375M in potentially fraudulent payments through AI analytics. Similarly, agencies like the IRS use AI frameworks to detect anomalies in taxpayer records, helping to close the tax gap and strengthen financial oversight [3].

Healthcare

Healthcare fraud can cost the industry hundreds of billions of dollars each year [4]. AI for healthcare fraud detection helps identify unusual claims or billing patterns, such as upcoding or unbundling, that may indicate fraudulent activity.

By automating claims processing, these systems reduce human error and quickly flag inconsistencies, enabling healthcare providers and insurers to protect resources while maintaining accurate and efficient operations.

Ecommerce

In ecommerce, AI fraud detection solutions help prevent fraudulent online purchases by analyzing customer behavior, purchase history, and device information to detect unusual activity. Systems can flag anomalies such as new account numbers or suspicious vendor details, ensuring transactions are legitimate. This real-time monitoring protects both merchants and customers, reducing chargebacks and enhancing trust across the online shopping experience.

Why should you implement robust AI fraud detection with N-iX?

As fraud tactics evolve, building secure and intelligent detection systems requires deep expertise and a trusted partner. At N-iX, we combine technical excellence with proven cybersecurity practices to help businesses design, implement, and scale robust and compliant AI solutions. Here’s how we help organizations strengthen their fraud prevention capabilities:

- Proven data and AI expertise: With more than 200 data, AI, and ML engineers, we build scalable models and analytics platforms tailored to your specific fraud detection needs.

- Strong security track record: N-iX security experts have successfully completed over 100 projects securing clients’ infrastructure, data, and digital assets from evolving threats.

- Extensive financial domain experience: Our teams have delivered over 250 finance projects and currently support more than 25 active finance clients, helping them mitigate risk and modernize critical systems.

- Strict regulatory compliance: We hold CyberGRX, ISO 27001, ISO 9001:2008, ISO/IEC 27701:2019, PCI DSS, and FSQS certifications, ensuring your AI solutions meet the highest security and privacy standards.

With the right approach and an experienced partner, AI can become your strongest defense against financial crime. Let N-iX help you build secure, intelligent systems that protect your business and customers with confidence.

References

1. Why Accelerated Data Processing Is Crucial for AI Innovation in Every Industry—Nvidia.

2. How AI Helps Fight Fraud in Financial Services, Healthcare, Government and More—Nvidia.

3. Artificial Intelligence May Help IRS Close the Tax Gap—US Government Accountability Office.

4. Inside the mind of criminals: How to brazenly steal $100 billion from Medicare and Medicaid—CNBC.

Frequently Asked Questions

1. How do AI systems analyze and identify potential fraudulent activities?

AI uses Machine Learning models trained on large datasets to recognize the difference between legitimate and suspicious transactions. It identifies fraud by spotting patterns and complex anomalies that deviate from established “normal” behavior in real time.

2. How are banks using AI for fraud detection?

Banks apply AI to monitor transactions, detect unusual spending patterns, and block suspicious activity before losses occur. AI models also help automate identity verification, enhance Anti-Money Laundering (AML) compliance, and support analysts in investigating potential fraud cases more efficiently.

3. What are the advantages of AI systems compared to traditional fraud detection approaches?

AI systems employ dynamic rules that evolve over time, leading to higher accuracy and fewer false positives than predefined rules. AI also provides massive scalability, monitoring huge transaction volumes and offering faster response.

4. What types of financial crime can AI-powered solutions detect?

AI helps mitigate various types of financial crime, including phishing scams, identity theft, payment fraud, and credit card fraud. It is also used in regulatory compliance for Anti-Money Laundering (AML) processes and to trace complex cryptocurrency transactions.

5. What are the main challenges when implementing AI fraud detection?

Key challenges include ensuring high-quality and accessible data, balancing security with user experience, and keeping up with evolving fraud tactics. Organizations must also address algorithmic bias, maintain transparency, and meet strict data privacy and compliance requirements in regulated industries.

Have a question?

Speak to an expert